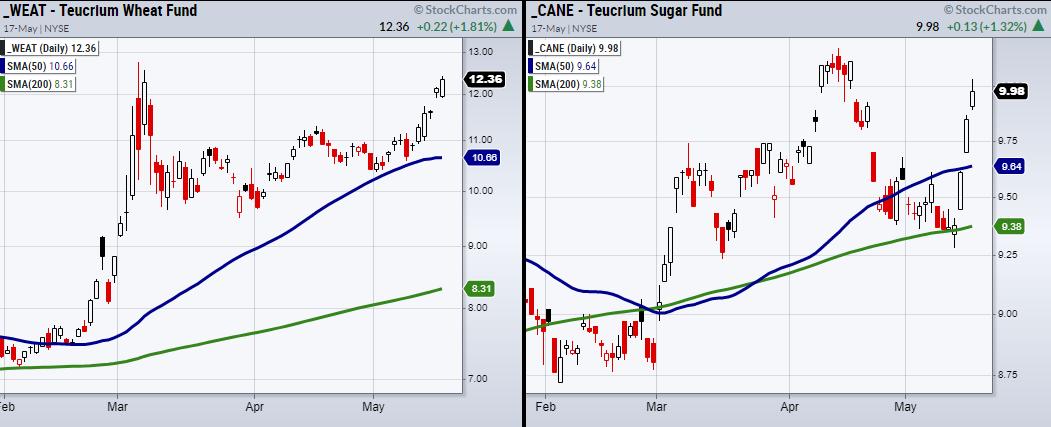

Up to now, this week has been big for wheat (WEAT) and sugar (CANE), with each gapping up on Monday and persevering with increased. Tender commodities have been on the transfer, as provide chain points involving China’s COVID instances spiking and Ukraine chopping its wheat output have quickly elevated costs. Many are realizing how delicate the meals commerce is and the way all the pieces seems to be main again to growing inflation.

Now international locations are starting to chop exports as they give attention to their populations’ calls for first. Because it turns into extra necessary to start planting for misplaced provide, fertilizers have turn out to be much less simple to acquire. With that mentioned, from a buying and selling perspective, not solely can we look ahead to entries into smooth commodities, however we also needs to observe fertilizer firms.

Two fertilizer-related firms we’re watching are Mosaic Firm (MOS), and CF Industries (CF).

At this level, CF might want to break to new highs, whereas MOS may very well be watched for an in depth over the 50-DMA at $65.88. We might additionally search for a bullish part affirmation with 2 closes over the 50-DMA in MOS. With that mentioned, relating to the general market, the main indices are heading into resistance and might want to summon extra shopping for to get via overhead sellers.

Particularly watching the S&P 500 (SPY), it might want to clear and maintain over $410 subsequent if the rally is to proceed. If a tough wall of promoting is hit within the SPY, keep cautious as even fertilizer firms will get damage if the market reverses. Nonetheless, we should always maintain these symbols on watch, since inflation and meals costs do not look to be settling down anytime quickly.

Observe Mish on Twitter @marketminute for inventory picks and extra. Observe Mish on Instagram (mishschneider) for day by day morning movies. To see up to date media clips, click on right here.

- S&P 500 (SPY): 410 resistance.

- Russell 2000 (IWM): Watch to carry over 179.27.

- Dow (DIA): 325.25 the 10-DMA to carry.

- Nasdaq (QQQ): 303.93 the 10-DMA to carry.

- KRE (Regional Banks): assist 58.75.

- SMH (Semiconductors): 248.17 subsequent resistance.

- IYT (Transportation): 235-239 resistance.

- IBB (Biotechnology): 115-118 resistance space.

- XRT (Retail): 70 resistance.

Forrest Crist-Ruiz

MarketGauge.com

Assistant Director of Buying and selling Analysis and Schooling

Mish Schneider serves as Director of Buying and selling Schooling at MarketGauge.com. For practically 20 years, MarketGauge.com has supplied monetary data and training to 1000’s of people, in addition to to massive monetary establishments and publications corresponding to Barron’s, Constancy, ILX Methods, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many high 50 monetary folks to comply with on Twitter. In 2018, Mish was the winner of the High Inventory Choose of the yr for RealVision.