EUR/USD: Fed’s Apples and ECB’s Oranges

● The greenback continues to strengthen, whereas the EUR/USD pair strikes down. Per week’s low was recorded at 1.0757 after the ECB assembly on Thursday, April 14. After correction, the ultimate chord, sounded at round 1.0808.

● We named three causes for the expansion of the US forex within the earlier forecast. The primary is the distinction between the financial insurance policies of the Fed and the ECB. Now, the likelihood of additional tightening the place of the US Central financial institution has elevated much more in opposition to the background of the most recent knowledge on inflation in the USA: the patron worth index has exceeded the forty-year excessive and reached 8.5%. Such an acceleration of inflation could pressure the regulator to behave extra vigorously and to revise its plans to lift the important thing charge and scale back the stability sheet in Might.

New York Fed President John Williams, who can also be vice chairman of the FOMC (Federal Open Market Committee), mentioned in an interview with Bloomberg that it is smart for the Fed to deliver rates of interest to a impartial stage as quickly as attainable, which, not stimulating, it doesn’t hinder financial development, and is within the vary from 2% to 2.5%. Due to this fact, a 0.5% improve in federal borrowing prices on the Might FOMC assembly seems fairly life like.

● In distinction to the Fed’s hawks, their European counterparts stay extraordinarily dovish. The ECB left the rate of interest unchanged at 0% at its assembly on April 14, which, in reality, was anticipated. Furthermore, the Financial institution’s representatives have already mentioned earlier that the expansion in the price of lending within the context of continuous financial uncertainty may do extra hurt than good.

The top of the regulator, Christine Lagarde, confirmed at a press convention that adopted the assembly that the ECB is transferring extra slowly than the Fed, and that the Eurozone can be hit tougher by the army actions in Ukraine. The American and European economies, in accordance with Ms. Lagarde, are as incomparable as apples and oranges. Such a fruity allegory made a powerful impression available on the market, on account of which the EUR/USD pair collapsed to the zone of two-year lows.

● Certainly, the present financial scenario within the euro space doesn’t encourage optimism and, in accordance with many consultants, will proceed to worsen sooner or later. The German financial sentiment index revealed final week fell to a brand new multi-month low: minus 41.0 (minus 39.3 a month earlier). The index of present financial situations of this locomotive of the European financial system additionally fell to minus 30.8 in April (minus 21.4 in March). In opposition to this background, the German GDP development forecast for 2022 was lowered from 4.5% to 2.7%.

The scenario could grow to be much more difficult, because the President of the European Fee Ursula von der Leyen and the pinnacle of EU diplomacy Josep Borrell introduced their intention to incorporate restrictions on the export of hydrocarbons from Russia within the subsequent bundle of anti-Russian sanctions. Thus, the danger of stagflation in Europe stays at a reasonably excessive stage.

● We talked about one more reason for the stress on the euro – the presidential elections in France within the earlier overview. Their first spherical befell on Sunday April 10. To this point, the incumbent President Emmanuel Macron is main with 27.84% of the vote. Marine Le Pen, head of the far-right Nationwide Rally Social gathering, gained 23.15%. The hole shouldn’t be very massive and there may be nonetheless a chance that the opposition could win within the second spherical on April 24. Its chief Marine Le Pen is a Eurosceptic. Please word that she referred to as for nearly the exit of the nation from the Eurozone again in 2017. And if this girl involves energy, the EUR/USD pair, in accordance with plenty of analysts, could fall to the extent of 1.0500, and even decrease.

● There’s one other issue pushing the pair south, which is the deterioration of world threat urge for food. The S&P500 inventory index has been falling for the third week in a row, whereas demand for safe-haven property such because the greenback and US Treasuries, quite the opposite, is rising.

● In the intervening time, 50% of analysts vote for additional strengthening of the greenback. The other opinion is shared by 40% and the remaining 10% of consultants have taken a impartial place. All development indicators and oscillators on D1 are coloured crimson, though 15% of the latter give indicators that the pair is oversold.

