Purchase Now, Pay Later websites have exploded onto the market in the previous few years. In only one month of 2020, the variety of lively customers jumped 186% year-over-year, based on knowledge from Sensor Tower.

It’s straightforward to see why BNPL apps are so widespread: they’re straightforward to make use of, obtainable virtually in every single place, and infrequently interest-free. However with so many alternative apps it’s not all the time straightforward to see what units them aside.

We’ve gathered collectively the elements that matter to you– rates of interest, late charges, credit score checks, and extra. Then we used these to seek out the 7 greatest Purchase Now Pay Later websites of 2022. Afterward, learn on to study extra about how BNPL apps work and the way they have an effect on your credit score rating:

What are the very best Purchase Now Pay Later websites?

- Affirm

- Klarna

- Splitit

- Afterpay

- Sezzle

- PayPal Pay in 4

- Zip (Quadpay)

1. Affirm: Finest Purchase Now Pay Later App for In Retailer

Affirm is the very best BNPL app for in-store as a result of it prices no charges, it’s accepted almost wherever, and it affords the widest vary of fee choices. Patrons can select from a regular Pay in 4 plan or a month-to-month mortgage that stretches as much as 48 months.

For smaller buys, the Pay in 4 choice is a good selection with no curiosity and no charges of any variety. Bigger purchases could qualify for month-to-month funds with an APR from 0% to 30%, however nonetheless no charges.

Plus Affirm works at 1000’s of shops, together with main names like Goal or Amazon. Don’t see Affirm at checkout? No downside. Affirm’s BNPL app permits you to create a digital bank card that can be utilized for on-line or in-store purchases.

Professionals:

- No late charges

- Can be utilized on-line or in-store

- Accepted virtually wherever because of a digital card

- The longest fee phrases of any BNPL

Cons:

- Month-to-month loans have charges that might be as excessive as 30%

- Rates of interest range based mostly on size, buy quantity, and even service provider – to allow them to be onerous to foretell

- Month-to-month mortgage exercise could also be reported to credit score bureaus

Curiosity:

- No curiosity for Pay in 4

- 10-30% curiosity for month-to-month mortgage

Phrases:

- Pay in 4 (4 funds over 6 weeks)

- Month-to-month (1 to 48 months)

Buy Restrict: As much as $17,500 relying on credit score rating

Credit score Test? Mushy pull

Down Cost? Provided that you don’t qualify for the complete buy quantity

2. Klarna: Finest Purchase Now Pay Later with a Digital Card

We’re calling out Klarna as the very best digital card, but it surely may additionally match as the very best in-store BNPL app, too. With Klarna you pay no curiosity on most plans, and there aren’t any charges so long as you make your funds on time.

Plus, you’ll be able to add your digital card to your cell pockets, like Apple Pay or Google Pay. This allows you to mix the comfort of BNPL with the convenience of contactless funds. Merely faucet your card, and also you’re immediately authorized.

And talking of cell, the Klarna app additionally provides you curated buying suggestions, rewards factors, and unique reductions.

Professionals:

- Works with over 400,000 retailers in 45 nations

- App affords curated buying suggestions

- No charges so long as you’re on time

- Rewards program with unique reductions

Cons:

- Late funds or non-payment could also be reported to credit score bureaus

- $7 payment for every late or returned fee (as much as 25% of the acquisition worth)

- Month-to-month loans could carry an rate of interest as much as 29.99%

Curiosity:

- 0% for Pay in 4 or Pay in 30

- As much as 29.99% for month-to-month mortgage

Phrases:

- Pay in 4 (4 funds over 6 weeks)

- Pay in 30 (Full buy due after 30 days)

- Month-to-month (6 – 24 months)

Buy Restrict: Will depend on credit score rating and buy historical past

Credit score Test? Mushy pull

Down Cost?

