“Commerce with the pattern!” That is an age-old knowledge that has been quoted time and again by many foreign exchange merchants and for an excellent cause. Buying and selling with the pattern implies that merchants must be buying and selling with the move of the market and never in opposition to it. Many profitable foreign exchange merchants maintain this mantra of their hearts and has served them properly as worthwhile foreign exchange merchants.

Nonetheless, there are additionally many foreign exchange merchants who try and commerce with the pattern however as a substitute find yourself buying and selling at peaks and bottoms within the flawed commerce path. They typically are chasing costs considering that worth is already trending when in reality the short-term transfer is only a blip on the value chart.

A grasp dealer as soon as advised me {that a} pattern is taken into account a pattern when it’s clearly trending. This assertion may be very complicated, however it does maintain a lot fact in it. Merchants typically assume {that a} pattern has started when in reality worth is simply shifting erratically. Markets which are actually trending are normally thought-about a pattern when it’s already apparent on the value chart. Usually, though this does verify that the market is trending, however many instances merchants determine a pattern solely when it’s already too late to commerce it. Value is overbought or oversold and is due for a market correction.

So, how will we commerce on the candy spot the place we might objectively verify a pattern whereas on the similar time not being too late within the get together. Reality is we frequently can’t. Nonetheless, there are instruments that would assist us determine if the market is considerably shifting in a single path. This may very well be the subsequent neatest thing.

DMI Kijun Development Foreign exchange Buying and selling Technique is a pattern reversal buying and selling technique that confirms pattern reversals primarily based on the directional motion of worth.

DMI Oscillator

DMI Oscillator is a momentum technical indicator which is predicated on the Directional Motion Index (DMI).

The traditional DMI indicator was developed with a purpose to assist merchants determine which path the value of an asset is shifting. It does this by evaluating the prior highs and lows of worth. It then plots two strains that crossover one another signaling the path of worth primarily based on its common directional motion. Many merchants typically take into account this indicator because the go to indicator for figuring out trending and ranging markets because it additionally has a mechanism by which merchants can objectively determine if the typical directional motion of worth is powerful sufficient to be thought-about a pattern.

The DMI Oscillator is predicated on this idea. Nonetheless, as a substitute of plotting two strains that crossover, it plots a line that oscillate from unfavorable to optimistic or vice versa. Constructive strains point out a bullish bias, whereas unfavorable strains point out a bearish bias. Nonetheless, this doesn’t verify if the motion is powerful sufficient to be thought-about as a attainable begin of a pattern. It plots one other dotted line which is dynamic. If a optimistic DMI Oscillator line crosses above a optimistic dotted line, the DMI Oscillator line adjustments to lime inexperienced indicating robust bullish momentum. If a unfavorable line drops beneath a unfavorable dotted line, the DMI Oscillator line adjustments to orange purple indicating bearish momentum.

Kijun-sen+

The Kijun-sen is a modified shifting common line which is likely one of the most vital elements of the Ichimoku Kinko Hyo technique of technical evaluation.

The Kijun-sin is mainly the median of worth for the final 26-bars. This creates a shifting common line that would characterize the short- to mid-term pattern path. It’s characterised by a line which may be very jagged and will reply to cost motion very quick, but on the similar time may be very dependable.

This modified shifting common line, when mixed with one other dependable shifting common line or different elements of the Ichimoku Kinko Hyo indicator can produce excessive likelihood pattern reversal alerts. It might additionally reliably point out the path of the short- to mid-term pattern.

Buying and selling Technique

This buying and selling technique is a pattern reversal technique which trades on the confluence of shifting common crossovers and a pattern reversal affirmation of the DMI Oscillator.

For the crossover, we will probably be utilizing the Kijun-sen+ line and a 36-period Exponential Transferring Common (EMA).

Development reversal alerts are thought-about legitimate every time the Kijun-sen+ line and the 36 EMA line crosses over, whereas the DMI Oscillator confirms the pattern path.

On the DMI Oscillator, the DMI Oscillator line ought to crossover with the dotted line and alter to the colour that signifies the path of the pattern.

Indicators:

- Kijun-sen+

- 36 EMA

- Dsl_-_DMI_oscillator

Most well-liked Time Frames: 30-minute, 1-hour, 4-hour and each day charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York periods

Purchase Commerce Setup

Entry

- The Kijun-sen+ line ought to cross above the 36 EMA line.

