The Engulfing Candle MT4 Indicator solves this by automating the detection course of. It scans value motion in real-time, identifies legitimate bullish and bearish engulfing patterns, and alerts merchants the second they kind. No extra squinting at charts or questioning whether or not that candle actually engulfed the earlier one.

How the Engulfing Candle Indicator Truly Works

The indicator operates on a simple premise: it identifies when a candle’s physique utterly engulfs the earlier candle’s physique. For a bullish engulfing sample, the present candle should open under the prior candle’s shut and shut above the prior candle’s open. Bearish engulfing patterns work in reverse—opening above and shutting under.

What separates this indicator from guide scanning is precision. Human eyes may miss delicate engulfing patterns throughout quick markets or when monitoring a number of pairs. The algorithm checks each candle shut systematically. When an engulfing sample types, the indicator locations an arrow on the chart and might set off audio alerts or push notifications.

Most variations of this instrument additionally embody filters. Some merchants solely need engulfing patterns that happen at assist or resistance ranges. Others choose indicators that align with the dominant pattern course. These filters assist scale back false indicators in uneven, range-bound markets the place engulfing patterns seem regularly however lack follow-through.

Actual Buying and selling Functions That Truly Matter

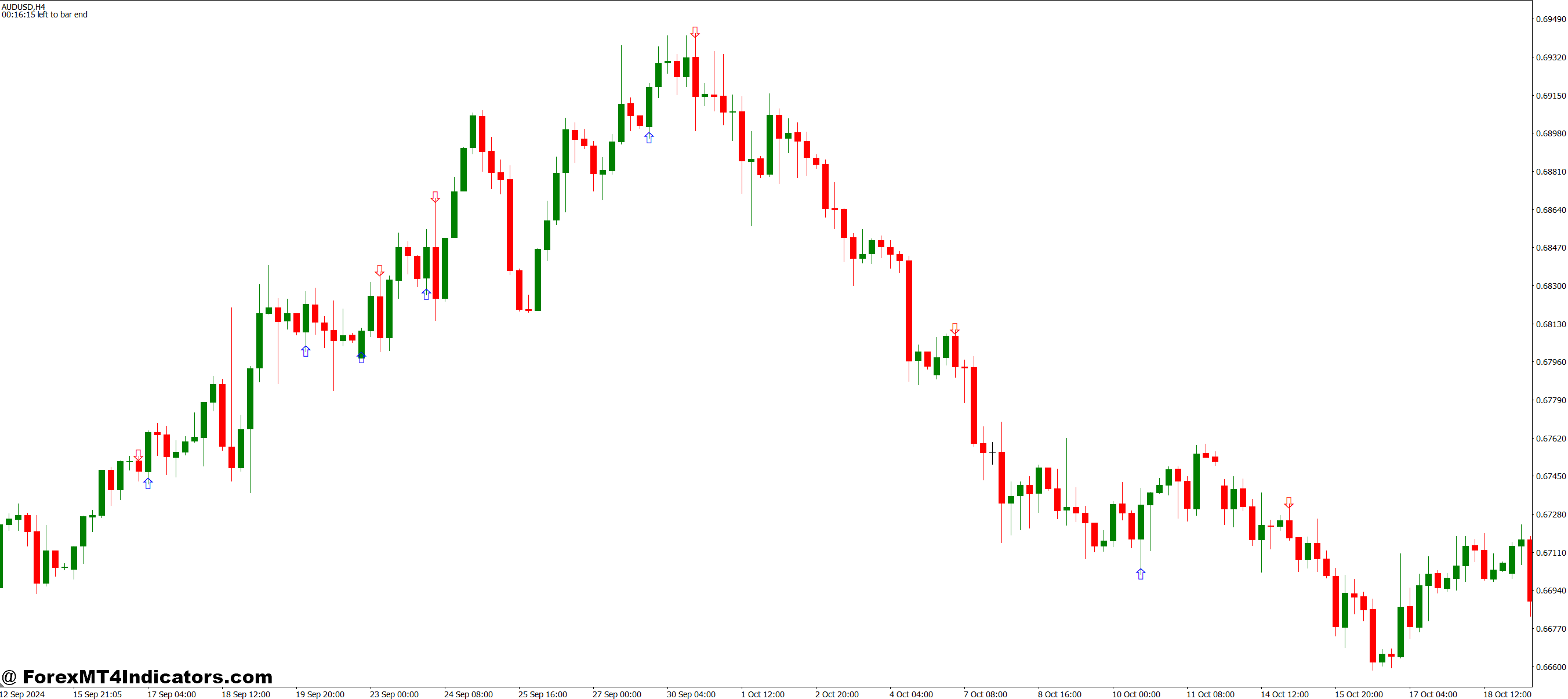

The indicator shines throughout pattern exhaustion phases. Take into account EUR/USD on the 4-hour chart after a powerful downtrend. Value hits a assist zone round 1.0800, and a bullish engulfing sample seems. The indicator marks it instantly. Merchants who act on this sign can enter lengthy positions with stops under the engulfing sample’s low, concentrating on the following resistance stage at 1.0850. That’s a 50-pip alternative with a 20-pip threat—strong risk-reward.

