The AO Divergence and ZeroLag MACD Foreign exchange Buying and selling Technique is a robust mixture that may considerably enhance the accuracy and effectiveness of a dealer’s decision-making course of. Within the fast-paced world of Foreign currency trading, with the ability to establish potential market reversals and momentum shifts is essential. The AO Divergence indicator highlights discrepancies between worth motion and the Superior Oscillator (AO), providing merchants precious perception into market developments. When paired with the ZeroLag MACD, which reduces lag present in conventional MACD alerts, merchants acquire a extra well timed and exact understanding of market actions, permitting them to behave shortly and decisively.

The AO Divergence helps merchants spot potential reversals by analyzing divergences between worth and momentum. This divergence happens when the value strikes in a single route whereas the AO strikes within the reverse, signaling that the development could also be dropping power. Alternatively, the ZeroLag MACD modifies the basic MACD by minimizing the lag, delivering quicker and extra responsive alerts. This discount in delay is especially helpful within the unstable Foreign exchange market, the place velocity is crucial to capitalize on short-term alternatives. Collectively, these two indicators present a extra dependable method to figuring out entry and exit factors.

When mixed, the AO Divergence and ZeroLag MACD Foreign exchange Buying and selling Technique affords merchants a complete toolset for analyzing each momentum and development power. The synergy between the 2 indicators creates a extra refined buying and selling technique, enabling merchants to detect early indicators of development adjustments and make knowledgeable buying and selling choices with larger confidence. On this article, we are going to discover how one can successfully use these indicators, outlining the steps to implement them in your buying and selling technique and the way they will improve your general market evaluation.

AO Divergence Indicator

The AO Divergence Indicator is predicated on the Superior Oscillator (AO), a momentum indicator that measures the market’s momentum by evaluating the present 34-period easy shifting common (SMA) to the 5-period SMA. The AO Divergence enhances the capabilities of the AO by specializing in discrepancies, or divergences, between the value motion and the AO indicator. Divergence happens when the value kinds new highs or lows, however the AO indicator doesn’t comply with go well with, signaling a possible reversal out there.

When utilizing the AO Divergence indicator, merchants are searching for cases the place worth motion and the Superior Oscillator are shifting in reverse instructions. For instance, if the value makes the next excessive, however the AO fails to substantiate this by not reaching a brand new excessive, it signifies that the shopping for momentum is weakening. This could be a sign that the present development could also be dropping power, and a reversal might be imminent. The AO Divergence is especially precious for recognizing potential development reversals early, permitting merchants to enter or exit positions with the next degree of confidence.

The ability of the AO Divergence lies in its potential to focus on these delicate shifts in market momentum that may not be instantly apparent from worth motion alone. By figuring out divergences, merchants can anticipate adjustments in market route earlier than they grow to be obvious on conventional worth charts. This makes the AO Divergence a precious instrument for merchants seeking to seize early entries or exits in trending markets, particularly in unstable environments like Foreign exchange.

ZeroLag MACD Indicator

The ZeroLag MACD Indicator is a modification of the basic MACD (Transferring Common Convergence Divergence) indicator, designed to handle the first limitation of conventional MACD: lag. The MACD is a trend-following momentum indicator that consists of two shifting averages—normally the 12-period and 26-period exponential shifting averages (EMAs)—and a sign line, which is the 9-period EMA of the MACD line itself. Whereas the MACD is broadly used for figuring out developments and momentum shifts, certainly one of its key drawbacks is the lag between when a sign is generated and when it may be acted upon, particularly in fast-moving markets like Foreign exchange.

The ZeroLag MACD addresses this challenge by altering the MACD system to scale back the lag time. That is achieved by utilizing a special method to the calculation of the MACD line and sign line, which permits it to reply extra shortly to adjustments in market circumstances. Because of this, the ZeroLag MACD offers quicker and extra correct alerts than the standard MACD, making it a super instrument for merchants who have to react shortly to cost actions.

With ZeroLag MACD, merchants can obtain earlier and extra dependable alerts of development adjustments, bettering the timing of their entries and exits. It’s significantly helpful for short-term merchants or these working in unstable markets the place fast decision-making is crucial. The quicker response time may also help merchants spot rising developments and reversals before with a daily MACD, permitting for extra exact commerce execution. Whether or not used along side different indicators or as a standalone instrument, the ZeroLag MACD helps streamline the buying and selling course of and enhances a dealer’s potential to capitalize on market alternatives in actual time.

