After I first began buying and selling, I as soon as requested a senior dealer find out how to know if the market is beginning to development or beginning to breakout. His reply didn’t appear to make sense at first, but it was very logical. He stated that you’d know if the market is trending if there’s a clear development that’s being fashioned. It actually didn’t make sense till he defined it. He stated most merchants take development reversal trades purely based mostly on indicators. Generally merchants blindly comply with indicators to a fault. Then he stated a development is a development when it’s both making increased swing highs and swing lows or it’s making decrease swing highs and swing lows. He stated that is the affirmation that merchants ought to search for. Indicators are high quality they usually assist merchants discover readability in an in any other case complicated market. Nevertheless, it’s value motion that makes the symptoms do what they do. It’s best to mix the affirmation of value motion and indicators. This idea opened my eyes to seeing charts in another way.

Affirmation is essential. Buying and selling shouldn’t be taking a commerce on the first signal of a reversal. Astute merchants watch for affirmation. Within the case of a development reversal, we watch for value to create increased swing highs and swing lows in an uptrend or decrease swing lows and swing highs in a downtrend.

Double Pattern Synergy Foreign exchange Buying and selling Technique is a straightforward buying and selling technique that includes development reversal indicators from two extremely dependable indicators along with a value motion development reversal setup.

Heiken Ashi Transferring Common

HAMA stands for Heiken Ashi Transferring Common. The Heiken Ashi Transferring Common is a development following technical indicator which is a variation of the usual Heiken Ashi Candlesticks but is derived from shifting averages.

Heiken Ashi actually means common bars in Japanese.

Whereas the Heiken Ashi Candlesticks are merely candlestick formations which common out a candle on its open and shut, the HAMA indicator is completely totally different. It plots bars on the worth chart that modifications coloration similar to the Heiken Ashi Candlesticks, however these bars behave extra like an Exponential Transferring Common (EMA).

The HAMA indicator modifications coloration relying on the path of the development. Blues bars point out a bullish development whereas pink bars point out a bearish development. Bigger bars point out a strengthening development, whereas smaller bars point out a weakening development or a retracement.

Double Pattern Revenue

Double Pattern Revenue is a development following customized indicator which relies on shifting averages.

This indicator plots two customized shifting common traces which comply with value motion fairly responsively. These two traces crosses over and work together relying on the path of the development. It additionally modifications coloration relying on the slope of the traces.

The sooner line is coloration inexperienced when the road is sloping up and pink when the road is sloping down. The slower line is blue when sloping up and white when sloping down.

Merchants can spot development reversal indicators based mostly on the crossing over of the 2 traces coupled with the altering of the colour of the traces.

Buying and selling Technique

This buying and selling technique offers commerce indicators based mostly on the crossing over of the Double Pattern Revenue traces and the HAMA bars.

First, the Double Pattern Revenue traces ought to crossover and alter coloration indicating a brand new development.

Then, the HAMA bars also needs to change coloration indicating the path of the brand new development.

Then, the Double Pattern Revenue traces ought to crossover the HAMA bars. These indicators will simply be an preliminary indication of a development reversal.

The development reversal is then confirmed after value creates a swing level within the path of the brand new development, retraces, then creates a swing level with out breaching the HAMA bars. As quickly as this value motion is confirmed, then the development reversal setup turns into legitimate and tradable.

Indicators:

Most well-liked Time Frames: 30-minute, 1-hour, 4-hour and day by day charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York periods

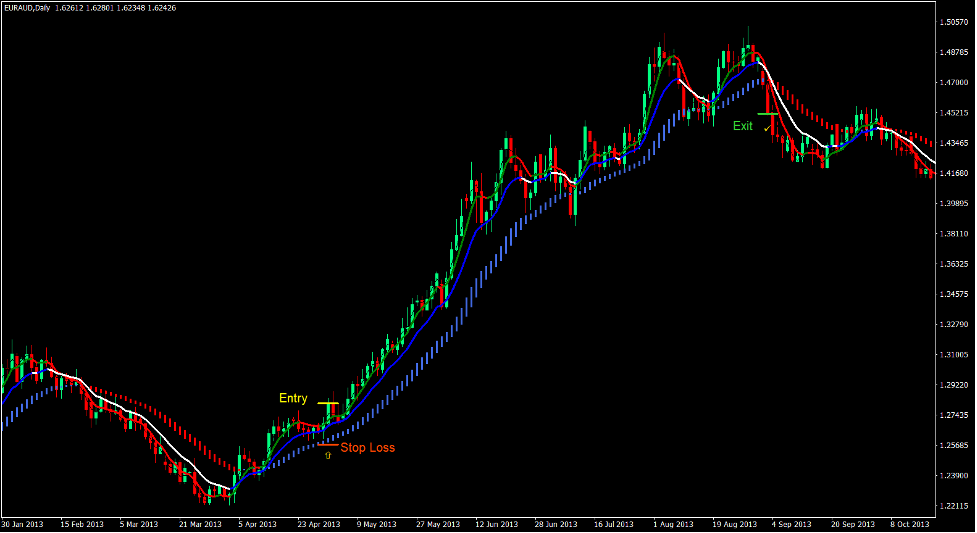

Purchase Commerce Setup

Entry

- The sooner line of the Double Pattern Revenue indicator ought to cross above the slower line.

- The traces ought to change to inexperienced and blue.

- The HAMA bars ought to change to royal blue.

- The Double Pattern Revenue traces ought to cross above the HAMA bars.

- Value motion ought to retrace in the direction of the HAMA bars then reject the world.

- Enter a purchase order as quickly as value motion creates a swing low on the world of the royal blue HAMA bars.

