USD/JPY has risen greater than 5% for the reason that starting of the yr. The principle motive is the prospect of additional divergence between the financial coverage trajectories of the Fed and the Financial institution of Japan. The weakening of the yen can also be facilitated by the occasions in Ukraine, the place Russia is conducting a navy particular operation, and inflation accelerated in Japan in opposition to the backdrop of a pointy rise in power costs (Japan is the biggest web importer of them).

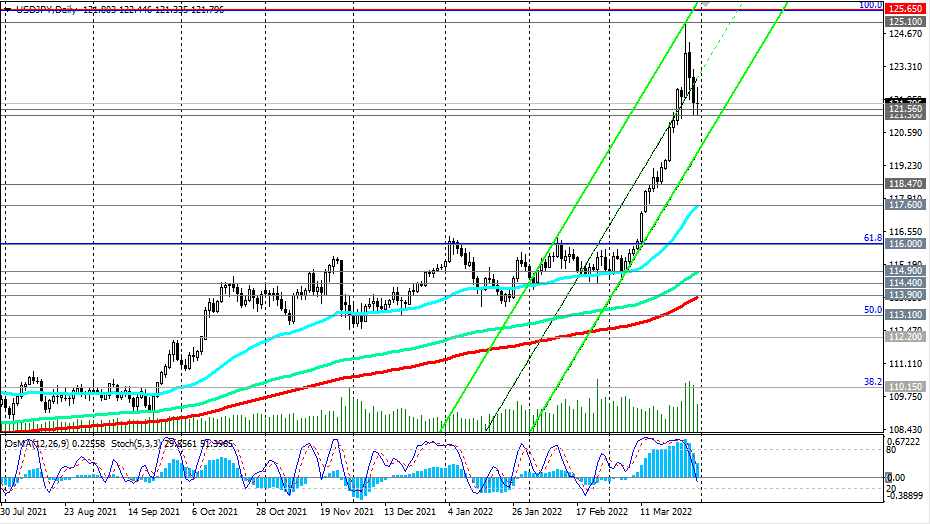

Nevertheless, because of the sharp weakening of the greenback within the earlier two days, the USD/JPY pair has declined, reaching an essential short-term assist degree of 121.56 by now. In case of its breakdown, the correctional decline of USD/JPY could proceed, however it’ll most probably be restricted by the assist ranges of 118.47, 117.60.

The most probably rebound from the assist degree of 121.56 and the resumption of progress. A breakdown of the native resistance degree of 122.43 will likely be a sign to renew buys.

In an alternate state of affairs and after the breakdown of the native assist degree of 121.30 USD/JPY will head in direction of assist ranges 118.47, 117.60. A deeper decline within the present state of affairs is unlikely.

Assist ranges: 121.56, 121.30, 118.47, 117.60, 116.00, 114.90, 114.40, 113.90, 113.10, 112.20, 110.15

Resistance ranges: 122.43, 123.00, 124.00, 125.00, 125.65

*) See additionally “Technical evaluation and buying and selling suggestions” -> Telegram

**) Get no deposit StartUp bonus as much as 1500.00 USD