Easy methods to Commerce with AO Divergence and ZeroLag MACD Foreign exchange Buying and selling Technique

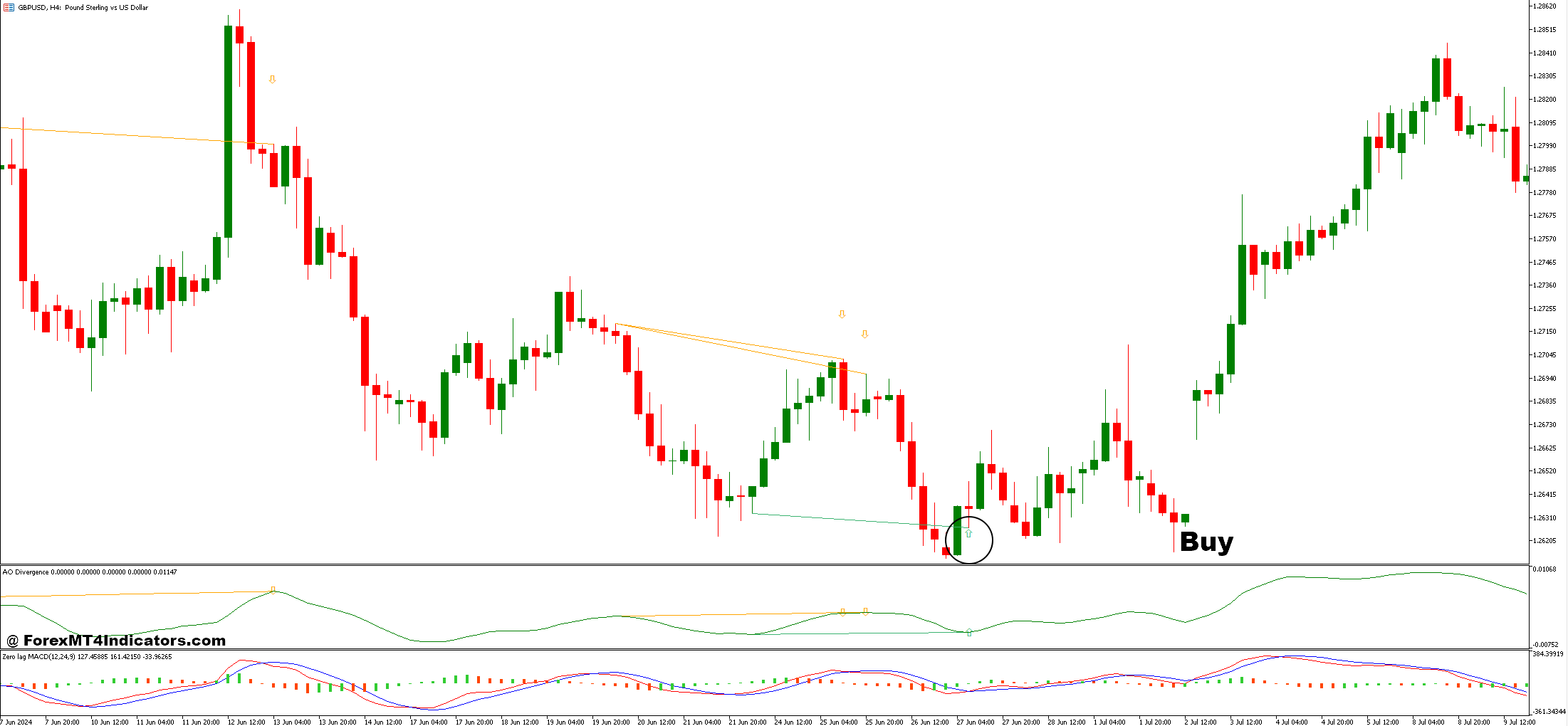

Purchase Entry

- Worth kinds decrease lows, however the AO kinds increased lows.

- Signifies weakening bearish momentum and potential reversal to the upside.

- ZeroLag MACD crosses above the sign line (MACD line crosses from beneath to above the sign line).

- This confirms upward momentum and strengthens the purchase sign.

- MACD histogram above zero (indicating rising bullish momentum).

- Enter a purchase place as soon as the ZeroLag MACD crosses above the sign line and the bullish divergence on AO is confirmed.

