The majority of the previous 5 classes was spent on a corrective word by the Indian fairness markets. There have been bounces that didn’t maintain because the NIFTY struggled to maintain its head above the 200-DMA degree. The earlier week noticed a large buying and selling vary of 590 factors. Within the earlier weekly word, it was additionally talked about that, for any sustainable up transfer to occur, shifting previous and preserving the top above the 17500 can be essential. The NIFTY failed to maneuver previous this degree. Whereas buying and selling consistent with the general weak international commerce setup, the NIFTY declined by means of the week and ended with a internet lack of 303.70 factors (-1.74%) on a weekly foundation.

The approaching week can also be an expiry week; we can have month-to-month by-product expiry, which is sure to affect the commerce. Nevertheless, the extent of 17500 continues to carry the very best Name OI accumulation. For any sustainable up transfer to occur, shifting previous this level might be significantly vital. Having stated this, the NIFTY has mildly violated a development line help on the NIFTY. It has taken help on the 50-Week MA which stands at 16935; this degree stays essential help on a closing foundation for the NIFTY within the close to time period. It has additionally violated the 200-DMA once more on the each day charts; 200-DMA stands at 17193. Over the approaching weeks, NIFTY’s worth conduct in opposition to the 17000 ranges might be essential to observe.

Volatility elevated a bit; INDIAVIX rose by 3.19% to 18.35. The approaching week is prone to stay rangebound. The upsides, if any, are prone to keep capped at 17500 ranges. On the decrease aspect, violating 17000 would imply some incremental weak spot for the markets. The degrees of 17350 and 17535 will act as quick resistance factors for NIFTY; helps are prone to are available at 17000 and 16880 ranges.

The weekly RSI is 49.85; it stays impartial and doesn’t present any divergence in opposition to the worth. The weekly MACD has turned bearish once more following a unfavorable crossover; it now trades beneath the sign line.

The sample evaluation exhibits that the NIFTY has mildly violated the prolonged development line help degree briefly; nevertheless, it has managed to shut above it. This development line begins from the 15400 degree, joins the following excessive level and extends itself. The NIFTY has additionally defended the 50-Week MA as of now, which stays an vital help degree to observe over the approaching weeks.

All in all, there’s little likelihood of the market seeing any runaway up transfer within the coming week. Within the occasion of any technical pullback, the upside strikes could get capped close to 17500 ranges. On the decrease aspect, defending the 50-Week MA on a closing foundation might be essential for the market. The protected and prudent option to navigate such a technically difficult market can be to be extremely stock-specific within the method. It could be clever to stay to low beta shares; additionally, specializing in defensive pockets like FMCG, Pharma, Consumption, and so forth. would repay as properly. A cautious method is suggested for the approaching week.

