Walmart shares suffered the largest one-day drop for the reason that eve of the Black Monday inventory market crash after the corporate, reduce its earnings steerage following 1 / 4 through which it was wrongfooted by the speedy tempo of inflation within the US.

The share value response, a very extreme one by the requirements of usually much less risky client staple shares, got here after the corporate revealed income in its newest quarter had taken an “surprising” hit owing to increased wages, a soar in gasoline prices and softness usually merchandise gross sales at its US companies.

Because the world’s largest retailer, and long-regarded as a bellwether of the American client, Walmart’s commentary comes at a time when buyers are scrambling to measure the impression of inflation, rising rates of interest and provide chain snarls on the US economic system.

“US inflation being this excessive and shifting so rapidly, each in meals and common merchandise, is uncommon,” mentioned chief govt Doug McMillon. “We knew that we had been up towards stimulus {dollars} from final 12 months, however the fee of inflation in meals pulled extra {dollars} away from [general merchandise] than we anticipated as clients wanted to pay for the inflation in meals.”

The corporate expects the upper staffing prices, affected by the winter wave of the coronavirus pandemic, to be remoted to the primary quarter. McMillon mentioned a “timing problem” with gasoline prices, which accelerated within the quarter “quicker than we had been in a position to cross them by means of” and had been $160mn increased within the US than the corporate had forecast, ought to be resolved by the tip of the primary half.

Points round US inflation — at its highest degree in 40 years and which the Biden administration has dubbed its “prime financial precedence” — usually tend to persist.

Walmart executives acknowledged extra clients had switched in direction of cheaper private-label gadgets, notably in groceries, and away from branded items. McMillon mentioned inflation in meals was operating at a double-digit tempo and he was “involved that inflation could proceed to extend”.

Helped by increased costs for a few of its gadgets and client demand that continues to be strong total, Walmart mentioned it anticipated web gross sales for its 2023 fiscal 12 months to extend 4 per cent in constant-currency phrases, up from the three per cent forecast it supplied in February.

Nevertheless, full-year earnings per share would now be down 1 per cent due to the surprising prices that emerged within the first quarter, it mentioned, having beforehand guided to a mid-single digit improve.

Within the present quarter, Walmart mentioned working earnings and earnings per share would every be “flat to up barely”, having beforehand forecast a rise within the low to mid-single digits.

The cuts to steerage caught buyers off guard, on condition that Walmart had indicated three months in the past it was persevering with to navigate value pressures and provide chain challenges.

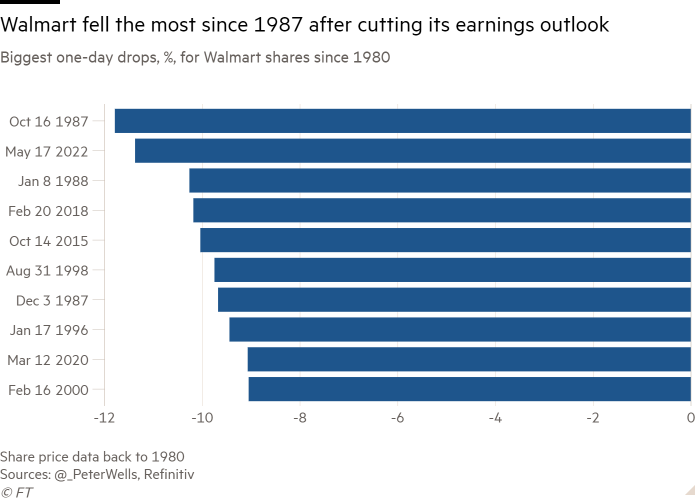

Shares closed 11.4 per cent decrease, handing the inventory its largest one-day drop since October 16 1987 — the session earlier than the Black Monday crash — and its second-largest decline up to now 40 years.

Do-it-yourself retailer House Depot was higher in a position to cushion the blow from value pressures. Earlier on Tuesday, the corporate lifted its 2022 outlook after defying forecasts for a quarterly earnings decline. The corporate has encountered rising costs in a lot of its core commodity classes, resembling lumber and copper, however chief govt Ted Decker mentioned it was not totally clear how inflation would have an effect on client behaviour sooner or later.

“Inflation is unquestionably increased than we thought,” Decker mentioned on an earnings name. “However our clients are resilient. We’re not seeing the sensitivity to that degree of inflation that we might have initially anticipated.”

Knowledge on Tuesday instructed US shoppers have continued to spend at a sturdy tempo regardless of rampant inflation. Retail gross sales, which embody spending on meals and gasoline, rose 0.9 per cent in April, in keeping with the US Census Bureau, matching economists’ forecasts, whereas March’s improve was revised increased to 1.4 per cent.

The retail management group, which excludes constructing supplies, motorized vehicle components and petrol station gross sales, rose 1 per cent, surpassing economists’ expectations for a 0.5 per cent improve. This was a slight moderation from March’s upwardly revised 1.1 per cent improve, after beforehand reporting a 0.1 per cent decline.

Walmart’s $141.6bn in first-quarter income cruised previous Wall Avenue’s forecast for nearly $139bn. Reported web earnings of $2.05bn within the first three months of this 12 months was down from $2.73bn a 12 months in the past.