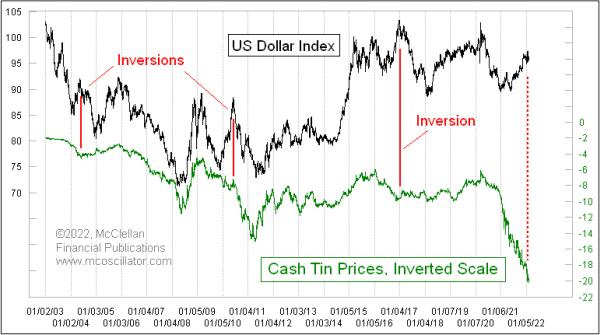

After I first launched this comparability chart of tin costs (inverted) versus the Greenback Index right here again in June 2021, I famous that “The US Greenback Index is headed for a multi-month uptrend, when you can imagine the message from tin costs.” That chart prediction labored out fairly effectively over the months since then, with the Greenback Index up greater than 6% following that article.

What’s curious is that, since then, tin costs have damaged their regular correlation with the Greenback Index and stored on rising, proven right here as a falling chart plot on the inverted scaling. This isn’t common conduct, but it surely has occurred earlier than.

Generally tin costs and the greenback get right into a optimistic correlation, proven as inversions on this chart, and when that occurs it has at all times been adopted by a significant drop for the greenback. I would not have a very good clarification for why it ought to work that means, however it’s a fairly constant phenomenon. Tin costs have gotten fairly prolonged within the months because the COVID Crash and are ripe for a reversal, which ought to set off the inverted reversal on this chart for the Greenback Index. However precisely when tin and the greenback ought to begin these reversals isn’t one thing this curious relationship will inform us.

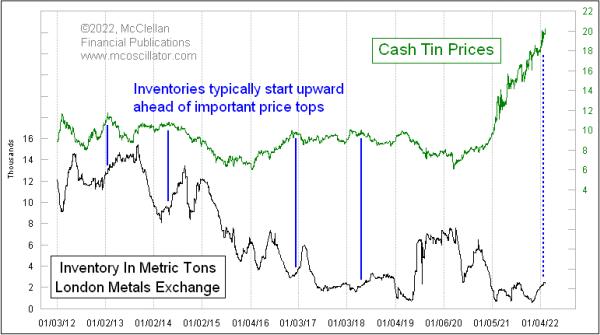

There’s one other curious relationship involving tin costs that has bearing on this present scenario. There are 550 warehouses at 32 places throughout the USA, Europe and Asia which can be accredited by the London Metals Change for the storage of “LME-registered manufacturers of steel, on behalf of warrant holders.” Storage ranges fluctuate with costs, which is often an inverse relationship. When costs rise, house owners pull steel out of storage to make use of it or promote it. Here’s a chart:

A curious factor occurs, although, at actually necessary value tops for tin. The stock ranges have a tendency to begin upward forward of the ultimate high for tin costs. We’re seeing such a phenomenon proper now, suggesting {that a} flip for costs is coming quickly. Sadly, that is once more a “situation”, not a sign, so it will not inform us the precise second of the flip.