Banks and inventory exchanges in Catholic international locations are closed at present on the event of Good Friday. All vital macro statistics, that are often printed on Friday, have been printed on Thursday. Particularly, yesterday’s preliminary shopper sentiment index of Individuals in April amounted to 65.7 (versus 59.4 in March and the forecast of 59.0), whereas expectations concerning the economic system and private funds have improved.

John Williams, President of the Federal Reserve Financial institution of New York and FOMC Vice Chairman, mentioned final night time that elevating rates of interest by half a share level on the Open Market Committee assembly seems to be “a really cheap possibility.”

The necessity for a number of half share level fee hikes has been introduced lately by different Fed officers. U.S. annual inflation hit a 40-year excessive of 8.5% in March, in keeping with the most recent information from the Division of Labor, and to fight accelerating inflation, “the Fed could have to boost charges above impartial ranges,” in keeping with Williams (a impartial rate of interest that doesn’t stimulate or decelerate financial progress, is, in keeping with Williams, within the vary from 2% to 2.5%. Now the vary of this fee is from 0.25% to 0.5%).

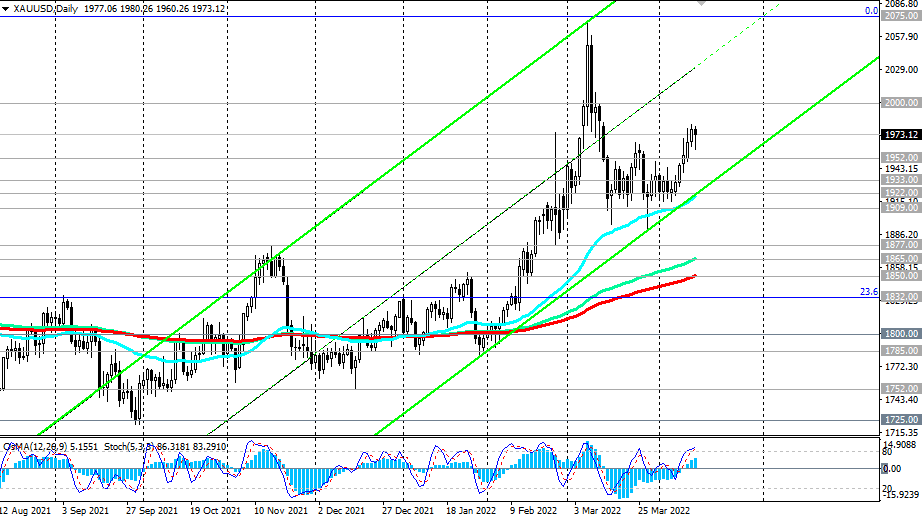

Regardless of the constructive outlook for the greenback, gold, as we are able to see, can be rising in worth, and the XAU/USD pair maintains a constructive pattern. Traders see gold as a hedging and retailer of worth instrument, defending their funding from a wide range of dangers. The prevailing unfavourable elementary background in the marketplace creates preconditions for additional progress of gold quotes.

A sign to enter lengthy positions could also be a breakdown of the native resistance stage of 1981.00 (every week excessive).

In another situation, and after the breakdown of the help stage of 1952.00, XAU/USD will fall to the help ranges of 1933.00 or 1922.00. Pending orders to purchase may be positioned close to these ranges.

Help ranges: 1952.00, 1933.00, 1922.00, 1909.00, 1900.00, 1877.00, 1865.00, 1850.00, 1832.00, 1800.00

Resistance ranges: 1981.00, 2000.00, 2070.00, 2075.00, 2100.00

*) see additionally “Technical evaluation and buying and selling suggestions” -> Telegram

**) Get no deposit StartUp bonus as much as 1500.00 USD

Supply: InstaForex