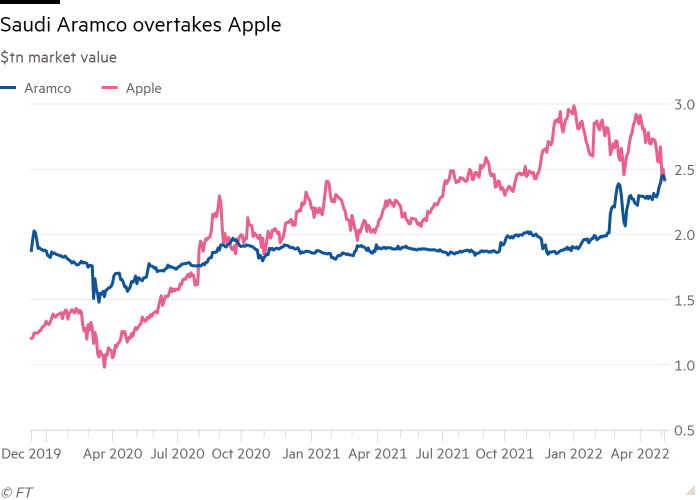

Saudi Aramco has overtaken Apple because the world’s Most worthy firm after increased oil costs pushed shares of the world’s greatest crude exporter to report ranges, whereas a broader tech inventory sell-off weighs on the iPhone maker.

The Saudi Arabian oil firm’s market capitalisation on Wednesday was $2.426tn, exceeding Apple’s $2.415tn by simply over $10bn.

It’s the first time that Saudi Aramco has regained the highest spot since 2020 and follows a broader sell-off in expertise shares because the begin of the yr.

Apple grew to become the primary firm to hit a $3tn market cap in early January, though its shares have suffered in current months as traders reassess lofty valuations within the tech sector in mild of a reversal in financial coverage and worries that inflation will weaken shoppers’ spending habits.

It has held up higher than some massive tech firms, having fallen again 19 per cent since its January excessive. Apple shares have been down 4.6 per cent at $147.35 on Wednesday afternoon in New York, taking their year-to-date drop to 17.1 per cent and placing the share worth at its lowest since November.

Whereas Apple not too long ago recorded its third-best quarter for revenues ever, chief government Tim Cook dinner stated provide shortages and lockdowns in China have been anticipated to value the corporate as a lot as $8 billion this quarter.

Some analysts query the benefit of evaluating the businesses, provided that Apple is a public firm based in a storage in California in 1976, whereas Saudi Aramco is a state-backed large with solely a small quantity of freely floated shares.

Saudi Aramco raised a report $25.6bn in 2019 when the state — which nonetheless owns 94 per cent of the corporate — listed 1.5 per cent of its shares in what was then the world’s largest ever preliminary public providing. In February the federal government transferred an extra 4 per cent of its shares to Saudi Arabia’s sovereign wealth fund.

Saudi Aramco’s shares, that are listed in Riyadh, have risen 27 per cent because the begin of the yr to commerce at a report 46 riyals ($12.26).

Oil costs, which surged to a 14-year excessive of $139 a barrel in March following Russia’s invasion of Ukraine, have helped among the world’s greatest oil and fuel firms ship report income within the first three months of the yr.

Saudi Aramco can also be anticipated to announce bumper income when it reviews first-quarter earnings on Sunday. The corporate’s internet earnings greater than doubled in 2021 to $110bn as resurgent financial exercise following the easing of worldwide coronavirus restrictions revived demand for hydrocarbons.

Further reporting by Peter Wells in New York