My weekly funding routine includes a evaluate of key sentiment indicators each Thursday. That is primarily as a result of the survey knowledge I evaluate is often up to date on Wednesday and Thursday of every week, so it is an ideal time to replicate on survey knowledge (how buyers are voting with their voice) versus worth efficiency (how buyers are voting with their capital).

Quite a few sentiment indicators have flashed considerably bearish readings in latest months as the foremost indexes have pulled again within the 10-20% vary. However that is nothing in comparison with the primarily bombed-out sentiment readings I noticed this week.

One of the crucial well-liked surveys out there’s the American Affiliation of Particular person Buyers (AAII) Survey. Each week, AAII members are invited to solid a poll of bullish, impartial or bearish on shares for the following six months. Whereas any survey has its imperfections, I like the truth that this survey has been round for thus lengthy in a reasonably constant format. As you will see later within the article, you’ll be able to evaluate how the numbers performed out throughout earlier bull and bear market cycles, even a long time up to now!

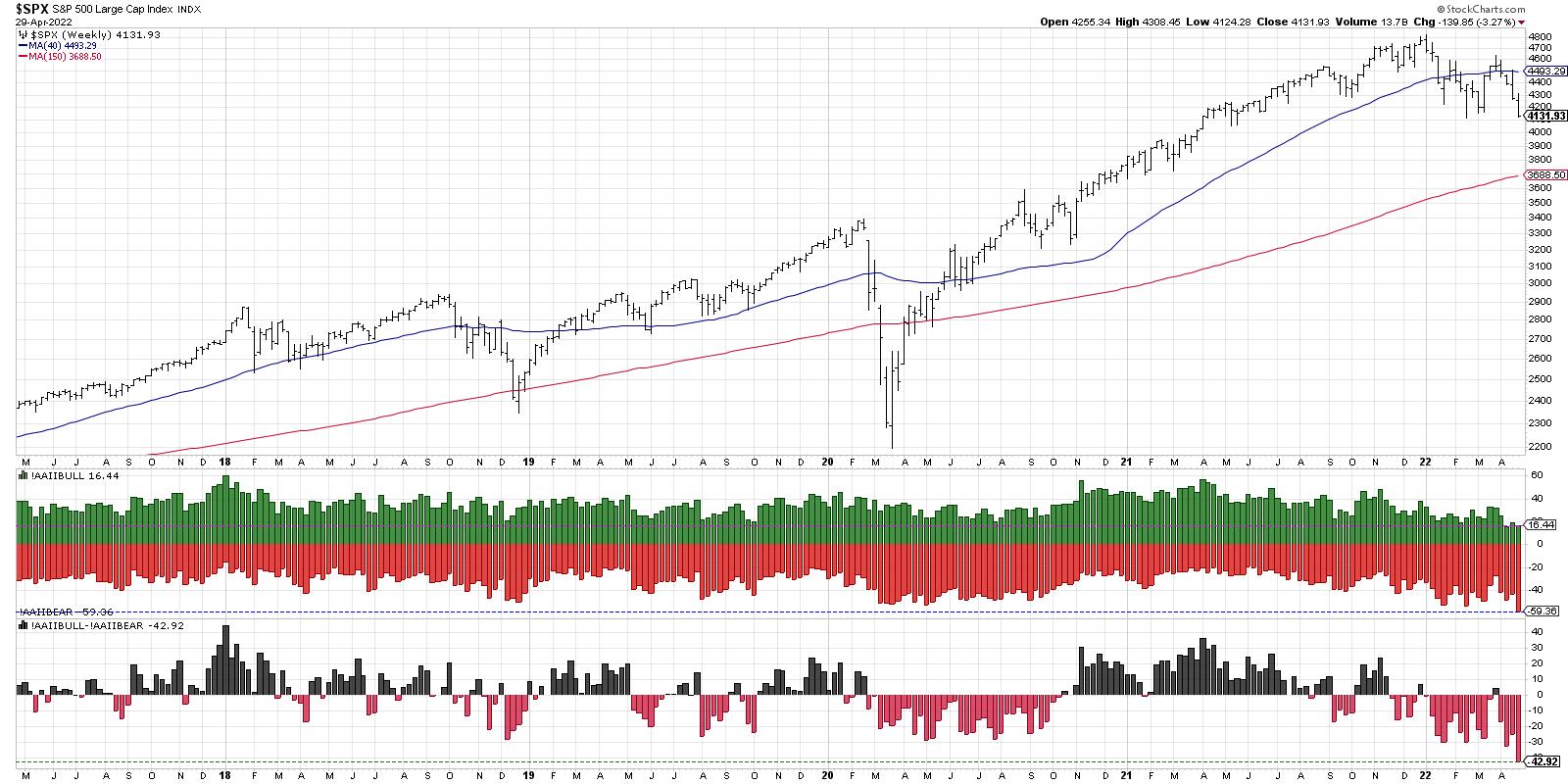

The present chart appears to be like like this:

The inexperienced bars symbolize the p.c of respondents who have been bullish, whereas the purple bars present the p.c of bearish respondents. The underside panel reveals the unfold between the 2, bullish minus bearish, and the impartial responses will not be included right here.

My first response this morning was that, apart from two weeks in the past, we now have not seen such a low degree of bullish votes (solely 16%) in over 5 years. I additionally seen that the bearish quantity, at virtually 60%, is the bottom we have seen in over 5 years. Lastly, the unfold between the 2 presently sits round -43%, with bears far outnumbering bulls. That is additionally nicely beneath the vary of the earlier 5 years.

So, mainly, the present transfer has been so extreme that you haven’t any historic parallel with out bringing in additional knowledge. I’ve discovered that when this occurs in your chart, you’re experiencing a market the place a deep historic evaluation is worth it.

