Vary analyzer with alert indicator

The thought behind the Vary analyzer is to supply our clients all the mandatory analyses to investigate market volatility.

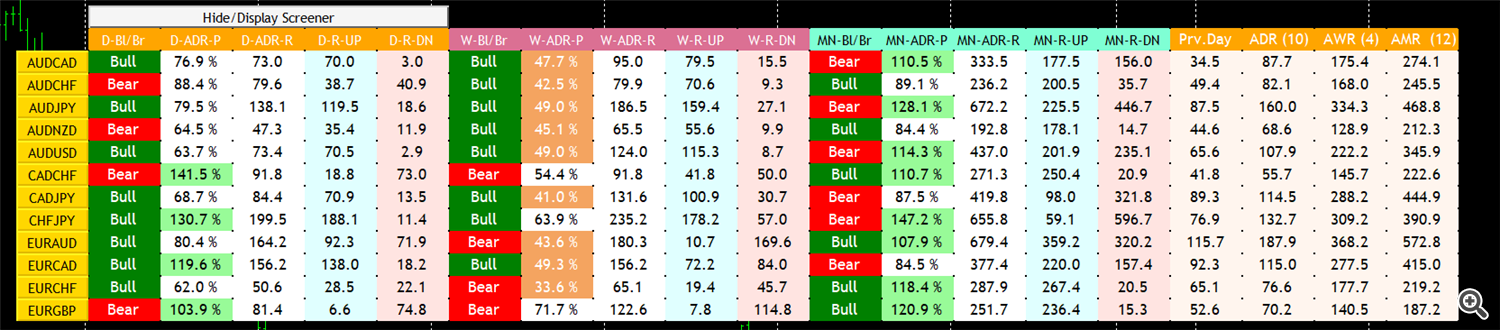

Find out how to learn Vary Scanner ?

D-Bl-Br : Present each day bar is bearish bar or bullish bar.

This parameter will present route of the present Every day bar.

- Bull : It means the present each day bar is bullish.

- Beark : It imply the present each day bar is bearish.

D-ADR-P : Every day ADR %.

This parameter will present the p.c of present Every day ADR. When the p.c is above 100% implies that we’re skilled a excessive volatility in that day.

D-ADR-R : Every day ADR Vary.

This parameter will present the ADR ( Common Every day vary in pips )

D-R-UP : The gap between the each day open value and the each day excessive value in pips.

D-R-DN : The gap between the each day open value and each day low value in pips.

W-Bl-Br : Present Weekly bar is bearish bar or bullish bar.

This parameter will present route of the present Weekly bar.

- Bull : It means the present weekly bar is bullish.

- Beark : It imply the present weekly bar is bearish.

W-ADR-P : Weekly vary %.

This parameter will present the p.c of present Weekly vary . When the p.c is above 100% implies that we’re skilled a excessive volatility in that week.

W-ADR-R : Weekly vary .

This parameter will present the AWR ( Common Weekly vary in pips ).

W-R-UP : The gap between the weekly open value and the weekly excessive value in pips.

W-R-DN : The gap between the weekly open value and weekly low value in pips.

MN-Bl-Br : Present Month-to-month bar is a bearish bar or bullish bar.

This parameter will present route of the present Weekly bar.

- Bull : It means the present Month-to-month bar is bullish.

- Beark : It imply the present Month-to-month bar is bearish.

MN-ADR-P : Month-to-month vary %.

This parameter will present the p.c of present Month-to-month vary . When the p.c is above 100% implies that we’re skilled a excessive volatility in that month.

MN-ADR-R : Month-to-month vary .

This parameter will present the AMR ( Common Month-to-month vary in pips ).

MN-R-UP : The gap between the month-to-month open value and the month-to-month excessive value.

MN-R-DN : The gap between the month-to-month open value and month-to-month low value.

Find out how to use ADR Zone ( Field ) ?

The ADR zone predicts the present day excessive and low based mostly on the ADR distance.

Development Reversal case

- If the value touches the excessive of the ADR zone with out breaking it means a pattern reversal from a UP pattern to DOWN Development.

- If the value touches the Low of the ADR zone with out breaking it, means a pattern reversal from a DOWN pattern to UP Development.

Development Continuation with excessive volatility case

- If the value breaks the excessive of the zone, it can lead to robust upward route

- If the value breaks the low of the zone, it can lead to a robust downward route.

When the value is outdoors of the ADR Zone, it implies that in the present day’s market is excessive volatility and costs transfer out of the Common Every day Vary.

Instance 2 : GBPUSD

Instance 2 : GBPUSD

Instance 3 : USDCHF

Instance 4 : AUDUSD

Instance 4 : AUDUSD

Please when you have any questions, be at liberty to submit a remark or sending me a PM.

Creator

SAYADI ACHREF , fintech software program engineer and founding father of Finansya.