Minimal wage legislation. Time beyond regulation pay. Paid sick go away legal guidelines by state. The listing goes on and on. Between federal and state office legal guidelines, there’s lots that employers must maintain monitor of. However, what about holidays? Are employers required to present holidays off to workers?

In the event you’re an employer, it is advisable to know the reply. That reply impacts every thing out of your firm coverage to your corporation hours.

Are employers required to present holidays off?

There are over 10 federal authorized holidays, together with Christmas Day, Memorial Day, and Juneteenth. The query is: Are federal holidays necessary for all companies and workers?

To reply the query extra totally, look to federal and state guidelines on the topic. Then, create an organization coverage that’s compliant—and follow it.

1. Perceive federal guidelines

So, who will get federal holidays off? Federal companies typically observe federal authorized holidays, which embody:

- New 12 months’s Day

- Martin Luther King Jr. Day

- President’s Day

- Memorial Day

- Juneteenth

- Independence Day

- Labor Day

- Columbus Day

- Veterans Day

- Thanksgiving Day

- Christmas Day

However, what about non-public employers? What do they should do about federal authorized holidays?

The Honest Labor Requirements Act (FLSA) is the massive federal legislation that establishes office requirements like minimal wage and time beyond regulation. So, does the FLSA require non-public employers to present workers paid time without work for holidays?

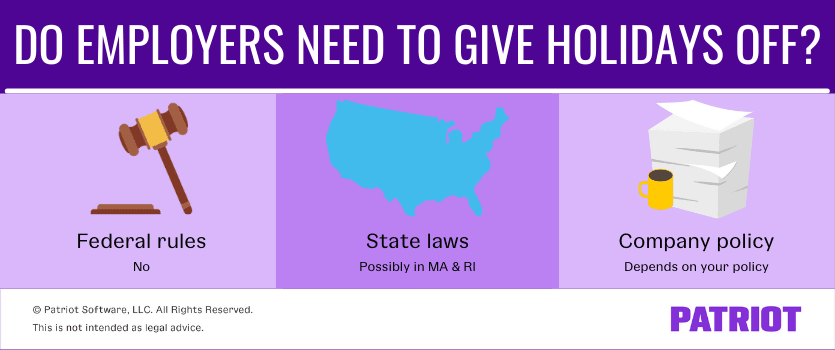

Nope. The FLSA doesn’t require that employers pay workers for time not labored, comparable to holidays.

There’s additionally no federal legislation requiring non-public employers to present workers any holidays off. And, there isn’t a federal legislation requiring non-public employers to present workers a premium pay fee (e.g., time and a half or double-time) only for engaged on a vacation.

Lengthy story brief: Non-public employers would not have to present workers time without work on holidays or present premium pay to those that work underneath federal legislation.

2. Test your state legal guidelines

Some states have stricter or further office legal guidelines than what the FLSA requires. This contains state:

So, are there state vacation pay guidelines? For probably the most half, no. Just like the FLSA, most states don’t require non-public employers to do something particular on holidays, comparable to give workers paid time without work, premium pay, or unpaid time without work.

Nevertheless, there are two states—Massachusetts and Rhode Island—which have vacation guidelines that affect non-public employers.

Massachusetts

Massachusetts’ vacation guidelines are often called “Blue Legal guidelines.” The Massachusetts Blue Legal guidelines decide which companies can legally function on state authorized holidays (and Sundays) and whether or not employers should give workers premium pay.

In the event you’re an employer in Massachusetts, it’s possible you’ll be required to acquire a allow to function on specified authorized holidays. State necessities depend upon what sort of institution you personal:

Retail

- Unrestricted holidays: The state doesn’t require a allow, premium pay, or voluntariness of employment.

- Martin Luther King Day, President’s Day, Evacuation Day, Patriots’ Day, and Bunker Hill Day

- Partially restricted holidays: You do not want a allow, however you may’t power workers to work. You may additionally want to present workers premium pay for working a vacation.

- New 12 months’s Day, Memorial Day, Juneteenth Independence Day, Independence Day, Labor Day, Columbus Day after midday, and Veterans Day after 1 p.m.

- Restricted holidays: You could get hold of a allow. And for those who get hold of a allow, premium pay and voluntariness of employment necessities could apply.

- Columbus Day earlier than midday, Veterans Day earlier than 1 p.m., Thanksgiving Day, and Christmas Day

Non-retail

- Unrestricted holidays: Most non-retail companies can function with out a allow or different state restrictions.

- New 12 months’s Day, Martin Luther King Day, President’s Day, Evacuation Day, Patriots’ Day, Bunker Hill Day, Juneteenth Independence Day, Columbus Day after midday, Veterans Day after 1 p.m.

- Restricted holidays: Most non-retail companies can’t function on all different authorized holidays except they meet an exemption.

- Memorial Day, Independence Day, Labor Day, Columbus Day earlier than midday, Veterans Day earlier than 1 p.m., Thanksgiving Day, and Christmas Day

Producer

- Unrestricted holidays: The state doesn’t require a allow, premium pay, or voluntariness of employment.

- New 12 months’s Day, Martin Luther King Day, President’s Day, Evacuation Day, Patriots’ Day, Bunker Hill Day, Juneteenth Independence Day, Columbus Day after midday, and Veterans Day after 1 p.m.

- Restricted holidays: Typically, you will need to get hold of a allow. And for those who do get hold of a allow, you can not require workers to work today except the work is completely vital and might lawfully be carried out on Sunday.

- Memorial Day, Independence Day, Labor Day, Columbus Day earlier than midday, Veterans Day earlier than 1 p.m., Thanksgiving Day, and Christmas Day

Try the Massachusetts Blue Legal guidelines for extra data, together with premium charges and necessities.

Rhode Island

Rhode Island requires non-public employers to pay workers a premium fee of time and a half on state authorized holidays for hours labored. And, workers should be capable of refuse work on holidays (except they’re employed by a producer that operates seven days every week).

Rhode Island authorized holidays embody:

- New 12 months’s Day

- Memorial Day

- Independence Day

- Victory Day

- Labor Day

- Columbus Day

- Veterans Day

- Thanksgiving Day

- Christmas Day

For extra data, take a look at A Information to Wage and Office Legal guidelines in Rhode Island.

3. Your organization coverage

After checking in in your federal and state necessities, create a compliant firm coverage that solutions Is vacation pay necessary?

Decide how your corporation handles holidays. For instance, you may:

- Require workers work as regular on holidays

- Give workers the time without work (paid or unpaid)

- Give workers premium pay (e.g., time and a half or double pay)

When you create your coverage, follow it.

So, do employers must pay vacation pay? The underside line

Generally, non-public employers aren’t obligated to do something particular in the case of workers and holidays. However generally, whether or not it’s important to give workers time without work or premium pay on holidays is determined by some components.

Ask your self:

- Am I a non-public employer? In the event you’re a non-public employer, federal legislation doesn’t require you to present workers vacation off or premium pay.

- Is my enterprise in Massachusetts or Rhode Island? In the event you’re a non-public employer and your corporation is in Massachusetts or Rhode Island, it’s possible you’ll want to present workers paid time without work on holidays, premium pay on holidays, or the correct to refuse work on holidays.

- What does my firm coverage say? After creating an organization coverage on holidays, observe it. In the event you say workers have paid or unpaid time without work on holidays, or for those who say workers obtain premium pay on holidays, follow it.

This isn’t meant as authorized recommendation; for extra data, please click on right here.