The market made it is low on Thursday and has made some good features off the lows. Tuesday was one other robust day. I proceed to love the setup right here for a rally.

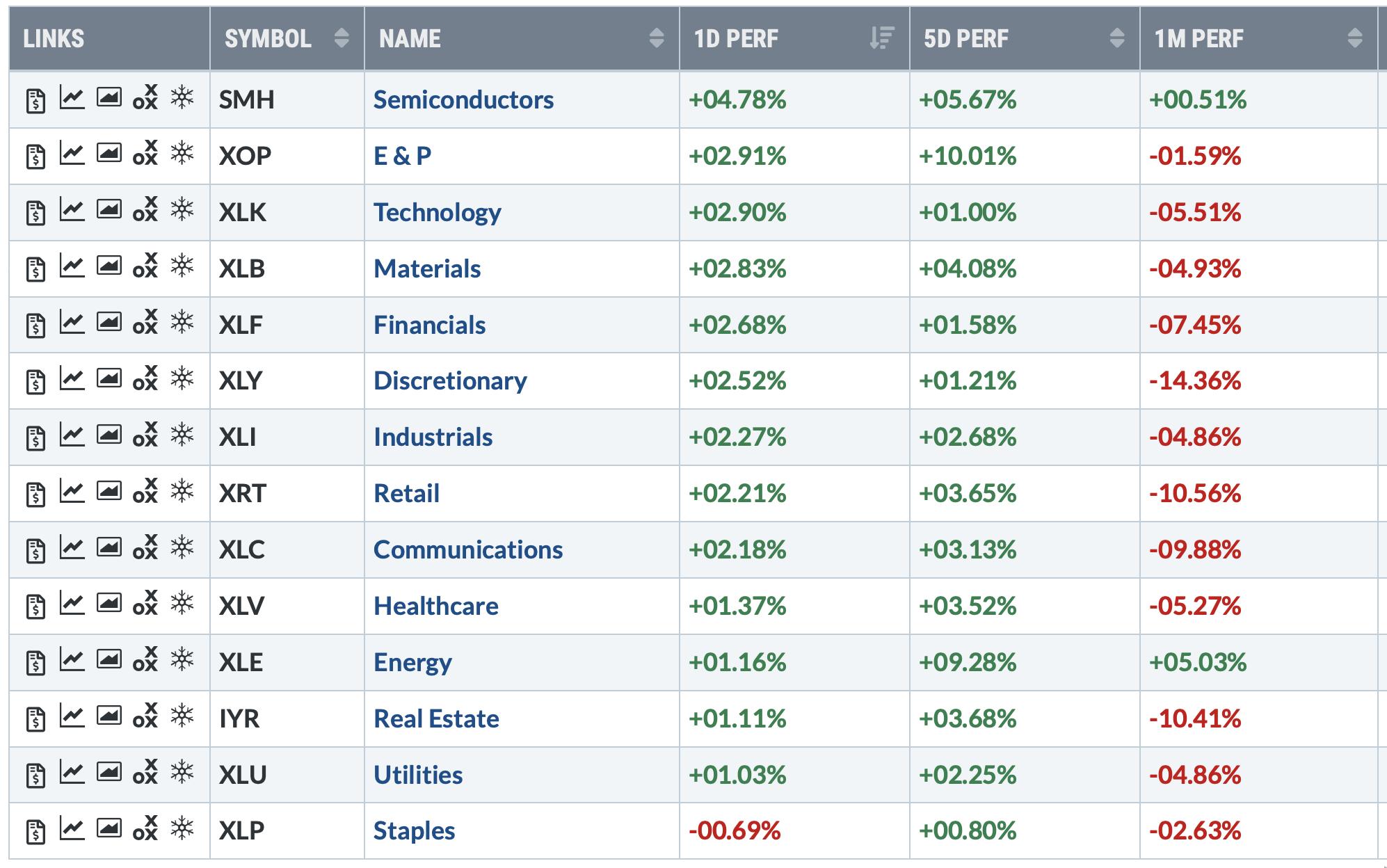

The opposite areas I’m searching for is a rotation from defensive to progress oriented sectors. Semiconductors actually popped on Tuesday and have executed properly during the last 5 days. Once I take a look at the listing that’s sorting primarily based on Tuesday’s outcomes, it has progress areas on the highest and defensive sectors on the underside. One space that’s not actually popping but is the discretionary sector.

