Regardless of the previous 5 days being immensely unstable, with the markets oscillating backwards and forwards in a variety, they nonetheless ended the week on a comparatively flat notice. The markets noticed the opening of the week with a severe gap-down following geopolitical tensions between Russia and Ukraine; the very subsequent day noticed the markets recouping all of the losses in an equally sturdy short-covering transfer. After oscillating backwards and forwards to the tune of 600-points on both facet, the remaining three days of the week had been spent in a a lot narrower vary. The headling index lastly ended with a modest lack of 98.45 factors (-0.57%) on a weekly foundation.

The approaching week can even have the present month by-product expiry; the periods will stay influenced by the rollover-centric actions. The weekly choices information counsel upside staying capped close to 17500 as that stage holds the very best Name OI. On the decrease facet, the Put OI stays at a most of 17000. This defines the seemingly vary for the approaching week, with all different exterior issues staying as anticipated. The geopolitical stress between Russia and Ukraine is the one exterior issue that continues to be fluid. The earlier week’s low of 16809 shall be essential to observe; this level additionally coincides with the prolonged development line that’s performing as assist at current.

Volatility surged throughout the earlier periods; INDIAVIX spiked by 18.66% to 22.17 on a weekly notice. The approaching week is more likely to start on a tepid notice; the degrees of 17450 and 17550 will act as seemingly resistance factors. The helps are available at 17100 and 16850 ranges.

The weekly RSI is 51.08; it’s impartial and doesn’t present any divergence in opposition to the worth. The weekly MACD continues to be bearish and under the sign line. A white physique occurred on the candles; this exhibits that the NIFTY closed increased than the degrees it opened at and, other than this, no different formations are seen on the charts.

There was lots of noise on the each day charts; nevertheless, the sample evaluation of the weekly charts exhibits the NIFTY consolidating sideways in a really large, however clearly outlined, vary. At present, the index trades above all its three key shifting averages; it’s just under the 20-week MA, which presently stands at 17591. Over the approaching days, the markets are more likely to keep in an outlined vary; some defensive approaches could also be noticed, with few such pockets displaying resilience. It is suggested that you just keep away from massive leveraged positions; whereas holding general positions mild, a cautious and vigilant strategy is suggested.

