While proudly owning a house is a dream come true for most millennials, should you don’t do the mathematics proper, you’ll find yourself despising what was meant to be a worthwhile funding.

With sky-rocketing property costs and a gradual rise in Residence Mortgage rates of interest, many are inclined to go for renting reasonably than shopping for. When figuring out whether or not to purchase or lease, you want take quite a few life-style in addition to monetary implications into consideration. Let’s weigh our choices.

Though proudly owning a house has lengthy been thought to be a tell-tale signal of success for a lot of, it may get tough to match renting and shopping for. Whereas renting lets you transfer everytime you select and requires much less funding, shopping for a house is a worthwhile funding which can enhance your wealth and fairness.

Learn on to resolve what’s finest for you.

Renting and shopping for have completely different up-front prices.

Once you personal a house, you’re responsible for extra than simply your month-to-month Residence Mortgage EMI (Equated Month-to-month Installment) cost. You’re answerable for paying for renovations, taxes, repairs, upkeep, and different dues. Proudly owning a house can simply develop into dearer than renting on account of these added prices.

Solely lease and utilities are sometimes the tenants’ duty. All the things else is the duty of the home-owner. To maneuver in as a tenant, you’ll have to pay a safety deposit.

As you proceed paying the stability of your Residence Mortgage, you’ll enhance your own home’s fairness. As per your native real-estate market situations, fairness additionally grows as the worth of your own home rises. If it is advisable to borrow cash sooner or later, dwelling fairness will increase your web value and can be utilized as safety for a mortgage. It is very important perceive that property values may lower relying on market situations.

Tenants can nonetheless construct wealth, however you’ll want a unique technique. If renting is cheaper than proudly owning, you possibly can construct your web value by frequently investing the distinction.

Extra Studying: Why You Ought to Assessment Your Residence Mortgage Periodically

Proudly owning a house is a large dedication. You need to prep your self for the duty, be it restore, upkeep or maintenance. In the event you lease, a lot of the required upkeep and repairs shall be dealt with by your landlord. Nonetheless, you’re responsible for damages attributable to you and the owner would sometimes cost you for a similar.

Assuming you may have to relocate sooner or later, renting is a extra adaptable various. In case your employment adjustments or it is advisable to relocate, you possibly can transfer on the finish of your settlement or you possibly can break your contract, give a month’s discover, and pay any expenses laid out in your rental settlement. Whereas as a home-owner, you don’t have lots of flexibility in the case of relocating. It must be rented out, bought, or simply left empty.

Secondly, with renting, you sometimes should settle for the house in “as is” situation. Making minor alterations/renovations to the house shouldn’t be one thing you are able to do. Nonetheless, as a home-owner, you’ve gotten that freedom.

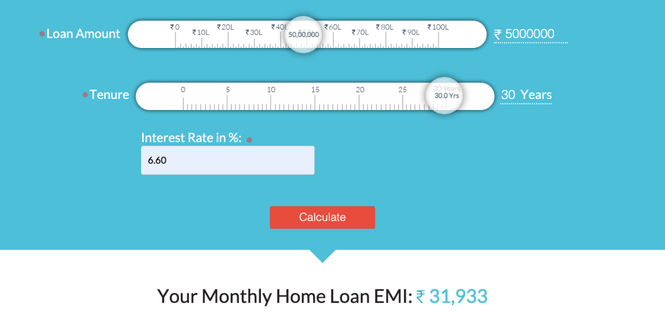

Making the selection entails contemplating your monetary state of affairs and the way renting versus buying would have an effect on you. You may decide which various is healthier for you by evaluating your estimated Residence Mortgage cost to the estimated lease cost.

Your month-to-month Residence Mortgage cost will rely on the worth, down cost, mortgage time period, property taxes, and rate of interest on the mortgage – extremely reliant in your Credit score Rating. Use the EMI Calculator to get a normal sense of what your month-to-month Residence Mortgage cost may very well be like.

A mortgage EMI calculator will help you crunch the numbers.

Extra Studying: Residence Mortgage EMI Calculator: How It Works

To guarantee that your determination remains to be one of the best one, it’s a sensible thought to periodically evaluate your dwelling state of affairs as your life and the housing market adjustments. Buying may be a greater possibility if lease costs are rising or if dwelling costs are declining.

Discovering the optimum alternative to purchase your dream home may be made less complicated should you sustain with the present actual property market. Consider, buying a house does entail hefty upfront prices in addition to ongoing prices for upkeep, repairs, and property taxes.

In the event you don’t save or make investments the cash you’ll have spent on the upper prices of home-ownership, renting a house received’t permit your cash to develop.

Nonetheless, it’s not a once-in-a-lifetime determination to lease or purchase. In case your monetary state of affairs or your life-style adjustments, you possibly can come again and revaluate at any second!

Have you ever made up your thoughts but? Examine should you’re eligible for a low-interest Residence Mortgage.

Copyright reserved © 2022 A & A Dukaan Monetary Companies Pvt. Ltd. All rights reserved.