Everyone seems to be entitled to their very own opinion and mine is that the problems we have skilled within the first half of 2022 might be mitigated within the second half. Till 2022, a lot of you I am positive considered me as a perma-bull. I’ve at all times stated that is not true, however that I will not speak bearishly in regards to the U.S. inventory market until I’ve purpose to take action. Since 1950, the S&P 500 has risen on an annual foundation 54 years out of 72. You might be just like the Peter Schiffs of the world and name for a market collapse each time you open your yap if you would like, however I am going to gladly decline and be proper 75% of the time. And if I can name a number of of these 18 annual declines, even higher!

In the event you had requested a big viewers what the most important subject was heading into 2022, I am positive you’d have heard a smattering of the same old suspects – our debt, the Fed, inflation, increased charges, housing bubble, inventory market bubble, and so forth. Throw within the latest points just like the Russia-Ukraine battle, hovering crude oil costs, and also you’d most undoubtedly have attention-grabbing selections.

However I consider the most important subject of all had nothing to do with any of that. To me, most of that’s noise. It is media banter. It is what everyone seems to be speaking about proper now. I hate to see portfolios ravished over a 4-5 month interval, however fairly truthfully, that is precisely what the U.S. fairness market wanted – a breather.

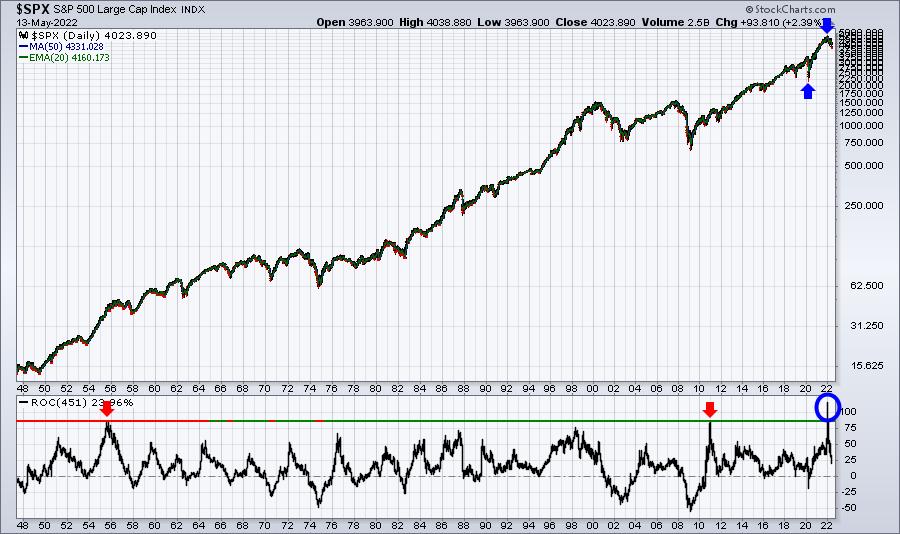

From the March 23, 2020 low to the January 3, 2022 excessive, there have been 451 buying and selling days. On the 75-year S&P 500 day by day chart under, I’ve included a 451-day price of change (ROC) so that you could see the March 23, 2020-January 3, 2022 rally, in comparison with the historical past of that 451-day ROC:

The blue arrows mark the March 2020 low and January 2022 excessive and the blue circle highlights the 451-day ROC above 100%. Word that the U.S. inventory market has NEVER moved so shortly to the upside. NEVER!!!! We had merely run manner too far. And the 2020 pandemic launched a complete new set of buyers and merchants to the inventory market. This group solely knew one factor – increased costs. Take into consideration the Reddit of us. They thought it solely took a fast point out or tweet of a inventory and it could triple in worth. These weren’t disciplined buyers and/or merchants. These had been pure speculators and this excessive bullishness confirmed within the fairness solely put name ratio ($CPCE).

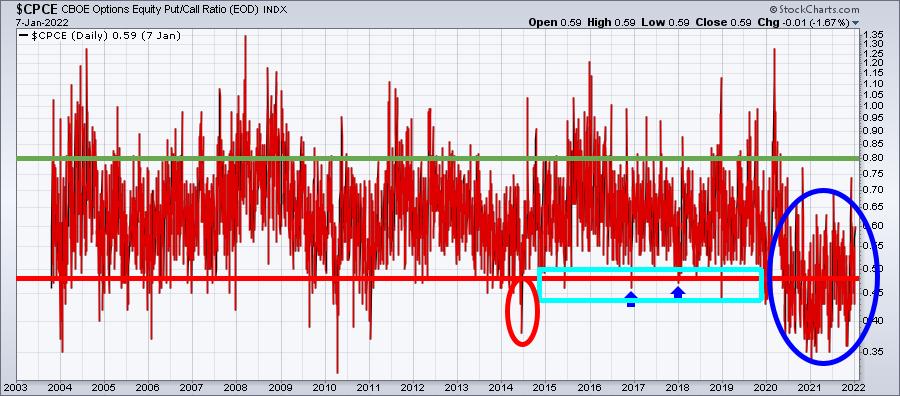

On January 8, 2022, we hosted our MarketVision 2022 occasion. I talked extensively in regards to the sentiment points we confronted heading into this 12 months. For sentiment, I wish to know what persons are doing with their cash. Some sentiment readings cope with “emotions” in regards to the present market atmosphere. I could not care much less about that. Present me what persons are doing with their cash! Typically talking, calls traded are bullish, whereas places traded are bearish. That is why I prefer to observe the CPCE. There isn’t any guesswork concerned right here. I am going to share with you a pair charts that I shared again at MarketVision 2022. This is the primary and what the chart seemed like on the time of the occasion:

I highlighted the HUGE good points that had been skilled off that March 2020 low and the way the 253-day (1-year) common of the CPCE had fallen to a CRAZY bullish stage – a stage by no means seen earlier than. The AVERAGE of the fairness solely put name ratio FOR A YEAR was at .48 and simply starting to rise. Let me illustrate how loopy that is. Under is a day by day chart of the CPCE, so that you could see the fairness solely put name readings daily for the previous 18 years:

When the CPCE dropped in mid-2014 under 0.40, the S&P 500 struggled for the following 12 months earlier than lastly topping in Might 2015. Word that the CPCE barely dropped beneath 0.48 on the time of that prime. ONE DAY’S .48 studying!!! Now have a look at that cluster of readings for the previous two years at an unusually low stage. Sentiment had NEVER reached this excessive bullish stage earlier than and possibly by no means will once more. We would have liked to “reset” sentiment earlier than the inventory market had an opportunity of additional appreciation. So now scroll again up and have a look at that 253-day shifting common of the CPCE that was simply starting to show increased in the beginning of 2022. Wish to know the place it’s as we speak? Verify this out:

The U.S. inventory market traditionally struggles as sentiment is resetting increased. And sentiment was our greatest problem as we opened 2022, not inflation, not rates of interest, not the battle, not the Fed. These had been the explanations the media centered on to allow sentiment to reset.