However right here’s the factor: not each engulfing sample deserves motion. On the 5-minute chart, these patterns kind continually throughout London session chop. A dealer testing this indicator on GBP/JPY scalping may see 15-20 indicators in a single session, most main nowhere. Context issues greater than the sample itself.

The indicator works finest when mixed with confluence elements. An engulfing sample at a Fibonacci retracement stage carries extra weight than one in the midst of nowhere. Identical goes for patterns forming at spherical numbers like 1.3000 on USD/CAD or at earlier swing highs and lows. Skilled merchants use the indicator as a set off inside a broader buying and selling plan, not as a standalone system.

Customizing Settings for Your Buying and selling Type

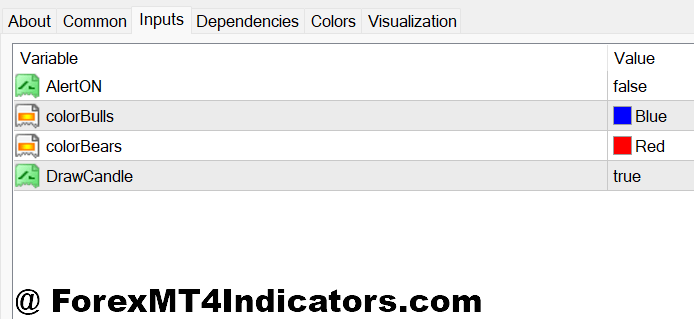

Most engulfing candle indicators supply adjustable parameters. The minimal physique measurement filter is essential. Setting this to five or 10 pips prevents the indicator from flagging tiny, insignificant engulfing patterns that happen throughout low-volatility intervals. Asian session merchants coping with AUD/JPY may want a 10-pip minimal to filter out noise, whereas somebody buying and selling GBP/USD throughout New York hours might use 15-20 pips.

Alert settings deserve consideration too. Visible arrows on the chart are useful, however audio alerts stop merchants from gluing their eyes to the display screen. Some variations enable electronic mail or cell notifications—helpful for swing merchants checking setups a couple of times each day slightly than watching charts continually.

Colour customization appears trivial till you’re monitoring eight forex pairs concurrently. Setting bullish indicators to brilliant inexperienced and bearish indicators to crimson makes patterns pop visually. Merchants utilizing darkish chart backgrounds may want to regulate transparency settings so arrows don’t mix into candlesticks.

One parameter that always will get missed is the lookback interval for pattern willpower. Some indicators gained’t sign bearish engulfing patterns throughout established uptrends, filtering counter-trend trades routinely. This setting will be expanded from 20 to 50 bars for swing merchants who need alignment with longer-term tendencies.

The Sincere Reality: Benefits and Limitations

The most important benefit is pace. The indicator identifies patterns in milliseconds that may take a dealer 30-60 seconds to identify and confirm manually. In risky markets after financial releases, that pace distinction captures entries different merchants miss. Automation additionally removes emotional bias—the indicator doesn’t care in regards to the earlier dropping commerce or hesitate due to worry.

Sample consistency is one other win. Guide merchants may need barely totally different standards for what constitutes a “legitimate” engulfing sample. The indicator applies the identical logic each time, creating consistency in sign technology. This makes backtesting and efficiency monitoring extra dependable.

That stated, the indicator can’t learn market context. It’ll flag an engulfing sample at 3 AM throughout low liquidity simply as readily as one throughout London open. Merchants have to filter indicators themselves primarily based on market circumstances, information occasions, and general volatility. An engulfing sample proper earlier than Non-Farm Payrolls? Most likely not the most effective time to behave on it.

False indicators are inevitable. Vary-bound markets produce engulfing patterns repeatedly with out significant value motion afterward. The indicator may present three bearish engulfing patterns on USD/JPY in a 20-pip vary, none resulting in sustained strikes. That is the place win charges are available in—profitable merchants settle for that perhaps 40-50% of indicators will probably be losers and give attention to risk-reward ratios that compensate.

Why This Beats Guide Sample Looking

Manually scanning for engulfing patterns throughout a number of timeframes and pairs is mentally exhausting. A dealer watching EUR/USD, GBP/USD, USD/JPY, and AUD/USD on each 1-hour and 4-hour charts must examine eight totally different chart mixtures continually. The engulfing candle indicator handles this monitoring routinely, liberating psychological bandwidth for commerce administration and evaluation.

