Subsequent week, the following assembly of the RBNZ will happen, throughout which, as anticipated, its rate of interest shall be raised once more, to 1.0%. Thus, the RBNZ is changing into a frontrunner within the means of tightening financial coverage amongst different main international central banks, and this may occasionally turn into a powerful and primary driver for the strengthening of the NZD within the subsequent few weeks, though right here an excessive amount of will depend upon the present financial scenario within the nation and on this planet.

The financial institution predicted that the speed would attain a peak of two.6% by the tip of 2023 (the earlier forecast of the Central Financial institution assumed that the speed would attain 2.1% by the start of 2024). Nonetheless, the forecast turned out to be weaker than the market expectations mirrored within the quotes, amid numerous dangers and uncertainty within the financial outlook.

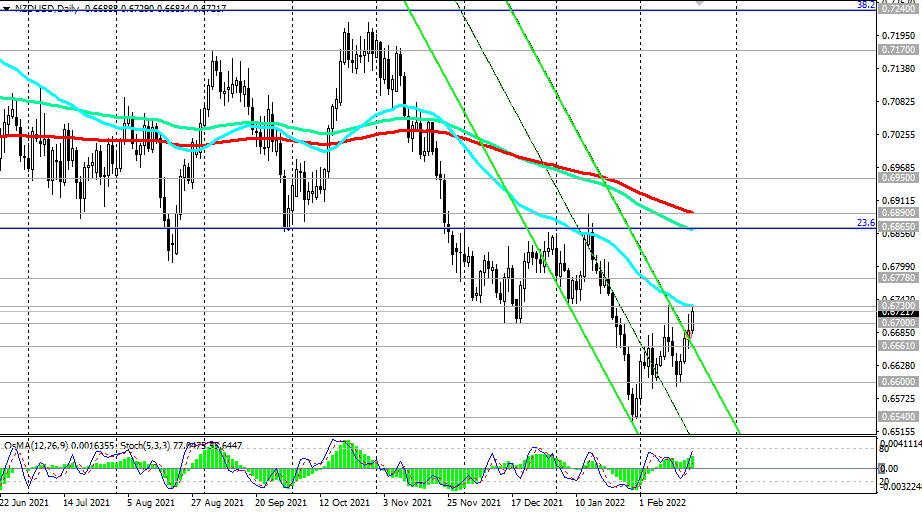

The zone of ranges 0.6700 and 0.6730 is a reasonably sturdy resistance zone, for the breakdown of which and additional development, the NZD/USD pair will want stable grounds and pretty sturdy drivers. Till Wednesday, when the RBNZ assembly takes place, they’re unlikely to look, except, in fact, sellers of the US greenback wish to decrease its quotes within the skinny market on Monday, when US banks and exchanges shall be closed on the event of Presidents Day.

On this case, and after the RBNZ assembly on Wednesday, the NZD/USD has the prospect of development in direction of the important thing resistance ranges of 0.6865, 0.6890.

See additionally -> Technical evaluation and buying and selling suggestions

*) essentially the most up-to-date “sizzling” analytics and buying and selling suggestions (together with entries into trades “by-the-market”) – https://t.me/fxrealtrading