A.I.S. Assets Restricted (TSXV: AIS, OTCQB: AISSF) (the “Firm” or “AIS”) pronounces that the Firm together with its three way partnership associate Spey Assets Corp. (“SPEY”) has acquired the Candela II Undertaking within the Incahuasi Salar in Argentina. The Firm paid US$1 million to buy 100% curiosity within the mission. Concurrently SPEY exercised its choice with AIS to accumulate an 80% curiosity within the Candela II Undertaking by paying US$1 million to the Firm. AIS retains a 20% curiosity within the Candela II Undertaking.

Highlights of Candela II work accomplished up to now:

- 25 floor samples and three bulk samples.

- 5 rotary drill holes with gap 5 all the way down to 209 metres.

- A NI43-101 report is being written by Montgomery & Associates.

- Ekosolve™ reviews from pattern 002 that had 160ppm of lithium, restoration utilizing a a number of wash program extracted greater than 90% of the lithium contained within the brine, the best recognized restoration ever recorded and printed by a direct lithium extraction system utilizing the Ekosolve™ DLE course of.

Fig. 1 – Work continues to progress on the Candela II Undertaking.

Manufacturing effectively program

A manufacturing effectively program will now be put in place to measure the brine move and to find out the porosity and transmissivity of the aquifers. Concurrently, a bigger pilot plant is now being designed to finish the proof of course of for Ekosolve™ solvent change DLE lithium course of.

SPEY has an choice to accumulate AIS’ remaining 20% curiosity within the Candela II mission by paying US$6 million by March 18, 2023.

Pocitos 1 & 2 Choices

In June 2021, AIS optioned its Pocitos 1 and a pair of licences on the Pocitos Salar to SPEY Assets for an choice price of US$100,000 per exploration licence and a pair of,500,000 Spey frequent shares.

Spey will be capable of train the Possibility and purchase a 100% curiosity within the Property from AIS by paying a complete of US$1,732,000 (the “Buy Worth”) previous to June 23, 2022. As well as, Spey should full a US$500,000 exploration program on the Property previous to June 23, 2022. Upon train of the Possibility and Spey’s acquisition of a 100% curiosity within the Property, AIS will retain a 7.5% royalty on the gross sales income of lithium carbonate or different lithium compounds from the Pocitos 1 and a pair of properties, web of export taxes. Consult with press launch dated June 24, 2021, for extra particulars.

In 2018 AIS accomplished two drill holes at Pocitos 1. The outcomes from assays performed by Alex Stewart present that lithium values of as much as 125ppm Li had been contained in brines that flowed from 350m to 400m intervals at greater than 50,000L per minute. The mission was deserted in 2018 because of the excessive magnesium however now that Ekosolve™ is ready to deal with brines with excessive magnesium the mission has change into viable and was re-optioned in 2021.

Pocitos 7 & 9 and Yareta III Exploration Licence Choices

AIS additionally has choices on Pocitos 7 and 9 and Yareta III properties and is actively looking for three way partnership companions to develop these lithium tasks.