The indicator additionally eliminates the “ought to I or shouldn’t I” paralysis. When a sample meets the indicator’s standards, there’s no ambiguity about whether or not it’s “engulfing sufficient.” The sign both fires or it doesn’t. This removes a major supply of hesitation that causes merchants to overlook entries whereas they’re nonetheless deciding.

In comparison with related reversal indicators just like the Pin Bar detector or Doji scanner, the engulfing sample indicator tends to provide clearer indicators with much less room for interpretation. Pin bars will be subjective—is that wick lengthy sufficient? Is the physique sufficiently small? Engulfing patterns have extra definitive standards, making the indicator’s job easier and its indicators extra dependable.

Methods to Commerce with Engulfing Candle MT4 Indicator

Purchase Entry

- Await affirmation shut – Don’t enter whenever you first see the bullish engulfing sample forming; wait till the candle really closes to keep away from fake-outs that reverse within the last 2-3 minutes.

- Verify the timeframe context – Use 1-hour charts or larger (4-hour, each day) for dependable indicators; 5-minute and 15-minute charts generate too many false engulfing patterns throughout uneven periods.

- Confirm you’re at assist – Solely take bullish engulfing indicators when value is at a transparent assist stage, earlier swing low, or spherical quantity like 1.0800 on EUR/USD—random patterns mid-range often fail.

- Set cease loss 5-10 pips under the sample low – Place your cease simply beneath the engulfing candle’s lowest level; if value breaks this stage, the reversal setup has failed, and that you must exit.

- Goal earlier resistance or 1:2 risk-reward minimal – Intention for not less than twice what you’re risking; in case your cease is 20 pips away, goal ought to be 40+ pips towards the closest resistance zone.

- Skip indicators throughout main information releases – Keep away from taking bullish engulfing patterns inside half-hour earlier than or after NFP, FOMC, or central financial institution bulletins—volatility invalidates technical patterns.

- Affirm with RSI under 40 – The sign is stronger when RSI on the identical timeframe reveals oversold circumstances; bullish engulfing patterns with RSI above 60 usually result in fast reversals in opposition to you.

- Keep away from patterns in robust downtrends – If GBP/USD is down 200+ pips in someday or under the 200 EMA, bullish engulfing patterns are counter-trend trades with decrease success charges—look ahead to pattern alignment.

Promote Entry

- Enter after the bearish engulfing candle closes – Don’t leap in mid-candle formation; look ahead to the total shut to verify the sample is legitimate and never simply short-term promoting strain.

- Use 4-hour or each day charts for swing trades – These timeframes filter out intraday noise; bearish engulfing on the USD/JPY each day chart carries extra weight than one on a 15-minute scalping chart.

- Search for resistance rejection – Solely act on bearish engulfing patterns at earlier swing highs, resistance zones, or psychological ranges like 1.3000 on GBP/USD—patterns in the midst of ranges fail regularly.

- Place cease loss 5-10 pips above sample excessive – Your cease goes simply above the engulfing candle’s highest level; if value breaks via, the reversal has failed, and also you’re out.

- Goal assist with 1:2 minimal risk-reward – In case you’re risking 25 pips, intention for 50+ pips towards the following assist stage; taking earnings too early kills your account even with a superb win charge.

- Don’t commerce throughout low liquidity periods – Skip bearish engulfing patterns throughout the Asian session on EUR/USD or Sunday night opens—skinny liquidity creates false indicators that don’t observe via.

- Verify RSI is above 60 – Bearish engulfing patterns with RSI in overbought territory (60-70+) have the next chance; indicators when RSI is at 40 usually reverse shortly.

- Ignore indicators in robust uptrends – If AUD/USD rallied 150 pips at this time or is above 200 EMA with no bearish construction, counter-trend bearish engulfing patterns usually fail—commerce with the pattern, not in opposition to it.

Sensible Takeaways for Merchants

Buying and selling foreign exchange carries substantial threat. No indicator ensures earnings, and the Engulfing Candle MT4 Indicator is not any exception. Its worth lies in bettering effectivity and consistency slightly than magically predicting market course.

The indicator works finest when merchants perceive what it’s displaying them and filter indicators via their very own evaluation. An engulfing sample at a key stage throughout trending markets warrants consideration. One in the midst of a variety throughout useless quantity doesn’t. Combining this instrument with assist/resistance evaluation, quantity indicators, or momentum oscillators creates a extra full buying and selling method.

For merchants spending hours searching reversal patterns manually, this indicator recovers useful time. For individuals who’ve missed key turning factors as a result of they weren’t watching on the proper second, the alert perform supplies a security internet. However on the finish of the day, the indicator is a instrument—its effectiveness relies upon fully on how merchants use it, after they belief its indicators, and the way properly they handle the trades that observe.

Advisable MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90