- The DMI Oscillator line ought to cross above the higher dotted line and will change to lime inexperienced.

- Value motion ought to present bullish traits.

- Enter a purchase order on the affirmation of those circumstances.

Cease Loss

- Set the cease loss on the assist beneath the entry candle.

Exit

- Shut the commerce as quickly because the Kijun-sen+ line crosses beneath the 36 EMA line.

- Shut the commerce as quickly because the DMI Oscillator line crosses beneath zero.

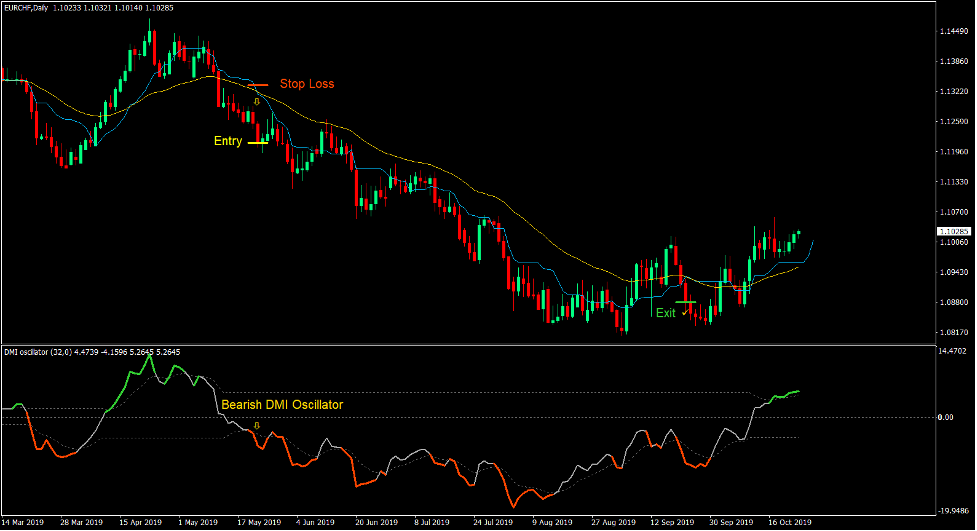

Promote Commerce Setup

Entry

- The Kijun-sen+ line ought to cross beneath the 36 EMA line.

- The DMI Oscillator line ought to cross beneath the decrease dotted line and will change to orange purple.

- Value motion ought to present bearish traits.

- Enter a promote order on the affirmation of those circumstances.

Cease Loss

- Set the cease loss on the resistance above the entry candle.

Exit

- Shut the commerce as quickly because the Kijun-sen+ line crosses above the 36 EMA line.

- Shut the commerce as quickly because the DMI Oscillator line crosses above zero.

Conclusion

This technique is an effective pattern reversal technique. It’s because on every commerce setup, the pattern power is confirmed utilizing the DMI Oscillator.

On prime of this, the Kijun-sen+ and the 36 EMA crossover setup is a extremely dependable commerce setup.

Merchants can rapidly earn earnings from the foreign exchange market utilizing this technique. It has the important thing components that are an excellent risk-reward ratio on trades that do lead to a pattern and an improved win charge utilizing the commerce confirmations above.

Foreign exchange Buying and selling Methods Set up Directions

DMI Kijun Development Foreign exchange Buying and selling Technique is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the amassed historical past information and buying and selling alerts.

DMI Kijun Development Foreign exchange Buying and selling Technique gives a chance to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Primarily based on this info, merchants can assume additional worth motion and regulate this technique accordingly.

Really useful Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Really useful Choices Buying and selling Platform

- Free +50% Bonus To Begin Buying and selling Immediately

- 9.6 Total Ranking!

- Routinely Credited To Your Account

- No Hidden Phrases

- Settle for USA Residents

Find out how to set up DMI Kijun Development Foreign exchange Buying and selling Technique?

- Obtain DMI Kijun Development Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you need to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out DMI Kijun Development Foreign exchange Buying and selling Technique

- You will notice DMI Kijun Development Foreign exchange Buying and selling Technique is offered in your Chart

*Observe: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain: