The inventory market is caught and lots of traders are having hassle understanding why it might’t bounce from right here. The aim of this text is to shed a bit gentle on the issues within the bond market and the way they’re influencing the opposite markets.

To start with, what’s going on with the US yields? The 30-year yield is up 8% in two days. That’s dashing proper alongside. It is the speed of change that places a lot stress on every little thing.

Whereas that is going larger, the US 10-Yr is rising. This enhance in borrowing prices adjustments most of the base ranges within the USA and a few all over the world. The USA has lots going for it, together with having most of the largest corporations on this planet based mostly in its tax realm. Nonetheless, different international locations on this planet cannot afford to have their rates of interest soar, so they’re making an attempt to carry them down. One instance is Japan.

Japan

Japan’s p.c of Debt to GDP is certainly one of (if not the) highest on this planet, so it is necessary for them to maintain their rates of interest extraordinarily low. This debt stage as a ratio is greater than double the US Debt ratio. If rates of interest spiraled uncontrolled, this might be an financial time bomb. It’s on my radar and I’ve been discussing this in my shopper newsletters since April ninth.

Once we chart the scenario, it creates a graph that’s getting very stretched. The chart under exhibits the Japanese 10-Yr on the backside inside the primary panel and the US 10-Yr in purple. They had been barely extra stretched aside in 2018, however now we’ve hovering inflation, so the speedy strikes up on the US chart are placing excessive stress on Japan. Now we have had an expansion this extensive (Orange decrease panel) earlier than, however solely as soon as. The Fed got here to the rescue to repair it then.

The chart under is identical black Japanese 10-Yr because the chart above, however the laptop adjustments the size to fill the entire panel. The true query is, can the Japanese Central financial institution preserve the big unfold by holding the yield at 0.25% or much less? Or will the stress to let it rise in an inflationary surroundings turn into too nice?

If they do not let the yield rise, then the Yen falls, which makes every little thing the nation imports that’s priced in US {Dollars} costlier for Japan, and the Yen continues to fall. I’ve plotted this because the Yen to the greenback to be in step with different foreign money charts on this article.

The lengthy view on the Yen is that it broke the 35-year uptrend earlier this yr, and has now fallen under a 20-year assist stage. It is dropping like a stone.

Euro and different currencies

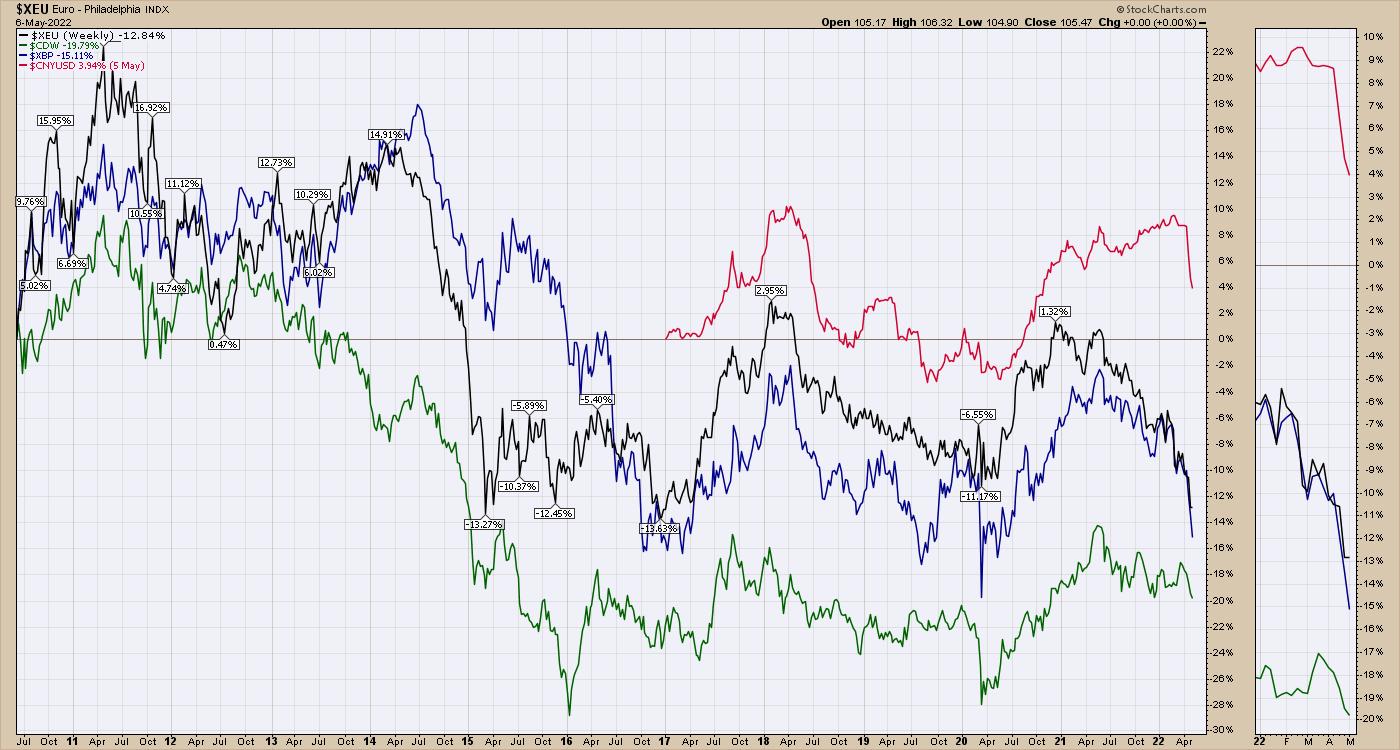

After I take a look at different main currencies, they’re falling arduous as properly. The Euro, the British Pound and the Chinese language Yuan are all dropping like stones. The Canadian Greenback in inexperienced is falling arduous as properly, however the fall is simply getting began.

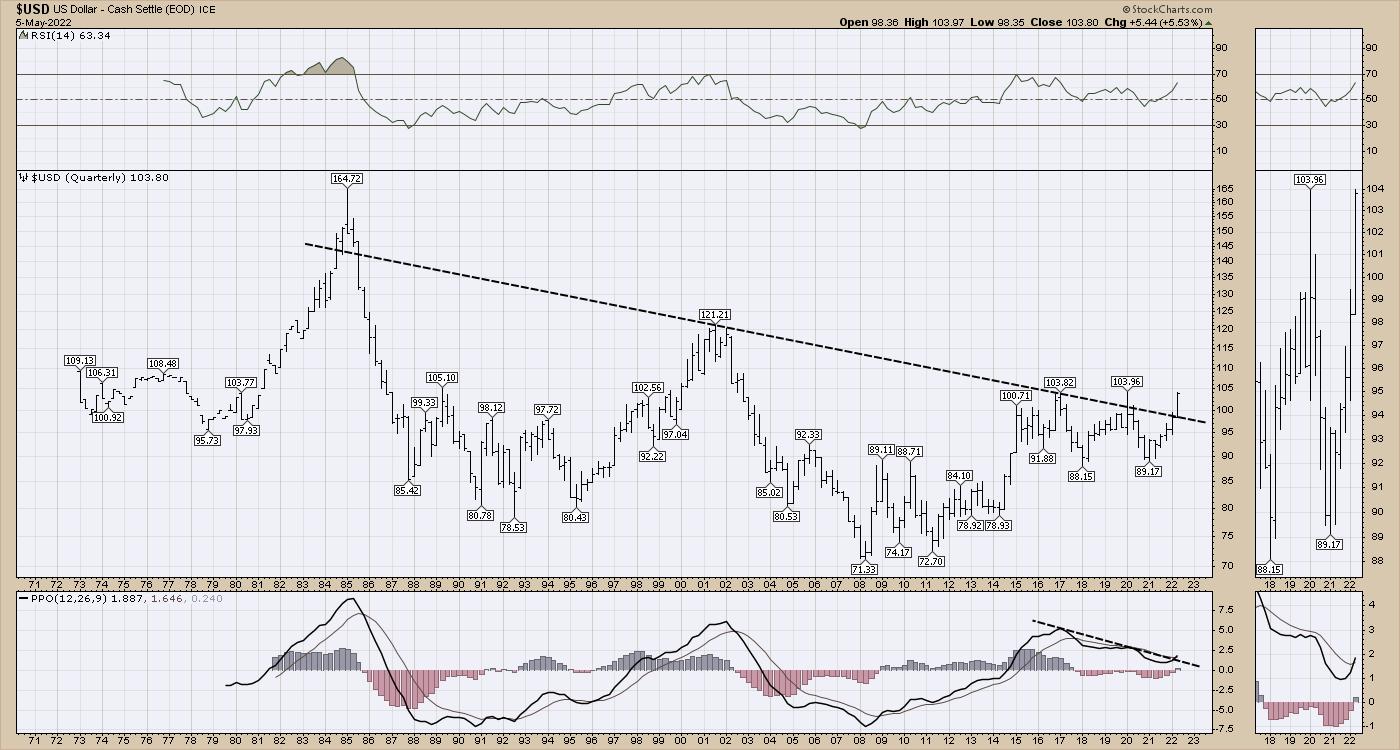

The US Greenback

Clearly, the opposite facet of all these foreign money pairs is the US Greenback. The problem is that, as the opposite currencies fall, the greenback rises. This quarterly (3-month) chart under is breaking a 36-year downtrend. There was a quick surge through the COVID kickoff, but it surely shortly retraced. Closing out June above the 104 stage can be 19-year highs and create a collection of upper lows and better highs on the lengthy time-frame. Buyers all around the world acknowledge how a lot the conflict within the Ukraine will have an effect on future commerce. If the prices for items are going to soar all over the world because the retraction of world commerce happens, that is inflationary. When objects are priced in US {Dollars}, it is vitally inflationary when your foreign money is dropping and the worth of products are rising.

With the speedy, long-term vital adjustments in each bonds and currencies, it’s no shock that the inventory market can also be displaying indicators of main adjustments. On Might 6, 2022, I narrated a 10-minute Your Day by day 5 video for StockCharts TV that covers these charts extra completely.

Your Day by day 5 — Might 6, 2022

Conclusion

As these main adjustments are forcing corporations and governments to reprice and reposition their strategy to the brand new financial circumstances, all of those charts are snapping necessary long-term pattern strains. Hovering inflation is an issue. The high-yield bond ETF (HYG) and the company bond ETF (LQD) are each dropping in a backyard hose waterfall just like the every day Yen chart above. Both we discover assist quickly, or extra property begin to go over the waterfalls.

A easy instance of how excessive issues are is the transfer within the US 30-Yr bond curiosity over the past 2 days (0.22%), which is nearly a double of what the Japanese rate of interest is being held at. Simply think about if Japanese debt funds began to double, and that is the place every little thing begins to come back off the rails. What if these debt funds must triple? Or quadruple? Till it falls aside, it’s nothing, however as soon as it begins, the vibration by way of the monetary system can be massive.

If you need to take a look at extra of our work, click on on over to OspreyStrategic.org. We even have a trial for $7 for the primary month there.

Greg Schnell, CMT, is a Senior Technical Analyst at StockCharts.com specializing in intermarket and commodities evaluation. He’s additionally the co-author of Inventory Charts For Dummies (Wiley, 2018). Based mostly in Calgary, Greg is a board member of the Canadian Society of Technical Analysts (CSTA) and the chairman of the CSTA Calgary chapter. He’s an lively member of each the CMT Affiliation and the Worldwide Federation of Technical Analysts (IFTA).