Following my article Which Shares Inside The Dow Are Value Holding? I acquired just a few questions on utilizing $ONE because the benchmark for a Relative Rotation Graph and whether or not it will be the higher benchmark to make use of?

The sincere reply to that query?

It relies upon

Let me clarify.

It is determined by what you might be after and that almost all typically is determined by what kind of investor you might be.

For skilled fund managers the reply, more often than not, is simple. Their job is to “outperform” a benchmark. Considered one of their “issues” is that almost all portfolio managers should not have the discretion to carry a whole lot of money of their portfolios. They HAVE to speculate, even after they assume/really feel/know for certain that the market goes down.

Due to this fact they should discover shares or sectors which are outperforming their benchmark. The one instrument within the TA toolkit for that’s relative power. And that’s the place Relative Rotation Graphs are available as they supply an all-inclusive picture of the present rotations out there and the place traders ought to give attention to choosing outperformers.

For them, the plain, and just about the one, alternative is to make use of the benchmark that they should beat because the benchmark for RRGs.

Retail merchants, most of our customers right here at Stockcharts.com, have much more leeway and discretion of their method to the market. As a matter of reality, they’ll just about do something they like. There isn’t any compliance officer, no Chief Funding Officer, no regulator, and no board member, wanting over their shoulders and monitoring their positions and portfolios to examine that they’re according to the advertising brochure, the actual fact sheet, and the restraints that had been put into place for his or her fund.

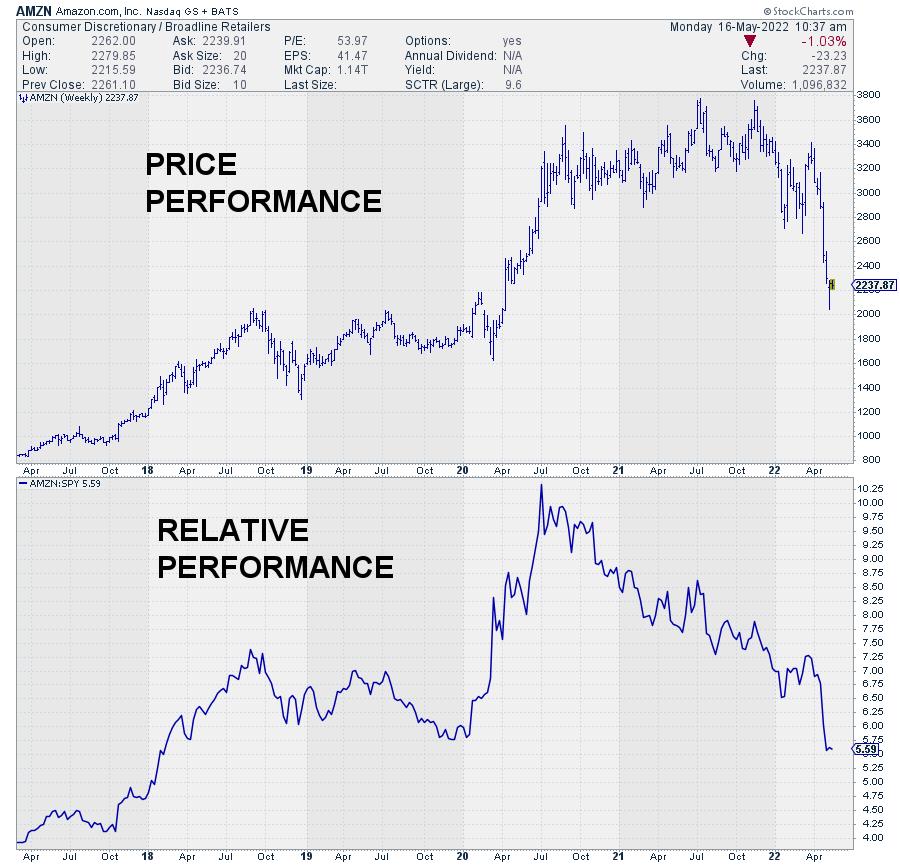

Value Efficiency vs Relative Efficiency

Simply to be clear. An everyday chart reveals us worth efficiency. If it goes up the safety will get costlier and vice versa. If we purchase that safety and it goes up in worth and we promote, we have now made a revenue.

Relative efficiency is a little more difficult because it measures the distinction between the worth of a safety and a benchmark, say the S&P 500 index.

After we purchase a inventory and its worth rises 5% whereas the S&P 500 rises 1% we have now outperformed the benchmark by 4%. Nonetheless, when the S&P 500 rises 10%, we have now UNDERperformed the benchmark by 5%. So even regardless of a worth acquire of 5% in absolute phrases, we have now “misplaced” 5% towards the benchmark.

This additionally goes in a declining market. Say the inventory that we purchased misplaced 5% in worth however the S&P 500 misplaced 10% in worth. In that case, regardless of a lack of 5% in worth phrases, we have now OUTperformed the benchmark by 5% as a result of our inventory misplaced lower than the benchmark.

When to make use of $ONE

In order a retail investor your solely concern is to make cash from investing, most should not within the relative efficiency sport.

BUT

When the market goes up most retail traders are nonetheless seeking to OUTperform the S&P 500. And rightfully so. That implies that when the inventory market is in an uptrend it makes complete sense to make use of the S&P 500 because the benchmark for relative power evaluation (and RRG) to search for the strongest sectors shares and attempt to outperform the market.

Then again, when the market is in a downtrend, the primary concern is to NOT LOSE cash. For that function, $ONE is the higher benchmark because it primarily takes 0% return because the benchmark. Something above is sweet, something beneath is dangerous.

When Is The Market In An UPtrend?

With a purpose to resolve when to make use of which benchmark, it’s crucial to find out once we assume the market is in an uptrend and when it’s in a downtrend.

A quite simple method (however efficient for this function) can be to make use of a easy shifting common. When the market is above its SMA the pattern is UP and vv.

Within the chart beneath I’ve, very arbitrarily, used a 20-week SMA to resolve if the pattern is UP or DOWN.

Within the durations after a inexperienced vertical line, the S&P 500 can be utilized because the benchmark for RRGs, and each different method primarily based on relative power. Within the durations after a purple vertical line, $ONE can be utilized.

Clearly, everybody can adapt the interval for the SMA to their very own fashion and funding horizon.

With the S&P 500 at the moment clearly in a downtrend, effectively beneath its 20-week SMA, it is smart to have a look at a Relative Rotation Graph for sectors utilizing $ONE because the benchmark.

That chart is printed above and it’s simply seen that solely the Power sector qualifies as an uptrend (in worth phrases) whereas all others, on the left-hand facet of the plot, are in downtrends. The current transfer larger on the JdK RS-Momentum scale means that they’re at the moment going by a pause, or a restoration, throughout the prevailing downtrend.

#StaySafe, –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels beneath the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can’t promise to answer every message, however I’ll actually learn them and, the place fairly doable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive technique to visualise relative power inside a universe of securities was first launched on Bloomberg skilled companies terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Navy Academy, Julius served within the Dutch Air Pressure in a number of officer ranks. He retired from the army as a captain in 1990 to enter the monetary business as a portfolio supervisor for Fairness & Legislation (now a part of AXA Funding Managers).

Study Extra