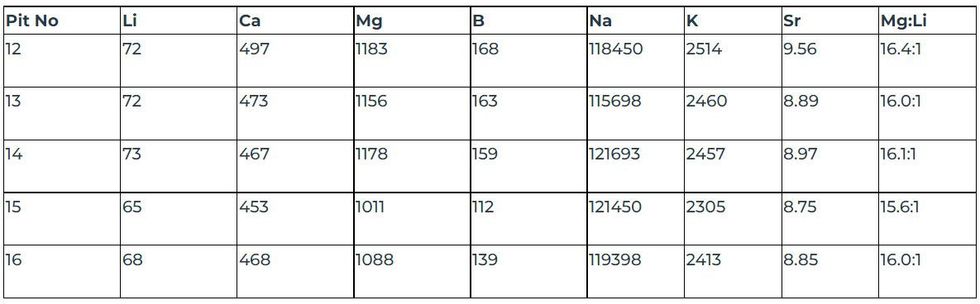

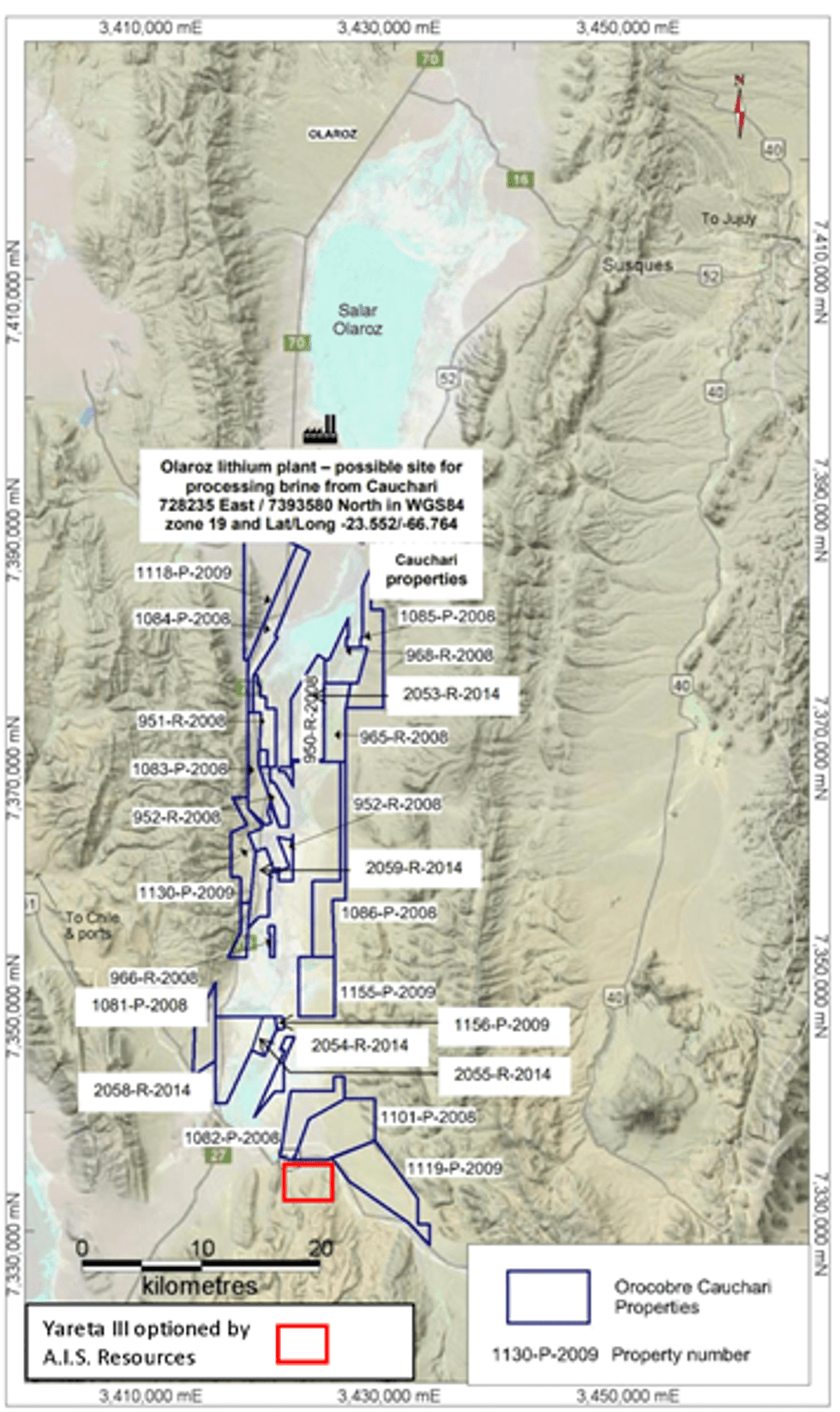

Pocitos 7 and 9 are situated on the southern finish of the Pocitos salar. A geophysics TEM survey and deep trench sampling was accomplished in 2018. The outcomes confirmed low resistivity on the japanese facet of the salar indicating sandy items containing brine could also be current. The lithium values assayed within the trenches by Alex Stewart are as follows:

Pocitos 7

Pits (All Values in ppm (components per million) 10,000 ppm=1%) Lat 24˚ 34’ 11.57”S Lengthy 67˚ 00’ 50” (Pit 12)

Pocitos 9

Pits (All Values in ppm (components per million) 10,000 ppm=1%) Lat 24˚ 35’ 52.86”Lengthy 66˚ 59’ 20.62” (pit 17)

