Up to date for tax 12 months 2025.

Because the child boomer technology ages, extra taxpayers are dealing with property and belief taxes for the primary time. Based on Accounting In the present day, the variety of revenue tax returns for estates and trusts (Kind 1041) elevated by 14.9% between 2020 and 2021. However for many people, dealing with taxes for an property or belief can really feel like deciphering a overseas language.

As extra folks navigate these tax types, it’s necessary to grasp IRS Kind 1041 and its intricacies. This information will stroll you thru the necessities, breaking down Kind 1041 submitting necessities, directions, and tricks to make your tax preparation much less daunting.

At a look:

- Revenue generated between the proprietor’s dying and asset switch to beneficiaries have to be reported to the Inner Income Service on Kind 1041.

- Beneficiaries are accountable for paying revenue tax if belongings are distributed earlier than incomes revenue.

- Not all trusts and estates should file Kind 1041 — solely these with income-producing belongings or nonresident alien beneficiaries.

- The due date for Kind 1041 will depend on the tax 12 months, which could be the calendar 12 months or a fiscal 12 months chosen by the executor.

What’s IRS Kind 1041?

IRS Kind 1041 is the U.S. Revenue Tax Return for Estates and Trusts. It’s used to report revenue earned by a decedent’s property or belief after the property proprietor’s date of dying however earlier than belongings are distributed to beneficiaries. Simply don’t confuse Kind 1041 with Kind 706, which is used for submitting an property tax return.

When an individual passes away, their property turns into a separate taxable entity. Any revenue this entity earns — from rental revenue, capital positive aspects, curiosity, or dividends — have to be reported on IRS Kind 1041. Equally, revenue earned by sure trusts can also be reported on this manner.

Totally different schedules, comparable to Schedule D (capital positive aspects and losses) and Schedule Ok-1, are additionally connected to Kind 1041 to report particular forms of revenue or the beneficiary’s share of revenue.

How does Kind 1041 differ from Kind 1040?

Kind 1040 is used to report the revenue of a person taxpayer, whereas Kind 1041 is used for the decedent’s property or a belief. For instance:

- Kind 1040 covers the revenue earned by a person earlier than their date of dying.

- Kind 1041 handles revenue earned by the property or belief after the person’s dying.

For instance, if somebody dies earlier than receiving their ultimate paycheck, the cash from that paycheck will likely be transferred to their property. This revenue must be reported on Kind 1041. However somebody should additionally file a ultimate return (Kind 1040) for the deceased — normally a partner, one other shut relative, or an lawyer. It will report all their revenue earned within the ultimate tax 12 months whereas they have been alive.

Kind 1041 instance

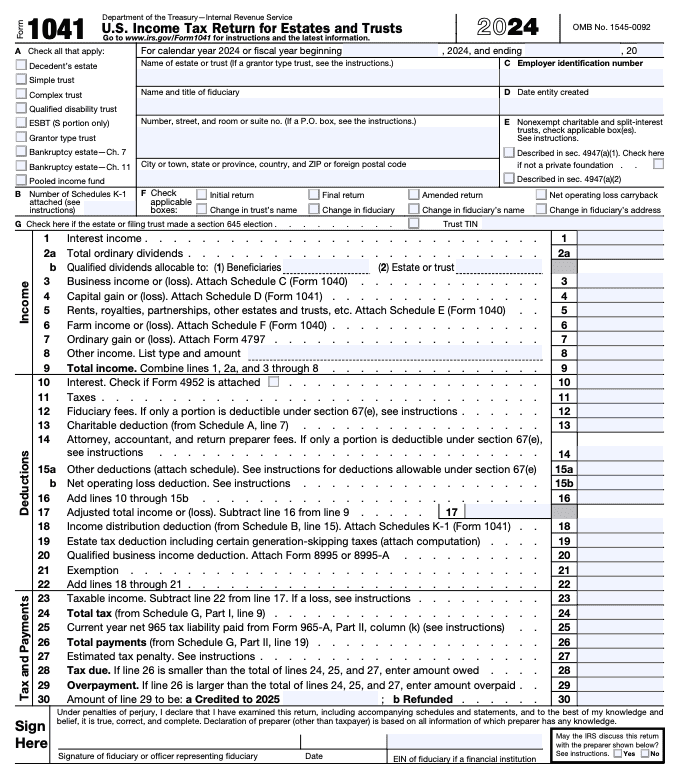

Right here’s what the primary web page of IRS Kind 1041 appears to be like like:

Ensure that to assemble all of the monetary paperwork essential to assist the tax deductions you wish to declare on Kind 1041. For assist with this, try our Kind 1041 tax preparation guidelines.

Kind 1041 directions: Who must file Kind 1041?

The fiduciary (executor, administrator, or trustee) managing the property or belief is accountable for submitting Kind 1041 to report any revenue tax legal responsibility of the property or belief.

You have to file Kind 1041 if the property or belief meets any of the next standards.

Decedent’s property

The fiduciary (or one of many joint fiduciaries) should file Kind 1041 for a home property that has:

- Gross revenue for the tax 12 months of $600 or extra, or

- A beneficiary who’s a nonresident alien.