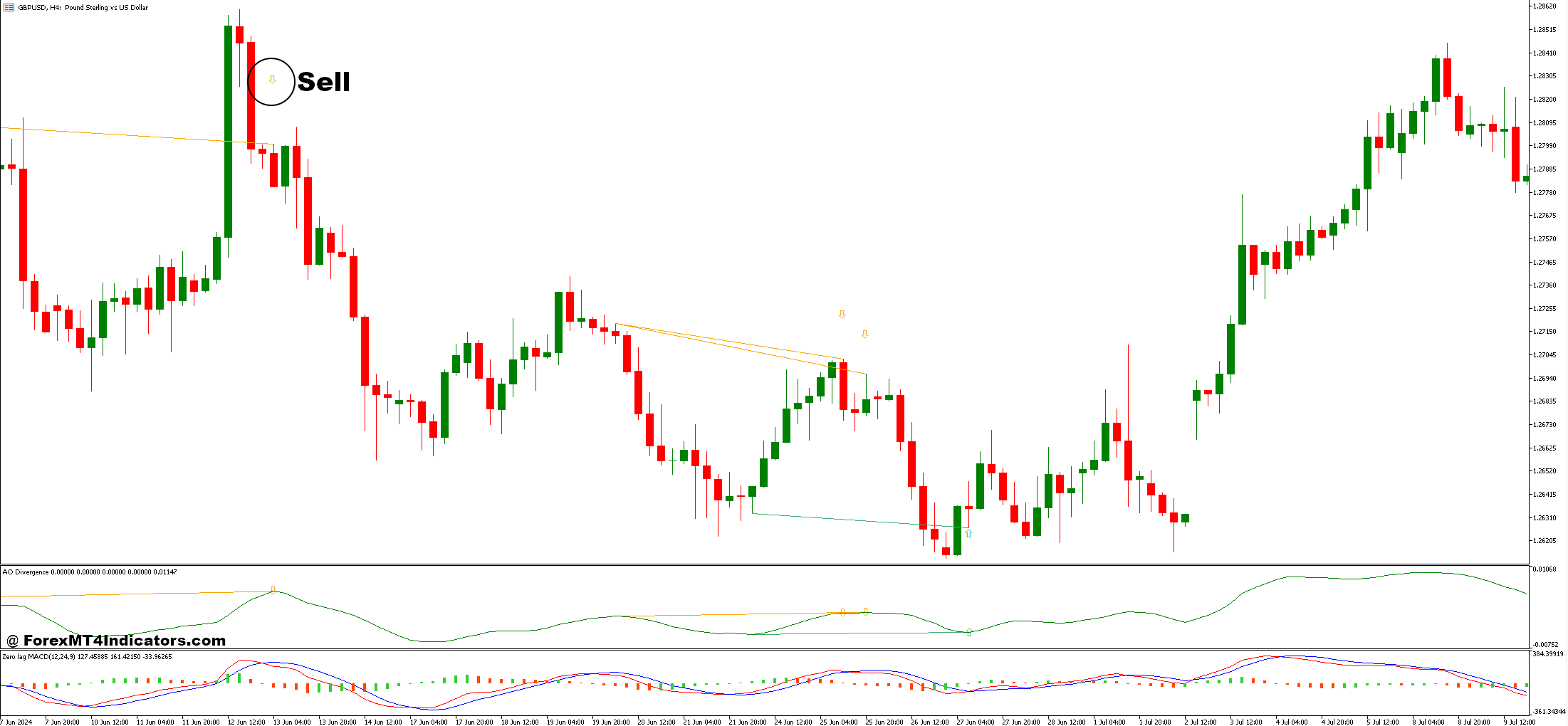

Promote Entry

- Worth kinds increased highs, however the AO kinds decrease highs.

- Signifies weakening bullish momentum and potential reversal to the draw back.

- ZeroLag MACD crosses beneath the sign line (MACD line crosses from above to beneath the sign line).

- This confirms downward momentum and strengthens the promote sign.

- MACD histogram beneath zero (indicating rising bearish momentum).

- Enter a promote place as soon as the ZeroLag MACD crosses beneath the sign line and the bearish divergence on AO is confirmed.

Conclusion

The AO Divergence and ZeroLag MACD Foreign exchange Buying and selling Technique is a strong and dependable technique for figuring out potential development reversals and momentum shifts in Forex. By leveraging the facility of the AO Divergence indicator to identify discrepancies between worth motion and momentum, and confirming these alerts with the ZeroLag MACD for quicker and extra correct entries, merchants can improve their potential to make well timed and knowledgeable buying and selling choices.

Beneficial MT4 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 50% Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Accomplice Code: 𝟕𝐖𝟑𝐉𝐐