Sector Evaluation for the Coming Week

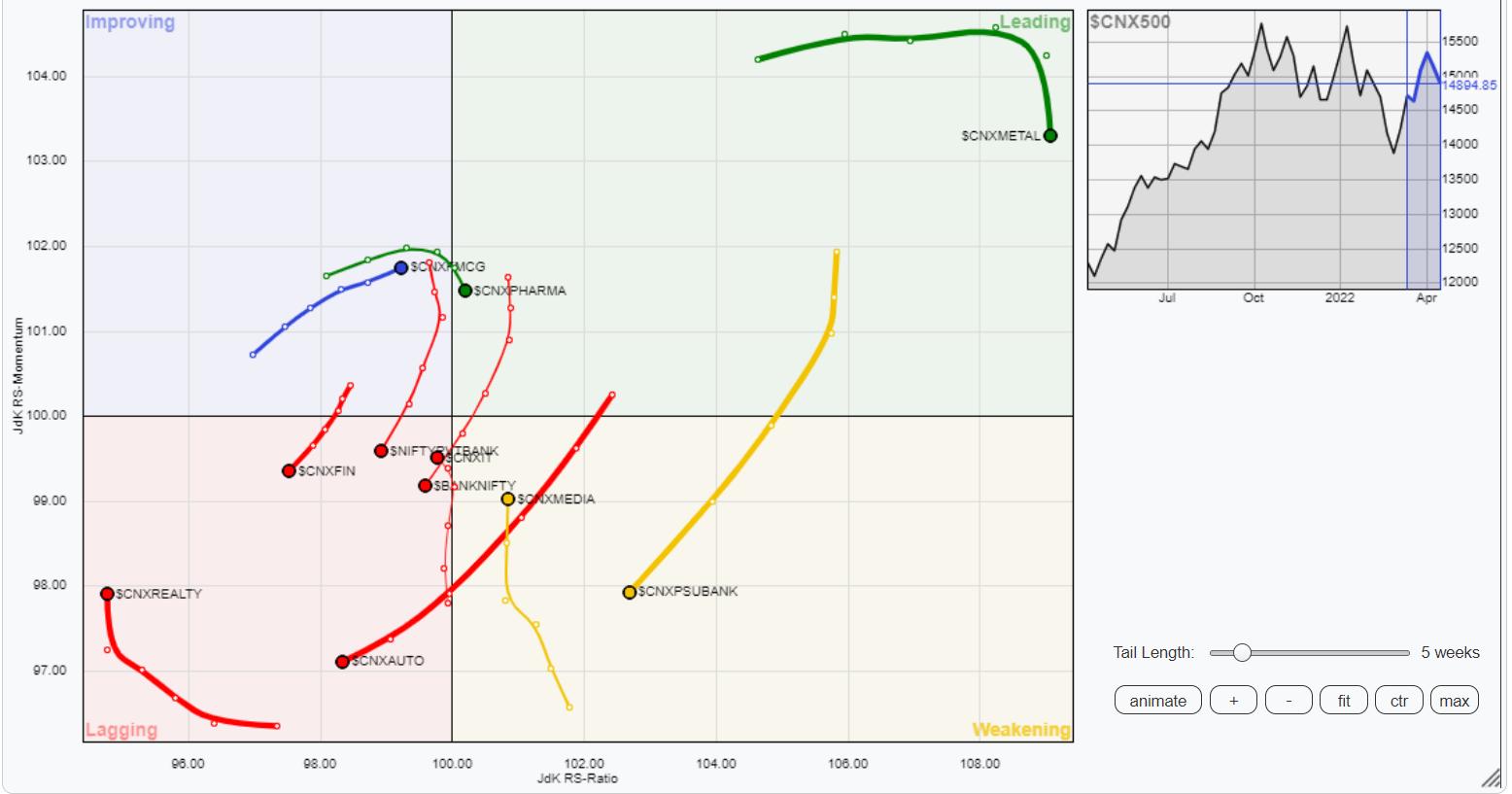

In our have a look at Relative Rotation Graphs®, we in contrast varied sectors in opposition to CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

The evaluation of Relative Rotation Graphs (RRG) exhibits that the Commodities, Power, Pharma and PSE indices are positioned contained in the main quadrant and should comparatively outperform the broader markets. The Commodities and Metallic indices are additionally contained in the main quadrant, however are seen giving up on their relative momentum. NIFTY Infrastructure index has rolled again contained in the main quadrant as properly.

The PSU Financial institution group continues to languish contained in the weakening quadrant. Media, too, is contained in the weakening quadrant, however it’s enhancing sharply on its relative momentum in opposition to the broader NIFTY500 Index.

The IT index can also be enhancing its relative momentum whereas staying contained in the lagging quadrant together with the Realty index. The BankNifty has rolled contained in the lagging quadrant, and the monetary companies group additionally continues to languish inside this quadrant. All these teams are prone to comparatively underperform the broader markets.

The FMCG and the consumption pack are firmly contained in the enhancing quadrant; they’re anticipated to do properly over the approaching week.

Necessary Word: RRG™ charts present the relative energy and momentum for a bunch of shares. Within the above Chart, they present relative efficiency in opposition to NIFTY500 Index (Broader Markets) and shouldn’t be used instantly as purchase or promote alerts.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Milan Vaishnav, CMT, MSTA is a certified Impartial Technical Analysis Analyst at his Analysis Agency, Gemstone Fairness Analysis & Advisory Providers in Vadodara, India. As a Consulting Technical Analysis Analyst and along with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Impartial Technical Analysis to the Shoppers. He presently contributes every day to ET Markets and The Financial Instances of India. He additionally authors one of many India’s most correct “Day by day / Weekly Market Outlook” — A Day by day / Weekly Publication, at the moment in its fifteenth 12 months of publication.

Milan’s main duties embody consulting in Portfolio/Funds Administration and Advisory Providers. His work additionally includes advising these Shoppers with dynamic Funding and Buying and selling Methods throughout a number of asset-classes whereas preserving their actions aligned with the given mandate.

Study Extra