UBS Group AG has grow to be an investor favourite in recent times as a dependable beacon of profitability. For Chief Government Officer Ralph Hamers, such stability poses a problem: the best way to repair one thing that isn’t visibly damaged.

Coming from ING Groep NV, the Dutch lender he’s credited with reworking, the Dutchman’s mission assertion is to tug UBS into the Digital Age. Final week, he made his long-awaited first transfer, shopping for robo wealth adviser Wealthfront for $1.4 billion in money.

The deal provides UBS greater than 470,000 extra U.S. shoppers, notably a youthful crop that’s nonetheless accumulating wealth. It’s a departure for the Zurich-based financial institution, lengthy accustomed to offering customized companies to the extremely wealthy. Hamers says the financial institution should embrace a broader base, even when it means pushing lower-margin, automated merchandise that aren’t the hallmark of UBS’s customized choices.

“Let’s not anticipate any person to eat our lunch, let’s do it ourselves,” Hamers stated in an interview this month, earlier than the Wealthfront deal was introduced. “Do you dare to cannibalize your personal enterprise? You don’t have any selection.”

However long-term workers priding themselves in tailored companies fear that automated recommendation would possibly dilute a cherished model. Buyers say that shifting into unfamiliar territory will in all probability require extra pricey acquisitions. And Hamers nonetheless has to show that he can put his stamp on the Swiss establishment. His first full 12 months handed with primarily beauty fixes like collapsing hierarchies or revamping tech groups, and his first strategic replace final 12 months received a lukewarm reception from analysts and workers alike.

Picture by Bloomberg Mercury

New Technique

UBS is poised to put out new monetary targets and provides extra readability on its technique when the financial institution studies fourth-quarter earnings on Feb. 1. The Wealthfront deal is the clearest indication but the place Hamers, 55, desires to take UBS, each geographically and strategically. He’s pushing for a blended mannequin, whereby advisers personally concentrate on the wealthiest and most profitable shoppers, whereas algorithms cater to much less prosperous and demanding prospects.

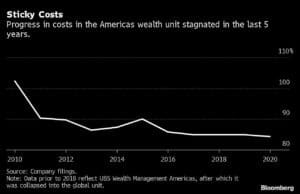

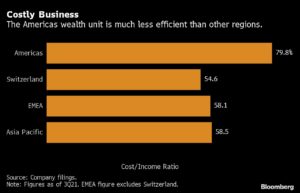

Stakeholders have lengthy pointed to the financial institution’s U.S. operations as an space in want of consideration. The enterprise is just too pricey, with a cost-income ratio of 80% in contrast with lower than 60% in all different areas. Belongings are too sub-scale when stacked up in opposition to friends, and UBS lacks the investment-banking punch to interrupt into the High 5 on Wall Avenue.

UBS stays dedicated to the area, as a result of promoting out like Credit score Suisse Group AG did in 2015 would successfully shut it out of the world’s largest wealth pool. As a substitute, Hamers sees the U.S. as a laboratory for his digital push that can assist reduce prices. Whereas some analysts questioned the comparatively excessive worth paid for Wealthfront, others anticipate the financial institution to pursue extra bolt-on offers because it tilts extra towards robo advisers.

Show It

“The digital wealth providing is a mannequin that must show itself,” stated Eric Hagemann, senior analyst at Pzena Funding Administration, a UBS shareholder. “Can a human being in a name middle ship a reputable substitute for a full-service high-touch mannequin? It’s actually unclear. After which that raises the query of is it actually value the price of having human beings concerned in any respect?”

Coming into an establishment steeped in personal banking custom, Hamers — along with his background in company and retail banking and direct Dutch method — was initially seen with skepticism by different leaders and their cohorts in UBS’s wealth arm. Monetary advisers have been involved that he would change centuries of practiced habits with a flashy app that may alienate and in the end drive away cherished shoppers.

It’s not the primary time Hamers has sought to shake up a enterprise that was doing nicely. However at ING, he needed to reboot a technique two years later, with stricter targets and 1000’s of job cuts, when inner resistance slowed down execution.

And the pace at which ING constructed out its digital platforms left the financial institution susceptible to cash laundering, leading to a report superb in 2018 for shortcomings in its checks. Hamers himself stays the topic of a probe by Dutch prosecutors into his position in ING’s previous failures to police cash laundering.

Hamers concedes the wealthiest prospects nonetheless want extremely customized recommendation that no machine might ever replicate. In idea, the digital-first mannequin is extra various and versatile and comes with the additional advantage of a human fallback ought to the shopper demand a extra private contact. It would push UBS right into a decrease class of wealth– these with $250,000 to $2 million in property– that it hasn’t beforehand focused in a significant approach.

International Push

Pushing enterprise by digital channels routinely chips away at margins. However UBS must act now whereas it has the funds to speculate, Hamers stated. Ultimately, it might roll out the mannequin in Europe and Asia, with some applications already being put in place this 12 months.

“The explanation it’s so straightforward to disrupt in banking is that we don’t cope with bodily items,” Hamers stated. “Music is digital. Cash is digital. Every part that’s an immaterial good will be disrupted by expertise.”

It’s a message he’s taken nice pains to get throughout. Hamers says the financial institution initially struck him as a hierarchical and divided when he first took over in late 2020. Items had few hyperlinks to at least one one other apart from residing below the identical roof, leaving the brand new CEO with a way that he was operating three separate banks, in response to individuals conversant in his pondering.

An econometrician by coaching, Hamers has a eager eye for particulars and information, analyzing potential issues from each attainable angle, in response to individuals who have labored with him.

At UBS, his administration model has additionally come throughout as unorthodox, the individuals say. If somebody complains about an issue, he tells them to go repair it.

“Folks typically prefer to be informed what to do,” Hamers stated. “However my perception is, that most individuals know what to do.”

Can’t Wait

Hamers gave the chief group extra oversight than simply their very own divisions. Rob Karofsky, the pinnacle of the funding financial institution, is now additionally co-head for the artificial-intelligence information group along with digital head Mike Dargan, whereas the chief of asset administration, Suni Harford can be in control of sustainability.

Hamers additionally abolished titles like group managing director, a crop of essentially the most senior 100 or so workers throughout the financial institution. Whereas they stored their elevated pay, they joined the ranks of unusual managing administrators. Conscious that his message would possibly in any other case not filter by the sediments of administration that stay, Hamers routinely seems in brief, impromptu movies that he beams to all workers.

The CEO acknowledges that it’s going to take time for his message to sink in. However on the similar time, his persistence isn’t countless as a result of the disruptions are happening now, and UBS can’t afford to sit down them out.

“The shift to digital in wealth is actually taking place now,” Hamers stated. “Each shopper I’ve talked to during the last 12 months and a half that I’ve been right here says UBS has nice merchandise and the perfect recommendation, however oh man, you may actually enhance in relation to digital.”

— By Marion Halftermeyer (Bloomberg Mercury)