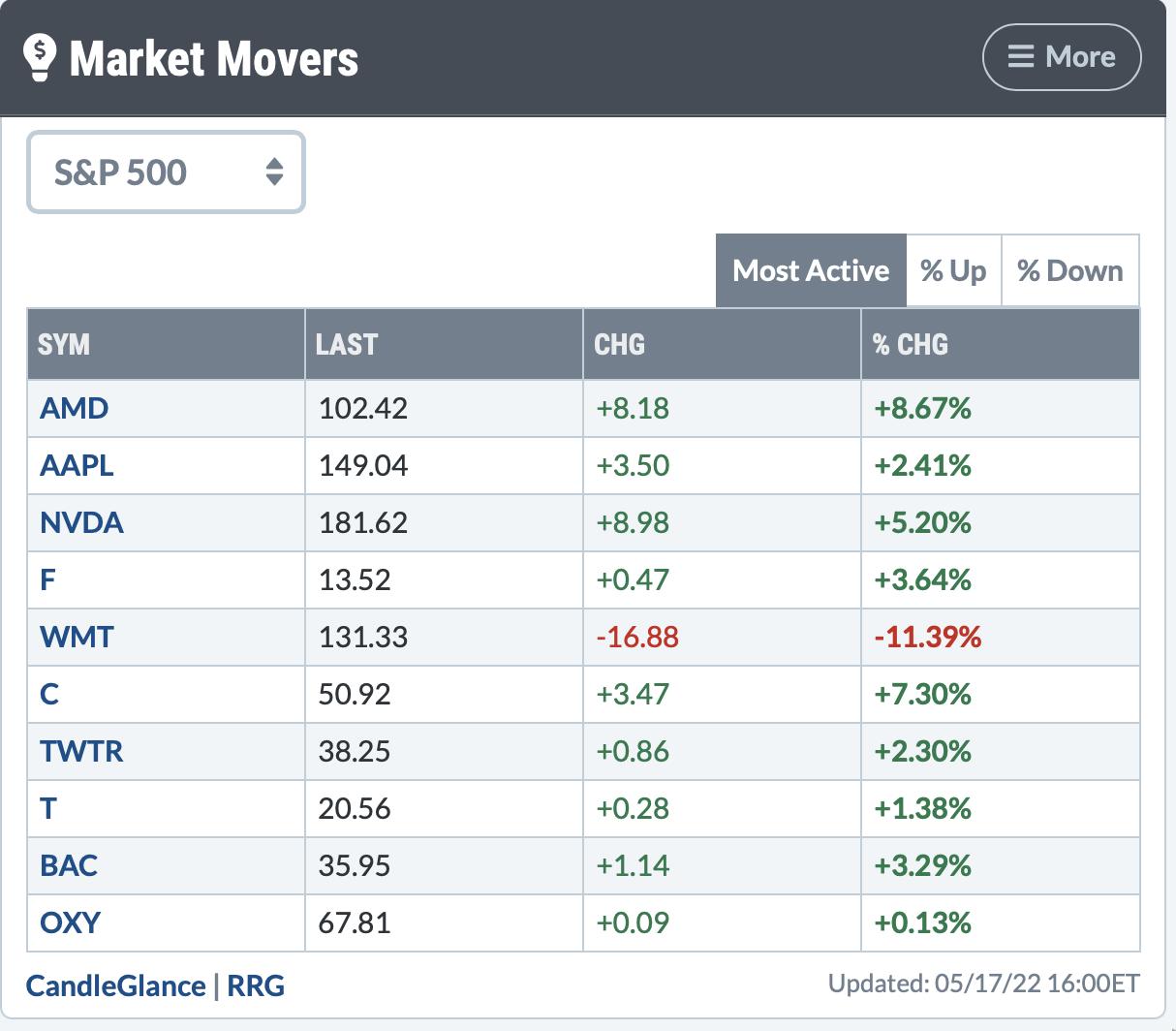

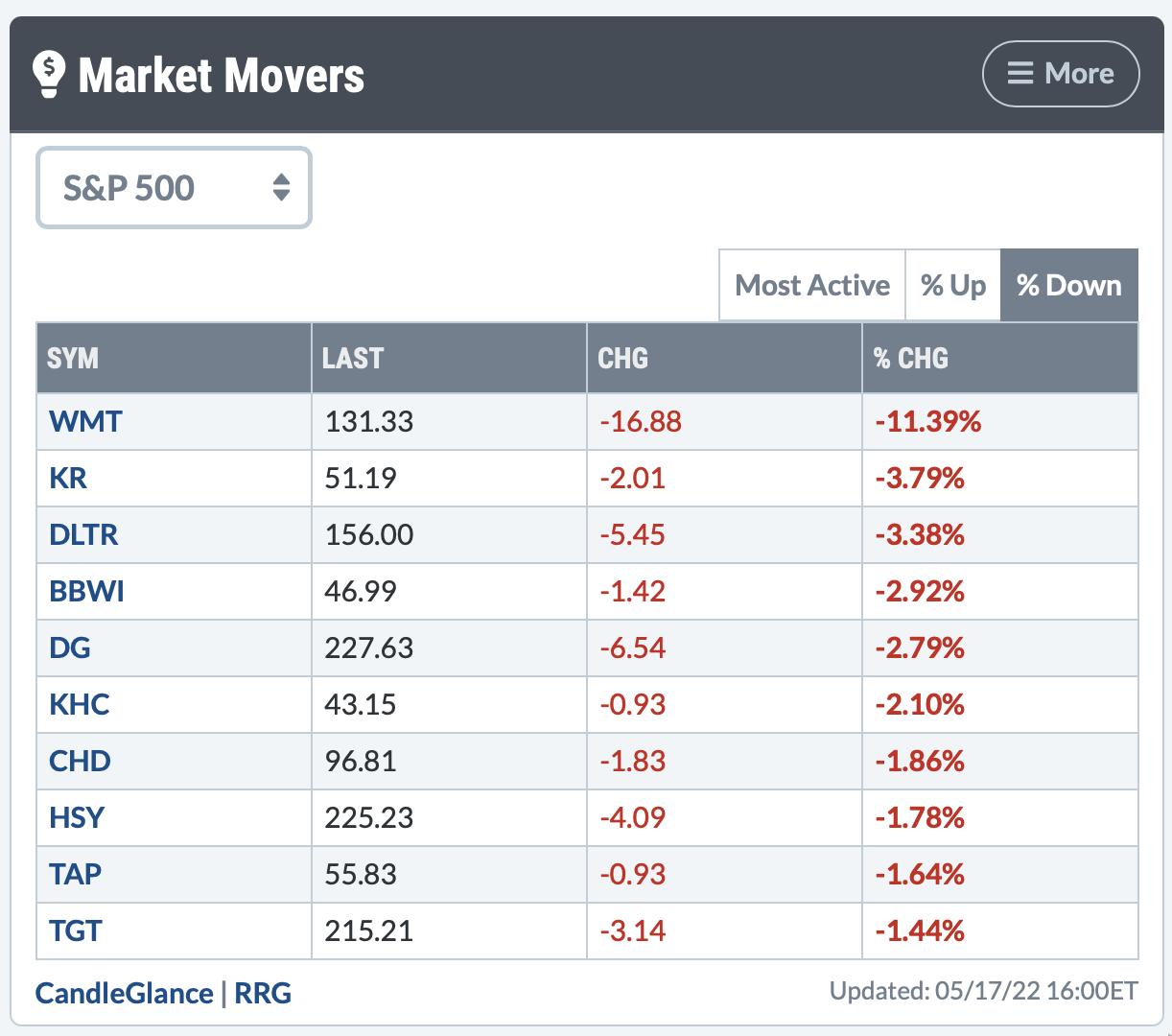

Wanting on the prime performing shares, most lively names and underperforming names, it does spotlight the rotation away from defensives.

Within the prime panel, probably the most lively listing is dominated by tech associated however there are two banks and an oil firm there.