The closest assist is positioned on the stage of 1.0800. The closest goal for EUR/USD bears can be April 14 low at 1.0757. And in the event that they handle to interrupt by way of this assist, they are going to then intention for the 2020 low of 1.0635 and the 2016 low of 1.0325. The bulls will attempt to elevate the pair above the 1.1000 stage and, if attainable, attain the 1.1050 zone. However to do that, they first want to beat the 1.0840 and 1.0900-1.0930 resistances.

● The upcoming week’s calendar contains speeches by Fed and ECB heads Jerome Powell and Christine Lagarde on Thursday April 21. Information on unemployment and manufacturing exercise within the US will even be revealed on today. As for the symptoms of enterprise exercise in Germany and the Eurozone as an entire, they are going to grow to be recognized on Friday, April 22.

GBP/USD: Battle for 1.3000

● Within the earlier forecast, most consultants (65%) supported the correction of the GBP/USD pair to the north and have been completely proper. It appeared at first of the week that the victory was on the facet of the bears: they managed to beat the assist within the 1.3000 zone and decrease the pair to 1.2972.

Recall that 1.3000 is a key assist/resistance stage as it isn’t solely the March 15 low, but additionally the 2021-2022 low. The bulls managed to grab the initiative on Wednesday, April 13, break by way of this resistance, attain the peak of 1.3147 and full the week additionally above it, at round 1.3060.

● The pound was supported by a attainable tactical victory of the Financial institution of England over the FRS within the battle for elevating rates of interest. Inflation within the UK elevated from 6.2% to 7.0%. The Financial institution of England predicted that it might peak in April, accelerating to 7.2%. Nevertheless, plenty of banks didn’t agree with the regulator’s opinion, believing that inflation won’t cease at this level, reaching 9.0% in April, after which its development will proceed. Due to this fact, the Financial institution of England must do one thing about it. And this “one thing” is, after all, one other improve in rates of interest. It was this prospect that pushed the British forex to development.

● We are able to count on the battle for 1.3000 to proceed subsequent week. If the victory is on the facet of the bears, they are going to attempt to replace the April 13 low of 1.2972 and open the way in which to the November 2020 lows round 1.2850, after which to the September 2020 lows within the zone 1.2700. The closest assist is 1.3050. 30% of analysts vote for the victory of the bears, whereas the bulk (70%) facet with the bulls. The resistance ranges are 1.3100, 1.3150 and the zone 1.3190-1.3215, then 1.3270-1.3325 and 1.3400. Among the many indicators on D1, the benefit of the reds is obvious. Among the many oscillators, 75% are coloured on this shade, one other 15% are inexperienced and 10% are impartial grey. Pattern indicators have 100% on the crimson facet.

● Among the many occasions in regards to the financial system of the UK, we will spotlight the speeches of the Governor of the Financial institution of England Andrew Bailey on April 21 and 22. Information on enterprise exercise within the manufacturing and companies sectors of the UK will even be revealed on Friday, April 22.

