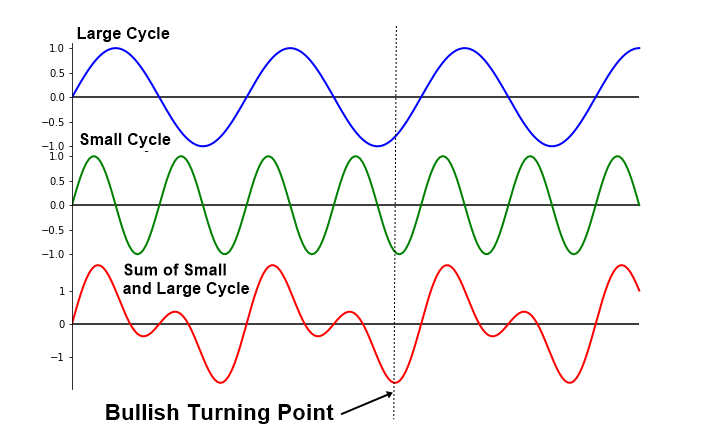

Buying and selling is sensible. We commerce to make the earnings from our buying and selling. Therefore, if you’re a dealer, crucial query to ask is “How do you make earnings by buying and selling?”. Say that you just and your good friend purchased the identical inventory. Nevertheless, your end result will be utterly totally different out of your good friend. Even when each of to procure the identical inventory, you can nonetheless lose cash whereas your good friend made cash. What makes the distinction between you and your good friend? It’s the entry timing. In one other phrases, crucial issue behind the profitable buying and selling is to know the very best entry in our buying and selling. This timing query is one thing that each dealer ought to and should ask. The truth is, we are able to formulate the reply to this query from the market cycle viewpoint. The straightforward reply is that this picture can visualize such a successful alternative.

Determine 5-1: Conceptual drawing to display greatest purchase entry

Say that EURUSD or Bitcoin have the big cycle and small cycle. Your greatest purchase alternative shall be within the space the place each small and enormous cycles are boosted collectively proven because the dotted line within the picture. That’s the skinny intersection the place each quick time period dealer and long run dealer are leaping in collectively. Nevertheless, that is the place most of common merchants are cease pondering past. There may be one downside on this picture though its idea is completely sound. The issue is that the market doesn’t have the common cycle, which we are able to observe its peak and trough with fastened time interval as within the sine curve of the Physics textual content ebook. Therefore, this picture is simply instructional to conceptualize the very best purchase entry. If it was like that, the cash making in Foreign exchange or Inventory market would have been a lot simpler shopping for EURUSD on Monday low and promoting at Friday excessive one thing like this or comparable. The truth is, what makes us onerous is that the market cycle will not be common however it’s stochastic.

Determine 5-2: Market cycle in EURUSD D1 timeframe

Market cycle is irregular. Typically, value strikes in gradual cycle and generally value strikes in quick cycle. Typically value swings round large amplitude and generally value swings round solely small amplitude. It’s the observations we are able to make every single day in Foreign exchange and Inventory market, the fuzzy and soiled cycles as an alternative of the clear sine curve. Therefore, any technical evaluation that doesn’t take into account this uneven and tough floor of the market will not be efficient to foretell the market.

Determine 5-3: Fractal cycle demonstration

The excellent news is that understanding the fractal wave may also help us to foretell the market tremendously. It’s as a result of fractal wave is the device that’s theoretically designed to work with value knowledge with many uneven cycles. Not like the fractal wave, many different instruments will endure extra with extra variety of uneven cycles within the value knowledge, for instance, like the conventional distribution and different cyclic strategies designed to function with common cycles. Therefore, fractal wave is the very best device to foretell the fuzzy and soiled cycles in Foreign exchange and Inventory market. Theoretically, it is without doubt one of the greatest device to mannequin stochastic cycles within the Foreign exchange and Inventory market too. The height trough evaluation is the necessary first step because it visualizes the fuzzy and soiled cycles within the readable kind for us. Due to this fact, the technical evaluation making good use of this peak trough evaluation is the necessary device to foretell the market.

Now going again to the entry timing query, how can we catch the second the place the small and enormous cycles are boosted collectively utilizing the technical evaluation? Though the technical evaluation is the great device to foretell the stochastic cycle, it nonetheless doesn’t suggest that they’re designed to seize the a number of cycles. The truth is, the reply is fairly easy. Catching the timing the place the small and enormous cycles are boosted collectively will be accomplished by combining two or extra methods to gauge your entry as an alternative of simply utilizing one single approach. Combining two or extra technical evaluation is an effective buying and selling technique as in apply we’d have to seize the intersection for greater than two cycles. Technically talking, once you use a number of methods, you will have a excessive probability to seize the very best entry.

As well as, utilizing two or extra chart timeframe may add some worth to enhance your buying and selling efficiency too. Good combination of the technical evaluation and the chart timeframe will yield the fruitful outcomes. Therefore, if you wish to turn into a profitable dealer, then coaching and apply are a should requirement. Right here is one ultimate notice. Because the market consists of the probabilistic cycles, your end result will not be going to be bullet proof. Due to this fact, it’s best to commerce with the excessive likelihood setup. You’ll want to perceive that buying and selling is about high quality and never about amount. As well as, figuring out the very best promote entry is strictly the identical as figuring out the very best purchase entry. We simply have to search for the intersection the place each small and enormous cycles are falling collectively utilizing the 2 or extra technical evaluation.

About this Article

This text is the half taken from the draft model of the E-book: Technical Evaluation in Foreign exchange and Inventory Market (Provide Demand Evaluation and Help Resistance). Full model of the ebook will be discovered from the hyperlink under:

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

It’s also possible to use Ace Provide Demand Zone Indicator in MetaTrader to perform your technical evaluation. Ace Provide Demand Zone indicator is non repainting and non lagging provide demand zone indicator with numerous highly effective options constructed on.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Beneath is the touchdown web page for Optimum Chart (Standalone Charting and Analytical Platform).

https://algotrading-investment.com/2019/07/23/optimum-chart/