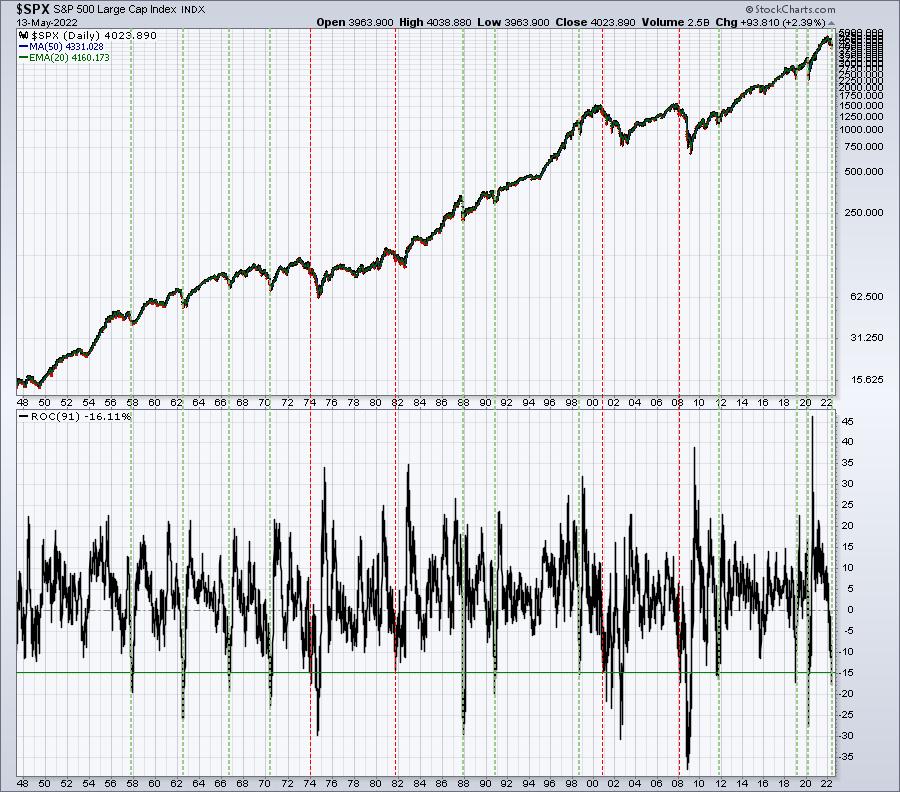

I do not know that we have bottomed, however I do consider we’re getting very shut. I stated in our MarketVision 2022 occasion that the important thing to being profitable in 2022 was going to be our capability to train PATIENCE. That is what I’ve executed. I’ve traded, however principally remained in money. My purpose is to be prepared with MORE shopping for energy after we in the end backside. In the event you consider we’re simply getting began to the draw back, I wish to present you yet one more S&P 500 chart. On this chart, I am going to present you one other price of change on the backside. This time it’s going to be the 91-day ROC. Why 91 days? Properly, that is the variety of buying and selling days it took for us to go from our January third excessive to the Thursday, Might twelfth low shut. How does this 91-day ROC examine to the remainder of historical past?

I’ve drawn a inexperienced horizontal line on the 91-day ROC panel to spotlight occasions when this ROC has reached -15%. I depend 15. Of those 15, 4 (red-dotted vertical strains) have resulted in additional draw back motion. 3 of those 4 occurred throughout secular bear markets (1974, 2000, and 2008). 11 (green-dotted vertical strains) different occasions since 1950, we have seen this 91-day ROC hit -15% they usually’ve all primarily marked main market bottoms.

I’ve stated repeatedly that we’re in a secular bull market. Be at liberty to disagree with me. However I’ve remained steadfast to that argument for the previous a number of years and it is served me properly. So I am going to keep it up once more.

I consider firmly that our greatest problem heading into 2022 was sentiment. As I’ve mentioned above, you may see that is one problem that’s starting to deal with itself. I can not go anyplace now {that a} dialogue does not escape in regards to the myriad of issues we now have now. And the media goes to be on all of them like a canine on a bone. The excellent news for us bulls is that market bottoms come loads ahead of rosy media forecasts.

I hope you are able to pounce on this generational alternative. I do know I’m.

To remain abreast of TONS of market-related information and charts, CLICK HERE to affix our rising EB Digest neighborhood {of professional} and particular person buyers/merchants. It is utterly free and requires no bank card to affix.

Completely satisfied buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person buyers. Tom writes a complete Each day Market Report (DMR), offering steerage to EB.com members daily that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a elementary background in public accounting as properly, mixing a novel talent set to method the U.S. inventory market.