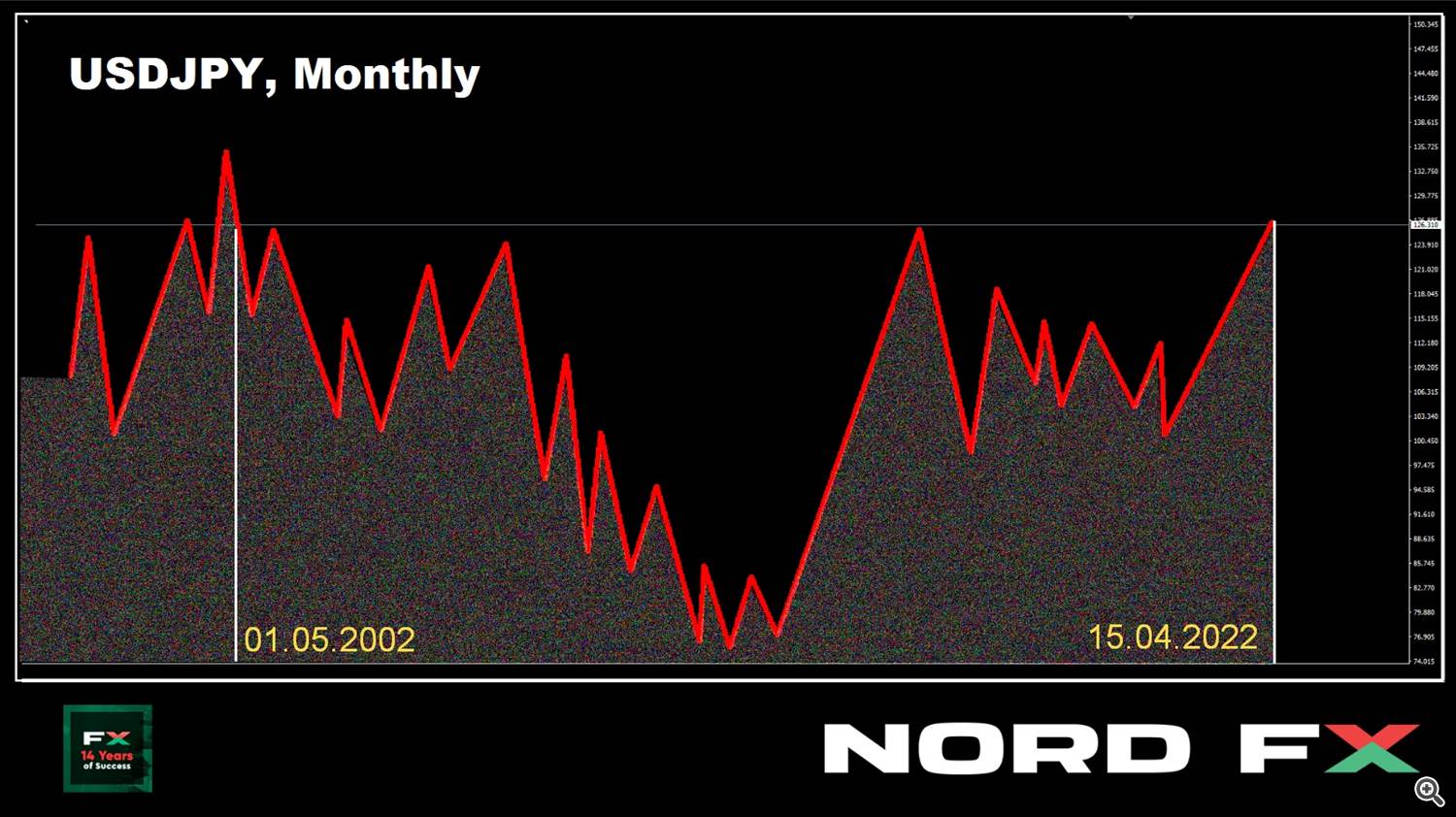

USD/JPY: Do We Anticipate New Anti-records from the Yen?

● It appears that evidently nothing can cease the autumn of the yen and the expansion of the USD/JPY pair. The Japanese forex units an anti-record after an anti-record, and the pair recorded one other excessive at 126.67. The final time it climbed so excessive was on Might 01, 2002, that’s, 20 years in the past.

● We famous within the final overview that almost all of Japanese persons are in opposition to the weak yen. Nevertheless, regardless of this, the Financial institution of Japan nonetheless refuses to lift the important thing charge and scale back financial easing. The regulator believes that sustaining financial exercise is far more essential than preventing inflation. And this divergence with the US Federal Reserve’s financial coverage is pushing the USD/JPY additional north.