- When you held a professional funding in a professional alternative fund (QOF) at any time in the course of the 12 months, you will need to file your return with Kind 8997 connected.

If the property generates no taxable revenue and has no nonresident alien beneficiaries, there’s no have to file Kind 1041.

An property is a home property if it isn’t a overseas property. A overseas property earns revenue from sources outdoors the US. This revenue isn’t related to any commerce or enterprise within the U.S. and isn’t a part of gross revenue. If you’re the fiduciary of a overseas property, file Kind 1040-NR, U.S. Nonresident Alien Revenue Tax Return, as a substitute of Kind 1041.

Belief

The fiduciary (or one of many joint fiduciaries) should file Kind 1041 for a home belief taxable beneath part 641 of the Inner Income Code that has:

- Any taxable revenue for the tax 12 months,

- Gross revenue of $600 or extra (no matter taxable revenue), or

- A beneficiary who’s a nonresident alien.

- When you held a professional funding in a professional alternative fund (QOF) at any time in the course of the 12 months, you will need to file your return with Kind 8997 connected.

A belief is a home belief if it meets each of the next checks:

- Court docket take a look at: A U.S. court docket can train main supervision over the belief administration.

- Management take a look at: A number of U.S. individuals have the authority to manage all substantial selections of the belief.

A belief that isn’t a home belief will get handled as a overseas belief. If you’re the trustee of a overseas belief, you will need to file Kind 1040-NR as a substitute of Kind 1041. Additionally, a overseas belief with a U.S. proprietor usually should file Kind 3520-A, Annual Data Return of International Belief With a U.S. Proprietor.

Exceptions

If the belief (or a portion of the belief) is a grantor kind belief, it should observe particular reporting necessities outlined by the IRS in Directions for Kind 1041 and Schedules A, B, G, J, and Ok-1, web page 13. Grantor trusts enable the grantor (the individual or individuals who created the belief) to have sure powers and possession advantages. Grantor trusts are usually ignored for revenue tax functions, and the IRS considers the revenue, deductions, and so forth., as belonging to the grantor.

Observe: Two or extra trusts are handled as one belief if the principle purpose for the trusts is to keep away from paying taxes AND they’ve the identical grantors and beneficiaries. This rule solely applies to the portion of the belief that comes from contributions (belongings added to the belief) after March 1, 1984. In different phrases, any cash or property added to the belief after that date will likely be topic to this “combining” rule if the factors are met.

Revenue to report on Kind 1041

Revenue for Kind 1041 contains cash earned by the property or belief from sources comparable to:

It’s important to separate revenue earned earlier than and after the date of dying, as solely the latter is reported on Kind 1041. The previous will get reported on Kind 1040.

Widespread deductions for estates and trusts

Here’s a brief record of frequent tax deductions and exemptions that may decrease the property’s taxable revenue:

- $600 exemption

- Executor charges (deductible if the property pays the executor for his or her providers)

- Skilled charges for lawyer and accountant prices

- Administrative bills, comparable to court docket submitting charges

- Required distributions to beneficiaries

- Charitable contributions made by the property or belief

When claiming deductions or tax credit, word that you could be additionally should file Schedule I, which is used to determine various minimal tax for estates and trusts.

Easy methods to calculate the revenue distribution deduction for Kind 1041

The revenue distribution deduction permits an property or belief to scale back its taxable revenue by the quantity of revenue it distributes to its beneficiaries in the course of the tax 12 months. This deduction ensures that revenue is taxed solely as soon as — on the beneficiary’s stage — slightly than each the belief and beneficiary being taxed on the identical revenue.

To calculate this deduction, use the distributable internet revenue (DNI) as the utmost restrict. DNI represents the property or belief’s complete revenue minus sure allowable deductions like charitable deductions and bills for administering the property. Distributions to beneficiaries can not exceed the DNI quantity. To keep away from errors on Kind 1041 and Schedule Ok-1, be sure to correctly assign revenue and doc the way it was distributed.

Kind 1041 FAQs

Reporting revenue from estates and trusts: Easy methods to file Kind 1041 with TaxAct

Submitting Kind 1041 doesn’t should be sophisticated! TaxAct’s intuitive tax software program guides you thru the method step-by-step, making certain you meet all of the submitting necessities whereas serving to you maximize any tax deductions or credit obtainable to the property or belief.

Head over to TaxAct Estates and Trusts to get began. When you need assistance in the course of the tax submitting course of, we even have detailed directions for:

Want extra time to file Kind 1041? Don’t neglect that TaxAct can even assist you file an extension for Kind 1041 by submitting Kind 7004 to the IRS. Coping with property and belief taxes is taxing sufficient — this ensures you’ll be able to take the mandatory time to arrange whereas avoiding penalties for late submitting.

The underside line

Submitting taxes for an property or belief will not be your thought of enjoyable. However with TaxAct’s assist, it doesn’t should really feel not possible. By understanding Kind 1041 and staying organized, you’ll conquer your revenue tax return like a professional this 12 months.