Cease Loss

- Set the cease loss on the swing low beneath the entry candle.

Exit

- Shut the commerce as quickly because the HAMA bars change to pink.

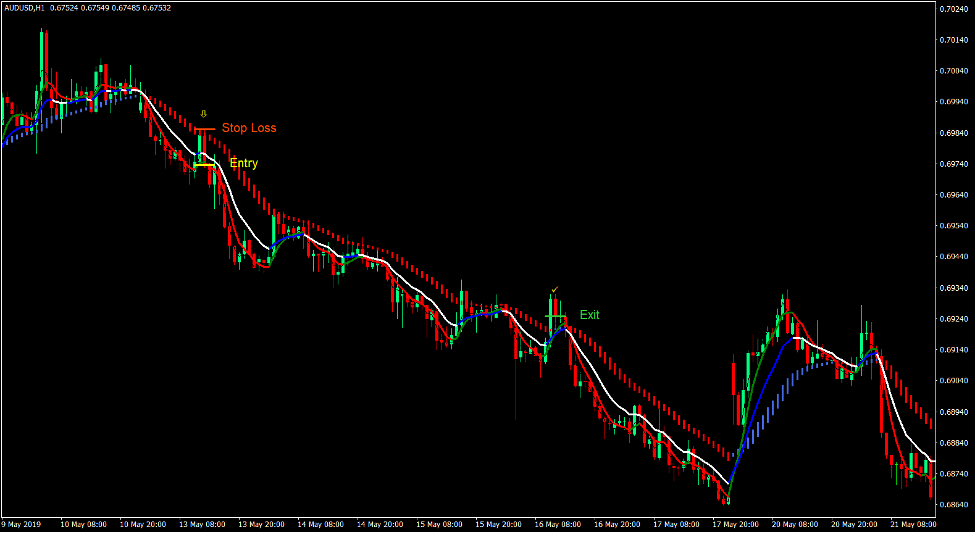

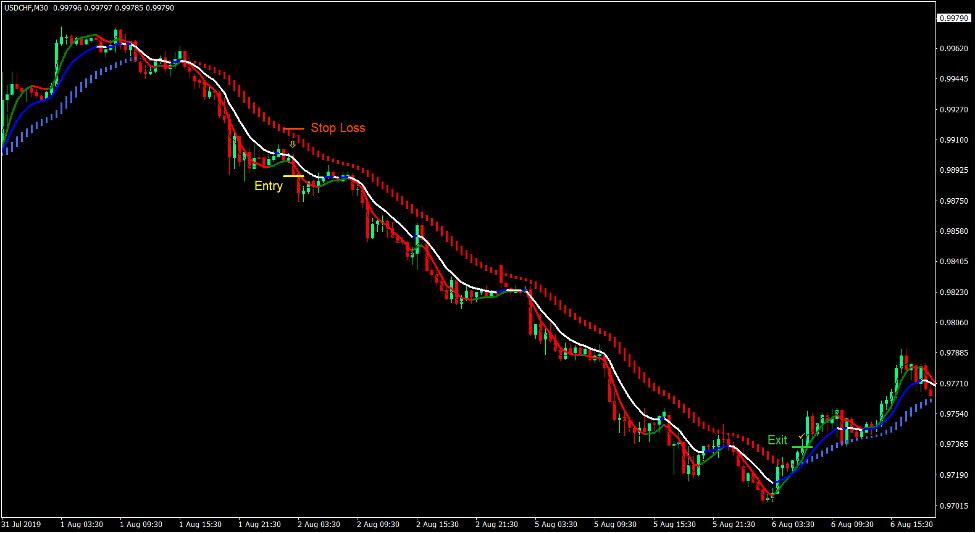

Promote Commerce Setup

Entry

- The sooner line of the Double Pattern Revenue indicator ought to cross beneath the slower line.

- The traces ought to change to pink and white.

- The HAMA bars ought to change to pink.

- The Double Pattern Revenue traces ought to cross beneath the HAMA bars.

- Value motion ought to retrace in the direction of the HAMA bars then reject the world.

- Enter a promote order as quickly as value motion creates a swing excessive on the world of the pink HAMA bars.

Cease Loss

- Set the cease loss on the swing excessive above the entry candle.

Exit

- Shut the commerce as quickly because the HAMA bars change to royal blue.

Conclusion

This buying and selling technique is an efficient development following technique that would assist merchants earn constant income.

The affirmation of a swing level that doesn’t trigger the HAMA bars to vary coloration signifies that the development is holding. Such confirmations assist enhance the accuracy of the commerce based mostly on value motion.

As a result of this technique trades on contemporary traits proper close to the beginning of the development and exits on the finish of a development, it permits merchants to squeeze out as a lot income from the brand new development. If the development lasts longer, merchants can revenue a lot from every commerce.

Foreign exchange Buying and selling Methods Set up Directions

Double Pattern Synergy Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the gathered historical past knowledge and buying and selling indicators.

Double Pattern Synergy Foreign exchange Buying and selling Technique offers a possibility to detect numerous peculiarities and patterns in value dynamics that are invisible to the bare eye.

Based mostly on this data, merchants can assume additional value motion and alter this technique accordingly.

Beneficial Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

How one can set up Double Pattern Synergy Foreign exchange Buying and selling Technique?

- Obtain Double Pattern Synergy Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 recordsdata to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you wish to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Double Pattern Synergy Foreign exchange Buying and selling Technique

- You will notice Double Pattern Synergy Foreign exchange Buying and selling Technique is accessible in your Chart

*Be aware: Not all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain: