The Grandaddy Russell 2000 rallied near its 200-week shifting common (subject of our earlier article) yesterday. On Wednesday, with rising yields as soon as once more, Gramps retreated.

In a bullish state of affairs, IWM continues to consolidate and rally within the coming days and weeks, finally breaking via the 200-week shifting common and persevering with to climb. Within the bearish case, if IWM can not regain its 200-WMA after a interval of consolidation, this key weekly technical stage will develop into vital bear market resistance. That may almost certainly result in decrease lows.

IWM is in a bearish part together with the opposite indices, however latest value motion has proven relative energy. What ought to we be careful for?

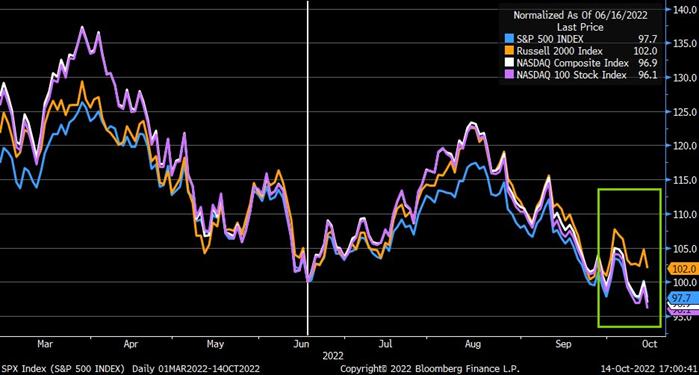

Whereas IWM struggles to interrupt above its 200-week shifting common, it has held its mid-June lows. SPY, DIA, and Nasdaq 100, all failed to take action.

Grandpa Russell’s firms are mid-cap and small-cap American companies which might be much less well-known manufacturers and have little publicity to worldwide markets, so the robust US greenback has much less influence. The Russell 2000 has violated the 200-weekly shifting common a number of instances earlier than. The truth is, with each disaster it was the NASDAQ that led whereas small caps remained weak. The explanations for that had been low rates of interest, low company tax charges and company buybacks. Small-cap firms didn’t have the identical advantages from these elements.

The truth is, this highlights the latest resilience of small and mid-cap shares in comparison with large-cap shares within the face of inflation, larger charges, slowing financial development and US greenback energy. Grandpa Russell nonetheless wants substantial work to the upside, however a possible multi-week backside is perhaps forming.

Are you interested by buying and selling small caps? Preserve updated with our evaluation so you may enter and exit trades on the proper time. You may join a free session with Rob Quinn, our Chief Technique Advisor, by clicking right here to be taught extra about Mish’s top-rated danger administration buying and selling service.

Mish’s Upcoming Seminars

The Cash Present: Be a part of me and plenty of great audio system on the Cash Present in Orlando, starting October thirtieth working through November 1st; spend Halloween with us!

Dealer’s Summit: Mish speaks with Helene Meisler on October twenty third at 12pm ET. Study extra right here.

Observe Mish on Twitter @marketminute for inventory picks and extra. Observe Mish on Instagram (mishschneider) for each day morning movies. To see up to date media clips, click on right here.

Given combined information, worry and powerful earnings, the charts are the most effective indicators for the way forward for the financial system, as Mish Schneider explains in this Yahoo! Finance look.

See Mish clarify why Bond merchants purchase unhealthy firm shares on Enterprise First AM.

Learn Mish’s newest article for CMC Markets, titled “Are Lengthy-Time period Treasuries Oversold?“.

Has the market bottomed? The place ought to passive buyers go to be protected? Mish digs into these questions and extra on Coast to Coast with Neil Cavuto.

Mish and Scott talk about a attainable mushy touchdown however with a great deal of headwinds to observe for on RFD-TV’s Cow Man Shut.

With BNN Bloomberg, Mish discusses the markets as U.S. banks reported earnings and why it is vital to observe long-term bonds and the steadiness investing within the sugar commerce.

The 6-7 yr enterprise cycle within the “inside” sectors of the U.S. financial system is dealing with an enormous check, as Mish discusses on NASDAQ Talks.

Watch some choose clips from Mish at ChartCon 2022!

Mish and Nicole speak danger, inflation, lengthy bonds, greenback and the place you may park some cash on TD Ameritrade.

- S&P 500 (SPY): 360 pivotal help and resistance at 380. 362 warning; 360, 351, 340 upside 375, 380, 385

- Russell 2000 (IWM): 168 help, 173 help.

- Dow Jones (DIA): Persevering with to carry 299 help; 308 resistance.

- Nasdaq (QQQ): 267 help, 274 resistance.

- Regional banks (KRE): 60 help, 64 resistance.

- Semiconductors (SMH): Assist at 175 and resistance at 182.

- Transportation (IYT): Assist at 202 with 208-210 resistance.

- Biotechnology (IBB): 115 help, 122 resistance.

- Retail (XRT): Lengthy-term help at 55; resistance at 62.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Schooling

Wade Dawson

MarketGauge.com

Portfolio Supervisor

Mish Schneider serves as Director of Buying and selling Schooling at MarketGauge.com. For practically 20 years, MarketGauge.com has supplied monetary info and schooling to hundreds of people, in addition to to massive monetary establishments and publications resembling Barron’s, Constancy, ILX Techniques, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many prime 50 monetary individuals to observe on Twitter. In 2018, Mish was the winner of the High Inventory Decide of the yr for RealVision.