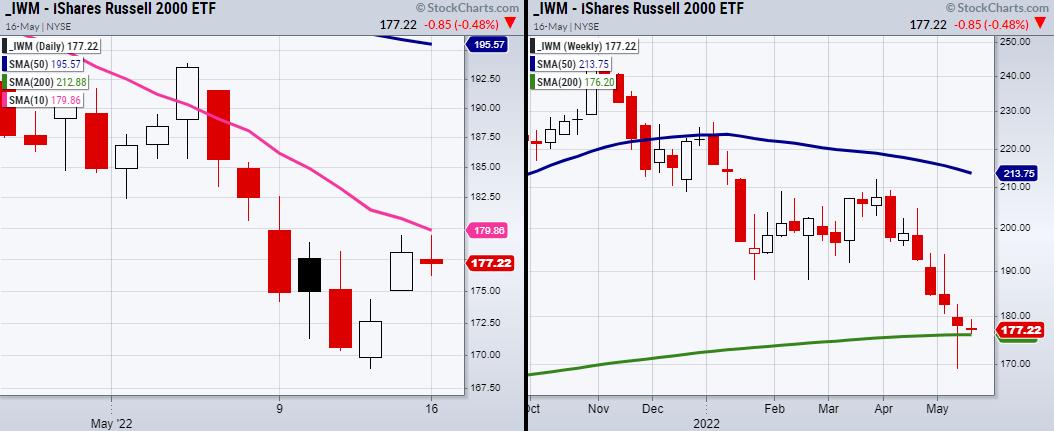

On Monday, the small-cap index Russell 2000 (IWM) examined its previous Friday excessive at $179.41, however finally couldn’t maintain. Simply above this value degree stands the 10-day transferring common at $179.86; this would be the subsequent pivotal space for IWM to clear if we’re going to see a continued rally from final Thursday’s low.

When searching for assist, IWM examined and held over its 200-week transferring common at $176.20. Each of those transferring averages sandwich IWM into an fascinating value space to look at in Tuesday’s buying and selling session.

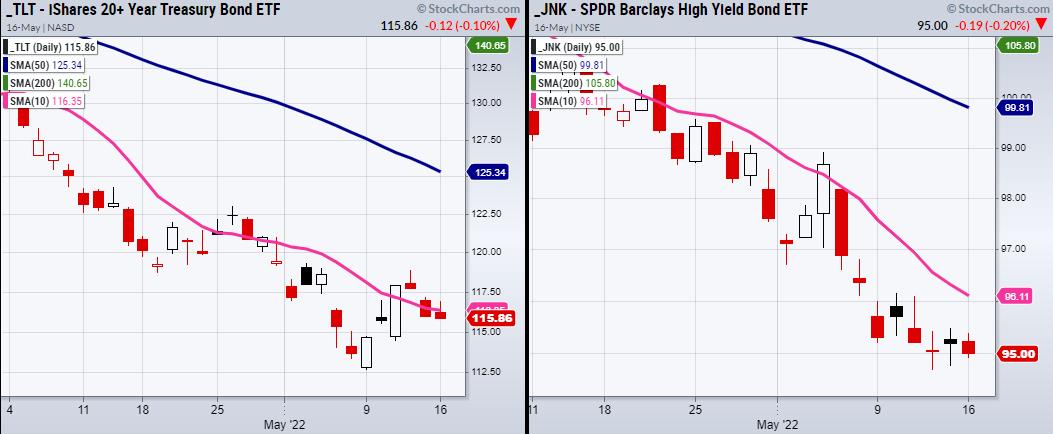

Subsequent, we should always search for affirmation of IWMs subsequent transfer by watching two necessary symbols. The primary is the 20+ Yr Treasury Bonds (TLT), whereas the second is Excessive Yield Company Debt (JNK).

Each may help us resolve which route the general market is leaning in the direction of.

As an example, the TLT can present upside market strain if it is unable to clear and maintain over its 10-DMA. Then again, if JNK begins to select up the tempo and pushes in the direction of its 10-DMA at 96.11, that might be a constructive signal for the market since it could present that traders/merchants are keen to purchase high-risk debt. Nonetheless, as a result of JNK seems to be weak and hasn’t given any upside indication, we should always keep cautious of shopping for equities proper now.

Having mentioned that, one image we’re presently watching is gold ETF (GLD). As a security play, GLD is fascinating, because it’s trying to clear again over its 200-DMA at $171.48.

Observe Mish on Twitter @marketminute for inventory picks and extra. Observe Mish on Instagram (mishschneider) for each day morning movies. To see up to date media clips, click on right here.

- S&P 500 (SPY): 410 resistance.

- Russell 2000 (IWM): must clear the 10-DMA at 179.86.

- Dow (DIA): 322 wants to carry. 325.67 to clear.

- Nasdaq (QQQ): Inside day. 309-317 resistance space.

- KRE (Regional Banks): Minor assist 58.75.

- SMH (Semiconductors): Inside day.

- IYT (Transportation): 235-239 resistance.

- IBB (Biotechnology): 115-118 resistance space.

- XRT (Retail): 70 resistance.

Forrest Crist-Ruiz

MarketGauge.com

Assistant Director of Buying and selling Analysis and Training

Mish Schneider serves as Director of Buying and selling Training at MarketGauge.com. For practically 20 years, MarketGauge.com has supplied monetary info and training to hundreds of people, in addition to to massive monetary establishments and publications resembling Barron’s, Constancy, ILX Methods, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many prime 50 monetary individuals to observe on Twitter. In 2018, Mish was the winner of the Prime Inventory Choose of the yr for RealVision.