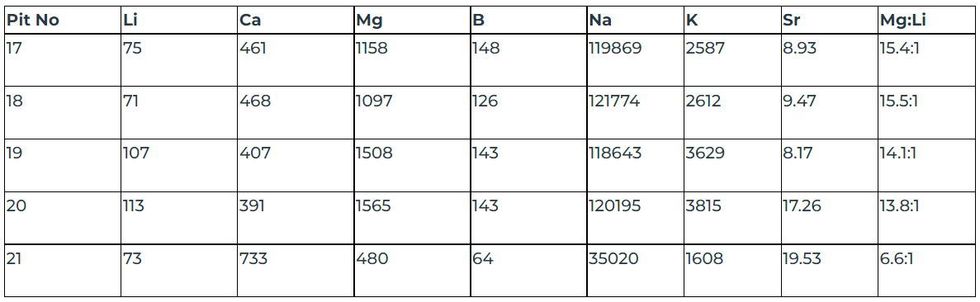

Yareta III Exploration Licence

Yareta III is on the southern finish of the Cauchari Salar close to Orocobre’s properties (now Allkem ASX:AKE). The mission isn’t on the halite on the salar. A gravity survey and TEM survey was performed by Orocobre in 2010 (the south east survey) with outcomes that point out that if brine is there concentrating on the southern finish of the salar it will likely be at depth.

Technical info on this information launch has been reviewed and accepted by Phillip Thomas, BSc Geol, MBM, FAusIMM MAIG MAIMVA(CMV) who’s a Certified Individual below the definitions established by the Nationwide Instrument 43-101 and is President, CEO of AIS Assets Ltd.

Fig. 2 – Yareta III exploration licence close to Orocobre/Allkem.

About A.I.S. Assets Restricted

A.I.S. Assets Restricted is a publicly traded funding issuer listed on the TSX Enterprise Alternate targeted on valuable and base metals exploration. AIS’ worth add technique is to accumulate potential exploration tasks and improve their worth by higher defining the mineral useful resource with a view to attracting three way partnership companions and enhancing the worth of our portfolio. The Firm is managed by a staff of skilled geologists and funding bankers, with a track-record of profitable capital markets achievements.

AIS owns 100% of the 28 sq km Fosterville-Toolleen Gold Undertaking situated 9.9km from Kirkland Lake’s Fosterville gold mine, a 60% curiosity within the 57sq km Vivid Gold Undertaking (with the proper to accumulate 100%), a 60% curiosity within the 58 sq km New South Wales Yalgogrin Gold Undertaking (with the proper to accumulate 100%), and 100% curiosity within the 167 sq km Kingston Gold Undertaking in Victoria Australia close to Stawell and Navarre. It additionally has a 20% three way partnership pursuits with Spey Assets Corp in lithium brines in Argentina on the Incahuasi and Pocitos Salars.

On Behalf of the Board of Administrators,

A.I.S. Assets Ltd.

Phillip Thomas, President & CEO

Company Contact

For additional info, please contact:

Phillip Thomas, Chief Govt Officer

T: +1-323 5155 164

E:pthomas@aisresources.com

Or

Martyn Ingredient.Chairman

T: +1-604-220-6266

E:melement@aisresources.com

Web site:www.aisresources.com

Neither the TSX Enterprise Alternate nor its Regulation Providers Supplier (as that time period is outlined within the insurance policies of the TSX Enterprise Alternate) accepts duty for the adequacy or accuracy of this launch.

ADVISORY: This press launch incorporates forward-looking statements. Though the Firm believes that the expectations mirrored in these forward-looking statements are affordable, undue reliance shouldn’t be positioned on them as a result of the Firm can provide no assurance that they’ll show to be appropriate. Since forward-looking statements handle future occasions and circumstances, by their very nature they contain inherent dangers and uncertainties. The forward-looking statements contained on this press launch are made as of the date hereof and the Firm undertakes no obligations to replace publicly or revise any forward-looking statements or info, whether or not on account of new info, future occasions or in any other case, until so required by relevant securities legal guidelines. Neither TSX Enterprise Alternate nor its Regulation Providers Supplier (as that time period is outlined in insurance policies of the TSX Enterprise Alternate) accepts duty for the adequacy or accuracy of this launch.