● The pair closed the week’s buying and selling session at 126.37. 45% of analysts vote for sustaining the uptrend subsequent week. Just a little extra, 55%, remembering a strong correction to the south after the same rally within the final week of March, count on one thing related now. It needs to be famous right here that when switching to the forecast for may-June, the variety of supporters of the greenback strengthening will increase to 80%. We’ve got already cited Rabobank strategists who consider {that a} fast USD/JPY soar above 125.00 will significantly improve the probability that the Japanese regulator will revise its quantitative easing (QE) program. And this soar befell final week.

● There’s full unanimity among the many indicators on D1: 100% of development indicators and 100% of oscillators search for, though 35% of the latter are within the overbought zone. Indisputably, the principle assist within the coming days would be the ranges of 126.00 and 125.00. Then, bearing in mind the excessive volatility of the pair, we will single out the zones 123.65-124.05, 122.35-123.00 and 120.60-121.30. As for the plans of the bulls, they are going to attempt to replace the excessive of April 15, and rise above 127.00. An try to designate their subsequent targets, specializing in the degrees of 20 years in the past, will fairly appear like fortune telling.

● There are not any anticipated releases of any essential statistics on the state of the Japanese financial system this week.

CRYPTOCURRENCIES: April 12: House Flight Day. However not for bitcoin.

● It’s not possible to name the primary half of April profitable for the crypto market. And if bitcoin was nonetheless making an attempt to leap over the 200-day SMA two weeks in the past, on April 04, then the bulls utterly capitulated and a neighborhood low was recorded at $39.210 on April 12. It’s noteworthy that Cosmonautics Day is well known on today: Yuri Gagarin went into house and circled the planet Earth on April 12, 1961, for the primary time on the earth. The BTC/USD pair didn’t make a breakthrough to the celebs. Fairly, we noticed a fall from orbit.

● As of this writing, on the night of Friday, April 15, the pair is buying and selling round $40,440. The whole market capitalization has barely decreased and continues to be beneath the essential psychological stage of $2 trillion, on the stage of $1.880 trillion. The Crypto Concern & Greed Index didn’t keep within the earlier orbit both: it fell from 37 to 22 factors and returned to the Excessive Concern zone.

● We wrote earlier that bitcoin has grow to be part of the worldwide financial system and now demonstrates a powerful correlation with inventory indices. Due to this fact, its quotes chart is essentially congruent, to begin with, with the S&P500 chart. So, as of March 2022, in accordance with Arcana Analysis, the correlation coefficient between BTC and S&P500 was 0.497. The principle cryptocurrency falls and rises after the inventory market. And that, in flip, falls or rises relying on the actions of the US Federal Reserve. There isn’t a longer any query of bitcoin’s independence.

● As we’ve got already talked about, there has lately been a transparent development in direction of the buildup of digital gold. The volumes of accumulation started to exceed emission many occasions over. Based on Glassnode, the speed of outflow of cash from centralized platforms has elevated to 96,200 BTC monthly, which is extraordinarily uncommon in historic retrospect. Along with the “whales”, the so-called “shrimps” (addresses with a stability of lower than 1 BTC) additionally contributed to the buildup. So why would not hodle sentiment result in larger costs?

The reply is easy: no new buyers. The previous ones both go into the state of long-term holders of cash, or eliminate them. Roughly $439 million price of crypto positions have been liquidated on April 12 alone, in accordance with Coinglass. On the similar time, greater than 88% of closed orders accounted for lengthy positions. Bitcoin futures contracts for $160 million have been additionally closed. However there isn’t any sturdy influx of recent investments into the crypto sector.

● Traders have misplaced their urge for food for threat for the reason that finish of March, the DXY greenback index and US 10-year bond yields attain new highs frequently. On account of rising inflation, which reached 8.5% within the US in March, the markets are ready for the US Central Financial institution to lift rates of interest once more on the Might assembly, and never by 0.25%, however instantly by 0.5%. That is the explanation why curiosity from high-risk property flows to extra conservative devices.