Sector Evaluation for the Coming Week

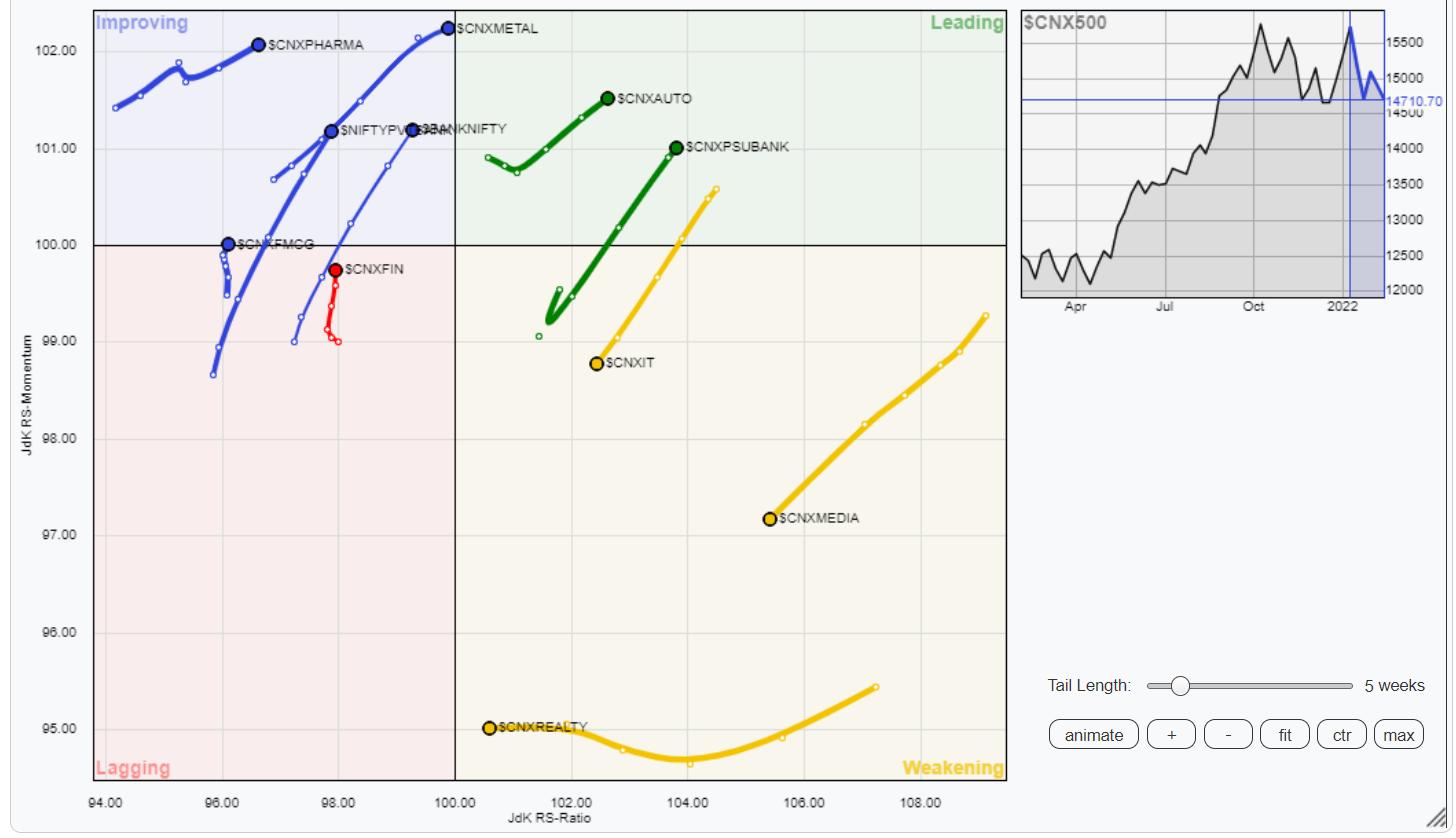

In our take a look at Relative Rotation Graphs®, we in contrast numerous sectors in opposition to CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

The evaluation of Relative Rotation Graphs (RRG) exhibits that, other than the Power Index, which has taken the flip for the higher whereas staying within the main quadrant, the opposite sector positions stay largely unchanged. Along with the Power Index, the NIFTY Auto, Commodities, PSE, and the PSU Financial institution Index are additionally contained in the main quadrant.

The IT and the Realty Index are contained in the weakening quadrant, together with the Infrastructure and the Media Indexes.

NIFTY Monetary Service, Consumption, and the FMCG indices are contained in the lagging quadrant. Nevertheless, they look like bettering on their relative momentum.

NIFTY Pharma, Steel, and the NIFTY financial institution indexes are contained in the bettering quadrant; on a weekly notice, they’re more likely to proceed exhibiting resilient efficiency in opposition to the broader NIFTY500 Index.

Vital Observe: RRG™ charts present the relative energy and momentum for a gaggle of shares. Within the above Chart, they present relative efficiency in opposition to NIFTY500 Index (Broader Markets) and shouldn’t be used straight as purchase or promote alerts.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Milan Vaishnav, CMT, MSTA is a certified Impartial Technical Analysis Analyst at his Analysis Agency, Gemstone Fairness Analysis & Advisory Companies in Vadodara, India. As a Consulting Technical Analysis Analyst and together with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Impartial Technical Analysis to the Shoppers. He presently contributes each day to ET Markets and The Financial Occasions of India. He additionally authors one of many India’s most correct “Each day / Weekly Market Outlook” — A Each day / Weekly Publication, at present in its fifteenth 12 months of publication.

Milan’s main duties embrace consulting in Portfolio/Funds Administration and Advisory Companies. His work additionally entails advising these Shoppers with dynamic Funding and Buying and selling Methods throughout a number of asset-classes whereas holding their actions aligned with the given mandate.

Be taught Extra