- 25% for Pay in 4

- No down fee for Pay in 30 or month-to-month mortgage

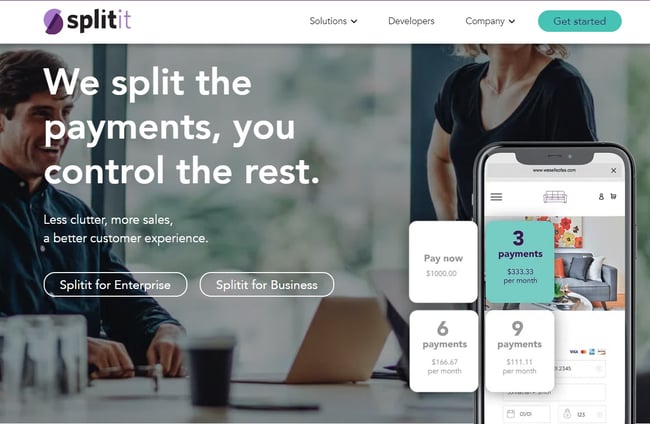

3. Splitit: Finest Purchase Now Pay Later for No Credit score Test

Splitit is in contrast to some other BNPL web site, as a result of it makes use of your current credit score, with no additional credit score test. If in case you have a bank card, you’re already authorized for Splitit. You get the financial savings of a 0% curiosity mortgage, with the safety of your bank card.

While you make a purchase order with Splitit, the app locations a short lived maintain in your bank card funds. Funds are then mechanically deducted once they’re due.

As a bonus, this implies your purchases nonetheless qualify for any card perks, reward factors, or airline miles you’d usually get out of your card supplier.

Professionals:

- 0% curiosity

- No credit score test

- If in case you have a bank card, you’re already authorized

- You’ll be able to acquire any rewards factors or perks out of your current bank card

Cons:

- You must have already got a bank card

- Doesn’t work with American Categorical

- Whereas Splitit has no curiosity, your funds could also be topic to your bank card charges if not paid in full

Curiosity: No curiosity

Phrases: 3, 6, 12, or 24 month-to-month funds

Buy Restrict: Identical as your bank card restrict

Credit score Test? No credit score test

Down Cost? First installment

4. Afterpay: Finest Purchase Now Pay Later for Sensible Spending

Not like another selections, Afterpay has a quick and easy utility course of that will or could not embrace a smooth credit score test. They provide 0% curiosity and don’t report purchases or fee historical past to the credit score bureaus.

However what makes Afterpay shine are the options designed to stop overspending, and reward sensible spending habits. One instance is a purchase order restrict that grows along with your historical past of fine funds. Additionally they characteristic computerized fee reminders to be sure you by no means miss an installment.

Professionals:

- 0% curiosity

- No credit score checks after the primary utility

- Doesn’t report buy historical past or fee historical past to credit score bureaus

- Buy restrict will increase with good fee historical past

Cons:

- Can solely be used with collaborating retailers

- Steep charges for late funds ($10 for the primary late fee, then $7 every as much as 25% of the acquisition quantity)

Curiosity: No curiosity

Phrases: 4 funds over 6 weeks

Buy Restrict: Begins at $600 and will increase with fee historical past

Credit score Test? Could do a smooth pull for brand new candidates

Down Cost? 25% upfront

5. Sezzle: Finest Purchase Now Pay Later for Dangerous Credit score

We’ve chosen Sezzle as the very best for bad credit report as a result of it’s the one BNPL app with the potential to assist enhance your credit score rating. The trick is that on-time funds assist you to improve to Sezzle Up.

Sezzle’s primary plan is a regular Pay in 4 choice, with 0% curiosity, no late charges, and a 6-week installment schedule. With this plan, Sezzle doesn’t report fee historical past to the credit score bureaus. However Sezzle Up is a reusable, revolving credit score line that does report your purchases and fee historical past. This lets you enhance your credit score rating with on-time funds you already deliberate to make.

Sezzle additionally companions with Ally or Bread to supply long-term financing. These loans do include curiosity however enable for a lot bigger purchases over for much longer intervals.