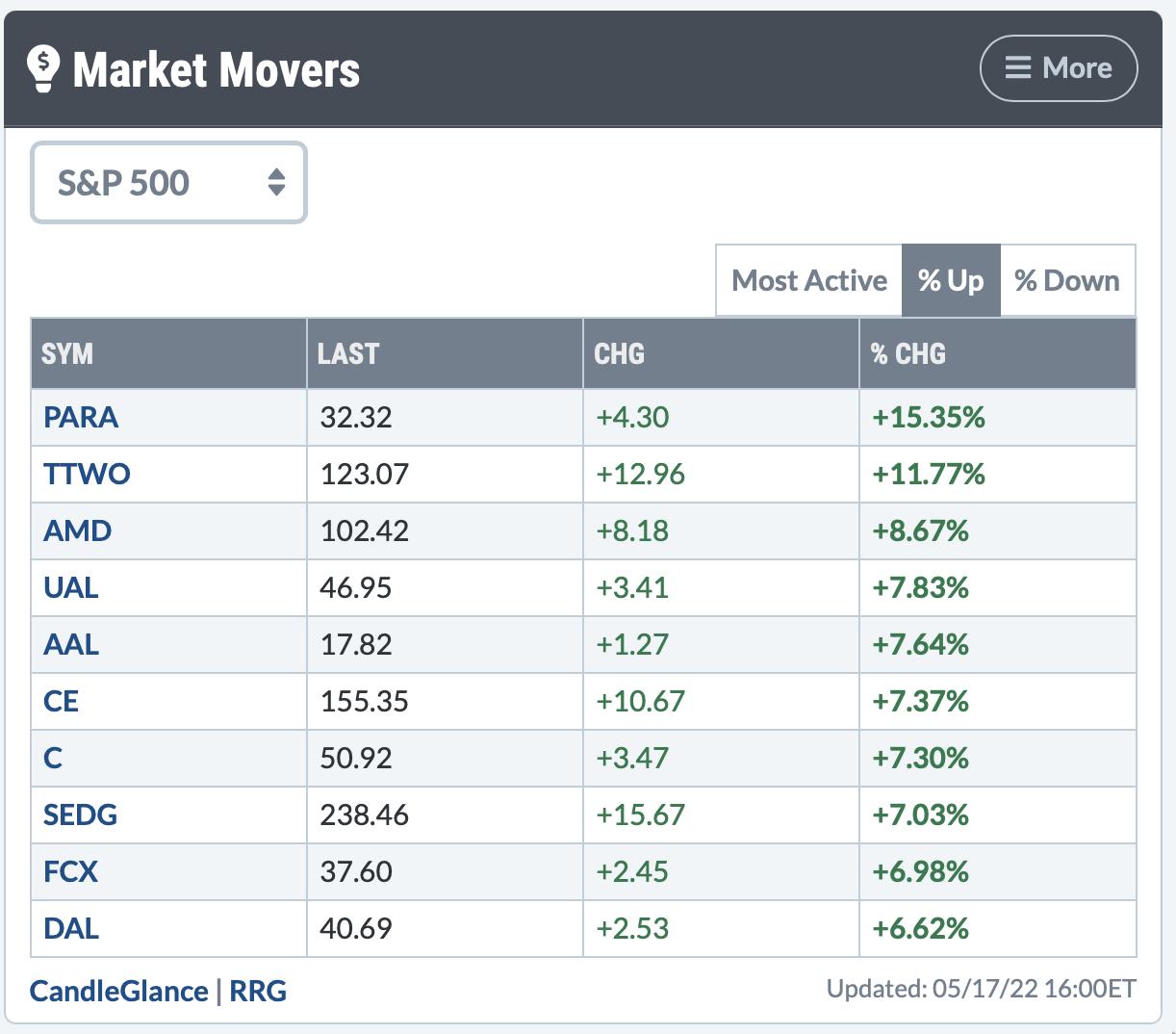

Wanting on the largest movers, it reveals a distinct image. Three airways made the listing. I used to be shocked to see FCX and SEDG on the listing really. The copper chart has been horrible and Photo voltaic Edge was not the place I might have appeared. Could be extra there in Clear Tech because it has been crushed down for over a yr.

One space I used to be not shocked to see was the defensive names because the weakest. Grocery shops, greenback shops and meals corporations had been promoting off.

To me it seems like a rally has began. If you would like extra data on the place to search for alternatives, I would encourage you to take at take a look at OspreyStrategic.org and join the $7 – 30 day trial. That will provide you with entry to the following 4 newsletters and movies.

Greg Schnell, CMT, is a Senior Technical Analyst at StockCharts.com specializing in intermarket and commodities evaluation. He’s additionally the co-author of Inventory Charts For Dummies (Wiley, 2018). Primarily based in Calgary, Greg is a board member of the Canadian Society of Technical Analysts (CSTA) and the chairman of the CSTA Calgary chapter. He’s an lively member of each the CMT Affiliation and the Worldwide Federation of Technical Analysts (IFTA).