● Based on Bloomberg analysts, the worth of the flagship cryptocurrency could quickly fall to $26,000. The consultants emphasised that if the technical evaluation sample referred to as “bear flag” works, then such a situation can be inevitable. Of their opinion, the BTC charge is now on its technique to testing a key assist stage round $37,500. If it doesn’t maintain above this mark, the market is in for a catastrophe.

● Analyst Jeffrey Halley’s forecast sounds barely extra optimistic. He believes that the flagship cryptocurrency continues to commerce throughout the established vary, the decrease restrict of which is at $36,500. If BTC falls much more, it could possibly result in severe losses for merchants and buyers. Nevertheless, if the worth of bitcoin soars within the close to future above the higher restrict of the vary of $47,500, this can be a prerequisite for reaching a brand new file excessive.

● There are additionally influencers who will not be apprehensive or upset by the present market scenario in any respect. These embrace Michael Saylor, CEO of Microstrategy, an organization recognized for its investments in bitcoin, and Cathie Wooden, head of funding firm Arch Make investments, who nonetheless consider in bitcoin and stay up for its development.

Saylor and Wooden spoke on the Bitcoin 2022 convention in Miami and concluded that the Fed’s financial coverage will proceed to be inflationary, pushing costs up. In such a scenario, in accordance with Cathie Wooden, bitcoin, as a way of hedging, has nice potential for development and its worth may attain a file $1 million per coin. “It takes fairly a little bit of effort to do that,” the pinnacle of Arch Make investments mentioned. “We do not want a lot. All we’d like is for two.5% of all property to be transformed to bitcoin.”

● Properly-known author and investor Robert Kiyosaki has the same opinion, he believes that the US greenback and different markets are on the breaking point attributable to rising meals, oil and vitality costs, in addition to widespread inflation. The creator of the bestselling ebook Wealthy Dad Poor Dad assured that what is occurring on the earth of finance is an indication of a coming disaster, and this course of will merely destroy half the US inhabitants. He famous that cryptocurrencies on this scenario are instrument to scale back dangers, however not all folks resort to utilizing this asset class. Kiyosaki emphasised that now 40% of Individuals don’t even have $1,000 of their financial savings. The inflation charge is rising, and this determine will quickly exceed 50%. Then, in accordance with the investor, a revolution will start.

● Morningstar analysts posted a report claiming that cryptocurrencies are not any match for the inventory and bond markets by way of returns. On the similar time, they word that bitcoin “continues to be too dangerous to be in comparison with gold.” The authors of the report argue that, regardless of the prospect of serious earnings that the cryptocurrency market can provide its individuals, one should be very cautious with it. “Each breathtaking rally has led to an equally brutal crash on the finish,” Morningstar notes.

● It’s tough to argue that hypothesis or funding in digital property is kind of dangerous. However there are specific issues on this enterprise, as in every other, that mean you can get extra advantages. It’s about them that we commonly discuss in our crypto life hacks part. This time it is about warmth vitality and a person named Jonathan Yuan who has children who like to swim within the pool. Nevertheless, they nearly didn’t do that as a result of the water was too chilly.

Yuan himself is actively concerned in mining and drew consideration to the truth that his gear generates an excessive amount of warmth. He bought a warmth exchanger and used it to put in a system for heating water. Based on him, because of this invention, the temperature within the pool might be maintained at about 32° C, and the crypto farm receives a water cooling system. Jonathan Yuan notes that just about every part might be heated in accordance with this precept: dwelling premises, garages and so forth. It’s assumed that the heating temperature can attain a most threshold of 60°C.

There are nuances right here, nonetheless. When the inventor pushed his ASIC miners to the restrict, the temperature within the pool rose above 43°C. His kids didn’t prefer it both they usually stopped swimming once more. So, the traditional Greek “father” of medication, Hippocrates, was proper, saying “good issues in small doses”

NordFX Analytical Group

Discover: These supplies will not be funding suggestions or tips for working in monetary markets and are meant for informational functions solely. Buying and selling in monetary markets is dangerous and can lead to a whole lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx