Bollinger Bands are the volatility bands positioned above and beneath the Transferring Common. Being primarily based on volatility, the bands widen and slim, i.e. they regulate themselves dynamically as the costs transfer. When the costs are unstable, the Bands widen with the rise in volatility; they contract in instances of low volatility.

Bollinger Bands are inclined to squeeze (get slim and contract) because the volatility falls. In accordance with John Bollinger, durations of low volatility are sometimes adopted by durations of low volatility. Any breakout or a breakdown from a Bollinger band squeeze usually ends in a serious trending transfer.

Vital: Bollinger Band Squeeze is actually a impartial formation. It ought to by no means be traded in isolation and no directional transfer ought to be anticipated. One should at all times look ahead to value affirmation; that’s, look ahead to the worth to penetrate the resistance or violate assist earlier than taking any directional name within the inventory.

The next three shares are presently underneath Bollinger Band Squeeze; the opposite items of technical proof current on the chart present a possible potential up transfer in value topic to their shifting previous the speedy resistance degree.

CROMPTON.IN

CROMPTON is displaying indicators of a possible reversal; any transfer above 390 will mark a possible development reversal for the inventory. The MACD is in persevering with purchase mode; the RSI reveals a robust bullish divergence towards the worth. Whereas the RSI has damaged out to a brand new excessive from a sample, the worth has not completed so. This has resulted within the bullish divergence of RSI towards the worth.

Whereas the inventory stays within the main quadrant when benchmarked towards the broader NIFTY500 index, the RS line towards the broader markets has flattened and has began to rise. The OBV is rising.

If the upward breakout occurs above 390, the inventory has the potential to check the 430 degree. Any transfer beneath 362 will nullify this view.

DIVISLAB.IN

DIVISLAB is presently in a sideways value motion because the inventory stays in a buying and selling zone of 4350-4550. It has tried to interrupt above the essential resistance degree of 4550 with higher-than-average volumes. Nonetheless, a throwback has taken the inventory again contained in the buying and selling vary.

A breakout will happen when the costs thrust above 4575 and maintain above that time. If that occurs, then the inventory might even see a breakout from a Bollinger band squeeze. The inventory is presently within the main quadrant of the RRG when benchmarked towards the broader NIFTY500 Index. The RS line towards the broader markets is rising and is above the 50-DMA.

If the breakout happens above the 4575 degree, the inventory has the potential to check 4965-5000. Any transfer beneath 4300 will nullify this view.

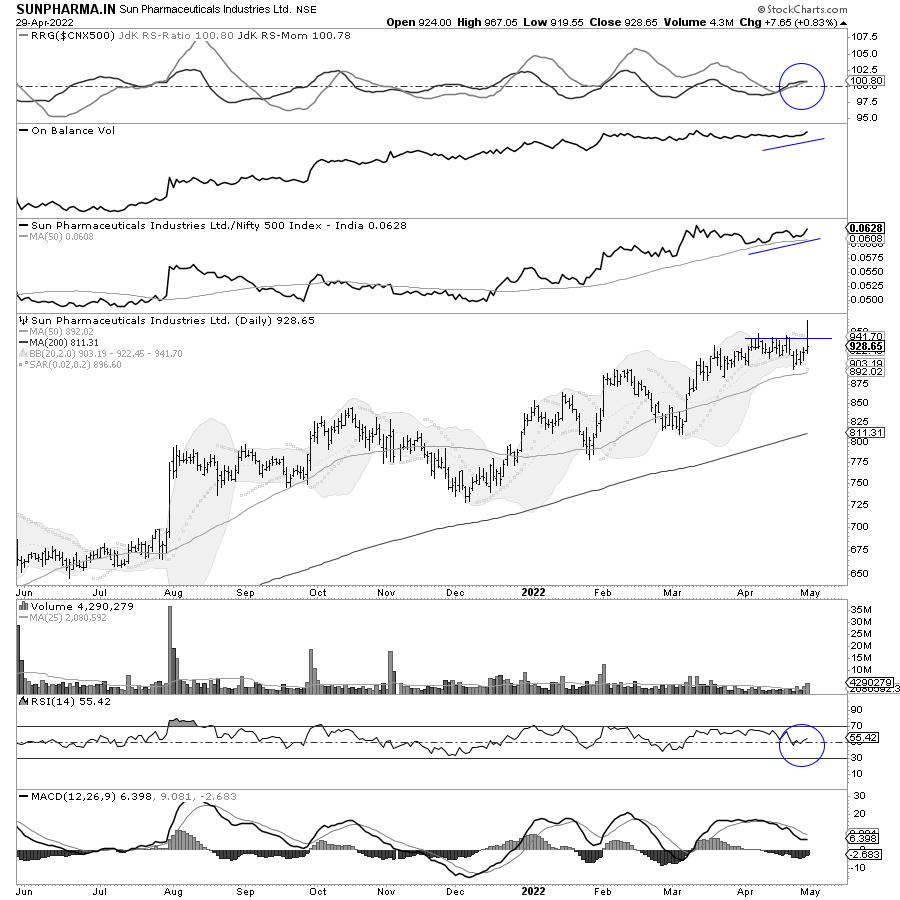

SUNPHARMA.IN

SUNPHARMA is likely one of the higher performers within the Pharma group; the inventory stays in a secular uptrend. Presently, after resisting the 941 degree a number of instances, the inventory is presently in a slim congestion zone. The volatility has considerably contracted on account of low volatility within the inventory.

A robust volume-supported transfer above 945 will lead to a breakout from this Bollinger band squeeze. The RSI is impartial and doesn’t present any divergence towards the worth. The RS line towards the broader NIFTY500 index is in a agency uptrend and guidelines above its 50-DMA.

Whereas the inventory has rolled contained in the main quadrant of the RRG when benchmarked towards NIFTY 500 index, the On-Steadiness-Quantity (OBV) has already marked a brand new excessive forward of the particular value breakout.

If the breakout happens on the anticipated strains, the inventory could take a look at the 985-1025 ranges. Any transfer beneath 900 will nullify this view.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Disclosure pursuant to Clause 19 of SEBI (Analysis Analysts) Laws 2014: Analyst, Household Members, or his Associates holds no monetary curiosity beneath 1% or larger than 1% and has not obtained any compensation from the Corporations mentioned.

The securities mentioned and opinions expressed on this report might not be appropriate for all buyers, who should make their very own funding choices, primarily based on their very own funding goals, monetary positions, and desires of particular recipients. This might not be taken in substitution for the train of unbiased judgment by any recipient.

The recipient ought to independently consider the funding dangers. The worth and return on funding could fluctuate due to modifications in rates of interest, international change charges, or some other cause. Previous efficiency isn’t essentially a information to future efficiency. The utilization of the Analysis Experiences and different Providers are ruled as per the Phrases of Service on https://equityresearch.asia/terms-of-use

The Analysis Analyst has not managed or co-managed the problems of any of the businesses mentioned and has not obtained any such remuneration from such actions from the businesses mentioned.

The Analysis Analyst has not obtained any remuneration from the Service provider Banking actions.

The Analysis Analyst has adopted an unbiased method with none battle from anybody. The Analysis Analyst has not obtained any compensation or different advantages from the businesses talked about within the report or third get together in reference to the preparation of the analysis report.

Compensation of the Analysis Analysts isn’t primarily based on any particular service provider banking, funding banking or brokerage service transactions.

The Analysis Analyst isn’t engaged in a market-making exercise for the businesses talked about within the report.

The Analysis Analyst submits that no materials disciplinary motion has been taken on him by any Regulatory Authority impacting Fairness Analysis Evaluation actions.

This report isn’t directed or meant for distribution to, or use by, any individual or entity who’s a citizen or resident of or positioned in any locality, state, nation, or different jurisdiction, the place such distribution, publication, availability, or use can be opposite to regulation, regulation or which might topic the Analysis Analyst to any registration or licensing requirement inside such jurisdiction.

Milan Vaishnav, CMT, MSTA is a professional Unbiased Technical Analysis Analyst at his Analysis Agency, Gemstone Fairness Analysis & Advisory Providers in Vadodara, India. As a Consulting Technical Analysis Analyst and together with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Unbiased Technical Analysis to the Shoppers. He presently contributes every day to ET Markets and The Financial Occasions of India. He additionally authors one of many India’s most correct “Day by day / Weekly Market Outlook” — A Day by day / Weekly Publication, at the moment in its fifteenth 12 months of publication.

Milan’s major duties embrace consulting in Portfolio/Funds Administration and Advisory Providers. His work additionally includes advising these Shoppers with dynamic Funding and Buying and selling Methods throughout a number of asset-classes whereas holding their actions aligned with the given mandate.

Study Extra