Professionals:

- 0% curiosity on Sezzle or Sezzle Up

- Can reschedule one fee (per buy) without spending a dime

- Sezzle Up can be utilized to enhance your credit score rating

- No late charges

Cons:

- Can solely be used at collaborating retailers

- $10 payment for rejected funds (card expired or inadequate funds)

- Late funds with Sezzle Up may harm your credit score rating

Curiosity:

- 0% curiosity for Sezzle or Sezzle Up

- Lengthy-term mortgage APR will depend on creditworthiness

Phrases:

- 4 funds over 6 weeks

- Lengthy-term loans are month-to-month funds as much as 60 months

Buy Restrict:

- $2,500 per order

- Lengthy-term loans as much as $40,000 relying on credit score historical past

Credit score Test? Mushy pull for Sezzle or Sezzle Up; Arduous pull for long-term financing

Down Cost? 25% for Sezzle or Sezzle Up

6. PayPal Pay in 4: Finest Purchase Now Pay Later for On-line

“Pay in 4” is a time period used for a lot of BNPL plans, but it surely’s additionally the title of a particular app. The ‘Pay in 4’ app is backed by the belief and comfort of PayPal. You need to use it wherever that PayPal is accepted– which supplies you entry to actually hundreds of thousands of companies.

“Pay in 4” is a time period used for a lot of BNPL plans, but it surely’s additionally the title of a particular app. The ‘Pay in 4’ app is backed by the belief and comfort of PayPal. You need to use it wherever that PayPal is accepted– which supplies you entry to actually hundreds of thousands of companies.

However the very best half is that Pay in 4 makes use of the identical app as all of PayPal’s different providers. Meaning you’ll be able to handle your loans, P2P funds, cell pockets, and even crypto transactions all out of your smartphone.

Simply don’t confuse Pay in 4 with PayPal Credit score. PayPal Credit score is a conventional, revolving credit score line that comes with its personal rates of interest and a tough credit score test.

Professionals:

- Use it wherever that PayPal is accepted

- Entry it out of your current PayPal app

- No late charges

- 0% curiosity

Cons:

- You’ll be able to solely use it the place PayPal is accepted

- Doesn’t work for in-store purchases

- Comparatively low buy restrict

- Not obtainable outdoors the U.S. or in all 50 states

Curiosity: No curiosity

Phrases: 4 funds over 6 weeks

Buy Restrict: $30 minimal; $1,500 most

Credit score Test? Mushy pull

Down Cost? 25% upfront

7. Zip (Quadpay): Finest Purchase Now Pay Later for Starters

Zip (previously often known as Quadpay) is an efficient choice for these trying to skip the credit score test. Zip affords 0% curiosity and doesn’t report purchases or fee historical past to the credit score bureaus.

The trade-off is that Zip prices patrons a small payment for every transaction. With their restricted installment choices and low buy restrict, Zip affords a foot within the door for many who could not qualify for different BNPL choices.

Professionals:

- 0% curiosity

- No credit score test

- Doesn’t report buy historical past or fee historical past to credit score bureaus

Cons:

- $4 transaction payment for each buy

- $7 payment for every late fee

- Just one choice for installment phrases

Curiosity: No curiosity

Phrases: 4 funds over 6 weeks

Buy Restrict: As much as $1,500 (retailers could set a decrease restrict)

Credit score Test? None

Down Cost? 25% upfront

| Curiosity | Time period | Buy Restrict | Credit score Test | Down Cost | Late Payment | |

| Affirm | 0% (Pay in 4); 10-30% (month-to-month) | Pay in 4; 1-48 months | As much as $17,500 | Mushy | Potential | No |

| Klarna | 0% (Pay in 4); as much as 29.99% (month-to-month) | Pay in 4; Pay in 30; 6-24 months | Variable | Mushy | 25% (Pay in 4); None for Pay in 30 or month-to-month | $7 every as much as 25% |

| Splitit | 0% | 3-24 months | Card restrict | None | 1st fee | No |

| Afterpay | 0% | Pay in 4 | Variable w/ fee historical past | Potential smooth | 25% | $10, then $7 every as much as 25% |

| Sezzle | 0% | Pay in 4 | $2,500 per order | Mushy | 25% | No |

| PayPal Pay in 4 | 0% | Pay in 4 | $30 min.; $1,500 max. | Mushy | 25% | No |

| Zip | 0%; ($4 trans. payment) | Pay in 4 | As much as $1,500 | None | 25% | $5, $7, or $10 every |

What are purchase now pay later apps?

Purchase Now, Pay Later apps are actually simply micro-loans. They assist you to purchase one thing in the present day and break up the associated fee over the following few weeks or months– typically with 0% curiosity.

Some BNPL websites associate with retailers to supply these loans at checkout. Others supply a digital card that you need to use like a bank card. BNPL apps are most frequently discovered on-line, however some can be utilized at in-person retailers as effectively.

For these causes, you’ll typically see BNPL apps known as “point-of-sale installment loans.”

How do purchase now pay later apps work?

Purchase Now Pay Later apps flip larger purchases into bite-sized funds. The main points could range from firm to firm, however all of them basically work the identical manner.

They begin out similar to a traditional buying expertise. You browse your favourite retailers on their very own websites or shops. While you’re able to checkout, you select the BNPL app as your methodology of fee.

When you haven’t already been pre-qualified, you’ll fill out a brief utility that appears similar to a fee display screen. Inside seconds, you’ll be notified when you’ve been authorized for a mortgage.

Right here’s the place issues begin to really feel completely different. Your buy is made, however you solely pay a small down fee. The BNPL supplier pays the service provider for the remainder. You’ll pay the stability again over a set of small, equal installments.

How do purchase now pay later apps become profitable?

Whereas a couple of BNPL apps cost late charges or transaction charges, most make their cash from partnerships with retailers. The service provider affords a BNPL choice at checkout and, in return, the BNPL app prices the service provider a small transaction payment.

So what does the service provider get? The BNPL supplier pays upfront for a sale they could not have gotten with out the mortgage. In truth, based on Klarna, BNPL results in 44% of customers making a purchase order that might have in any other case been delayed.

Does purchase now pay later have an effect on my credit score rating?

Most BNPL loans don’t have an effect on your credit score rating, for good or for unhealthy. The mortgage phrases are normally too quick, and most BNPL suppliers don’t report your fee historical past.

Making use of for a BNPL app could contain a credit score test, however that is normally a smooth inquiry. A smooth inquiry, or smooth pull, is sort of a background test to your credit score. These smooth checks gained’t have an effect on your credit score both.

That mentioned, you need to pay shut consideration to the main points of your BNPL mortgage. Some lenders do report your purchases and fee historical past to the credit score bureaus. This implies they can be utilized to enhance your credit score rating. However it additionally implies that late or lacking funds can harm your credit score, too.

Purchase Now Pay Later vs Credit score Card

Each BNPL apps and bank cards can be utilized to defer funds, however they arrive with some necessary variations.

- BNPL loans all the time include a set variety of funds– and so long as these funds are on-time, they’ll normally cost 0% curiosity. Bank cards even have funds, however when you don’t pay the complete stability, you’ll begin to accrue curiosity on no matter’s left.

- When BNPL apps do cost curiosity, it’s virtually all the time easy curiosity. This implies you solely pay curiosity on the borrowed cash. Bank cards cost compound curiosity as an alternative. This implies you’ll pay curiosity on each the stability and any current curiosity.

- Lastly, every BNPL buy is its personal lump-sum installment mortgage. These one-time credit score traces should be authorized every time. Bank cards, however, are revolving credit score traces that can be utilized repeatedly.

Resolve Now, Purchase Later

Since most BNPL apps gained’t have an effect on your credit score rating, you would check out a couple of choices till you discover one that you simply like. Simply watch out to not overspend. Having a couple of mortgage choice makes it straightforward to neglect how a lot it provides up. The most effective plan is to decide on a BNPL web site forward of time, then keep it up till your mortgage is paid off.