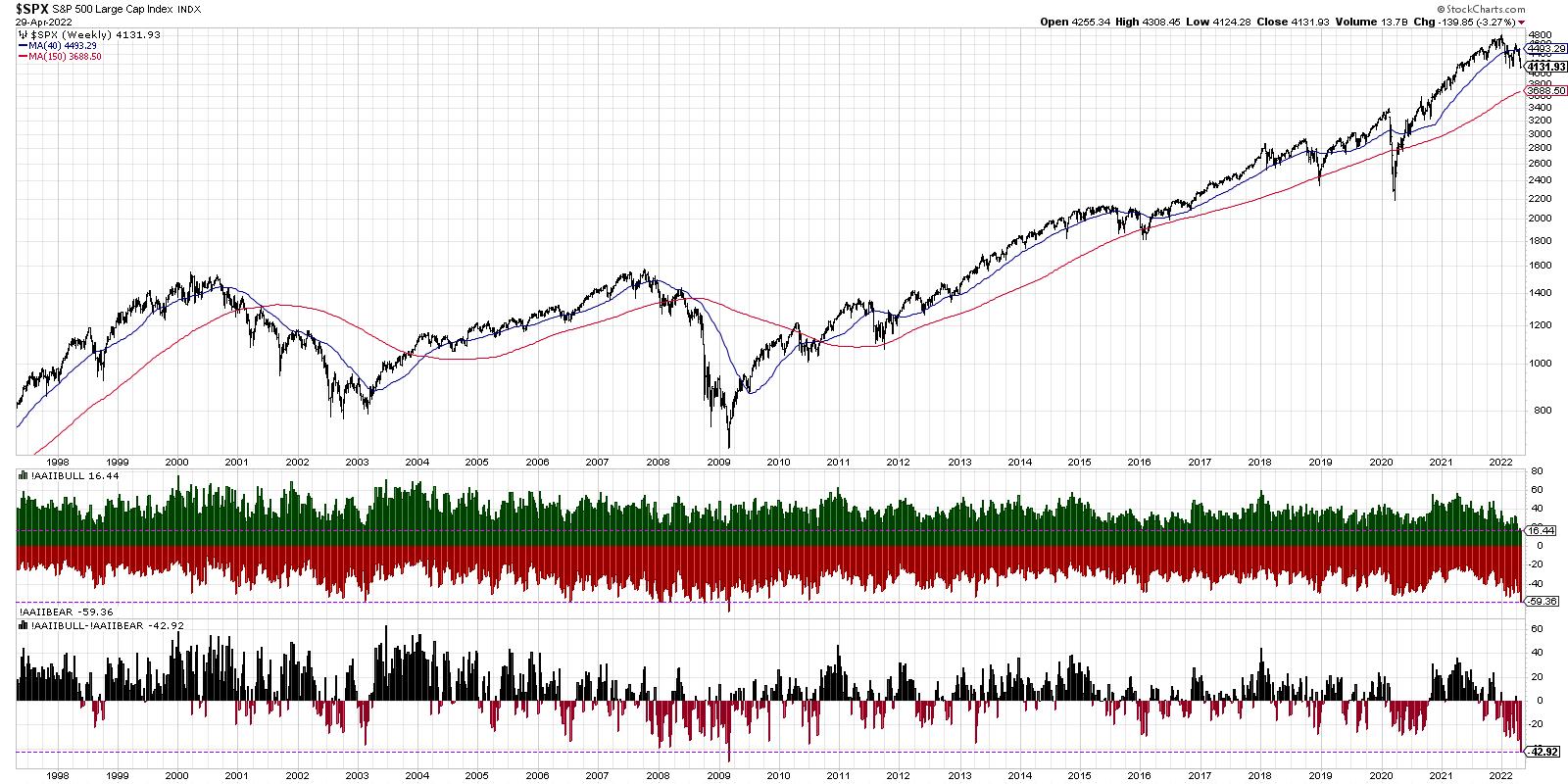

Let’s herald 20 extra years of information, which can take us again to the late Nineteen Nineties.

This reveals the present bearish readings are certainly among the most extreme we have seen even going again to the pre-2000s secular bull market. The one different time bullish sentiment has been this low was in 2016. The bearish studying of just about 60% was solely seen on the 2003 market low, the 2006 pullback, and far of 2008 going into the 2009 market backside. The unfold of bulls to bears has solely been this damaging (-43%) one different time within the final 25 years, and that was on the 2009 market low.

Now let’s dig into every of those durations in a little bit extra element.

It is fascinating to me that the sentiment in March 2003 was extra bearish than within the third quarter of 2002, which was the precise backside of that cyclical bear market part from 2000-2002. The 2003 low was a retest of the 2002 lows, however the prospect of shifting to new lows for the cycle made buyers extremely bearish.

The 2006 remark is a compelling one, in that it occurred throughout a short pullback throughout a cyclical bull market part. Comparable pullbacks in 2005 noticed considerably bearish sentiment, however not the intense seen in 2006. The market shortly recovered and went on to new multi-year highs quickly after.

The 2008-2009 remark is maybe probably the most regarding, as a result of the primary leg down within the first quarter of 2008 noticed a really related sample of bearish sentiment. As you’ll be able to see, the sentiment remained excessively bearish for over a 12 months, culminating within the fairly damaging readings in March 2009.

I used to be taught that buyers are typically excessively bearish at market bottoms and overly bullish at market tops. However a evaluate of the AAII survey knowledge during the last 25 years reveals that this has certainly occurred… however solely among the time. In sure instances, just like the 2008-2009 cyclical bear market, excessively bearish sentiment was just the start of a protracted and painful journey to the draw back.

Wish to digest this text in video format? Head over to my YouTube channel!

RR#6,

Dave

P.S. Able to improve your funding course of? Try my YouTube channel!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your personal private and monetary scenario, or with out consulting a monetary skilled.

The writer doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the writer, and don’t in any method symbolize the views or opinions of every other particular person or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps buyers decrease behavioral biases by way of technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness methods to investor determination making in his weblog, The Conscious Investor.

David can also be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency centered on managing danger by way of market consciousness. He combines the strengths of technical evaluation, behavioral finance, and knowledge visualization to establish funding alternatives and enrich relationships between advisors and shoppers.

Study Extra