When automaker BMW invested in U.S. clear metal startup Boston Steel and Mercedes Benz purchased a stake in Swedish startup H2 Inexperienced Metal, the investments represented greater than the greening of an industrial portfolio. They marked the primary steps within the decarbonization of metal — a course of that can require the reinvention of not solely how metal is made however primarily a reimagining of your complete metal provide chain.

As a result of metal is a fundamental constructing block of the worldwide economic system, it components into the manufacturing and operations of most industries from auto manufacturing to aviation to building to family home equipment. Which means it contributes to all of their carbon footprints. Though metal is likely one of the most recycled supplies on the planet, its preliminary manufacturing and vitality calls for make it the most important industrial client of coal and one of the crucial carbon-intensive industries on Earth. The sector accounts for two.6 gigatons of carbon dioxide emissions yearly, making up roughly 10 % of the worldwide complete.

In accordance with the Worldwide Power Affiliation, “to fulfill international vitality and local weather targets, emissions from the metal trade should fall by at the very least 50 % by 2050, with persevering with declines in direction of zero emissions thereafter.” To perform this, producers want a brand new vitality supply for manufacturing in addition to new uncooked supplies, necessities that can upend a big portion of the mining trade particularly.

Decreasing emissions within the instant future

Metal can have no alternative as its largest customers — corporations resembling Mercedes and BMW — more and more demand “inexperienced metal” of their quest to fulfill their very own local weather targets. However metal producers received’t must do it alone, as upstream and downstream on the availability chain start to work collectively.

Any resolution would require a spectrum of expertise adjustments and particular person efforts to extend efficiencies to maneuver the trade ahead.

Within the instant future, metal producers can decrease emissions by 10 % to 30 % by making use of greatest accessible applied sciences, larger high quality iron ores and optimizing gasoline combine at blast furnace (BF) and blast oxygen furnace (BOF) operations. Efforts like these are significantly vital in locations resembling China and India, the place there may be preponderance of those older services and newer strategies and feedstocks can have a cloth affect on your complete trade’s emissions.

Greater investments are wanted for sustainable change

However to comprehend bigger emission reductions would require vital funding in new expertise: This would possibly embrace hydrogen-based discount to supply DRI/HBI with low/no emissions, carbon seize, storage and use applied sciences and even newer alternate options, resembling molten electrolysis. Additionally pivotal to ahead progress shall be an elevated emphasis on the round economic system and the recycling of scrap metal to interchange main metal manufacturing.

Oliver Wyman modeled a variety of worldwide and key steel-producing regional situations, assuming bold mixtures of applied sciences and emission-abatement measures. We additionally assumed altering market shares of BF-BOF and EAF-based manufacturing. Whereas actual timelines are exhausting to foretell, sure traits emerged for the trade:

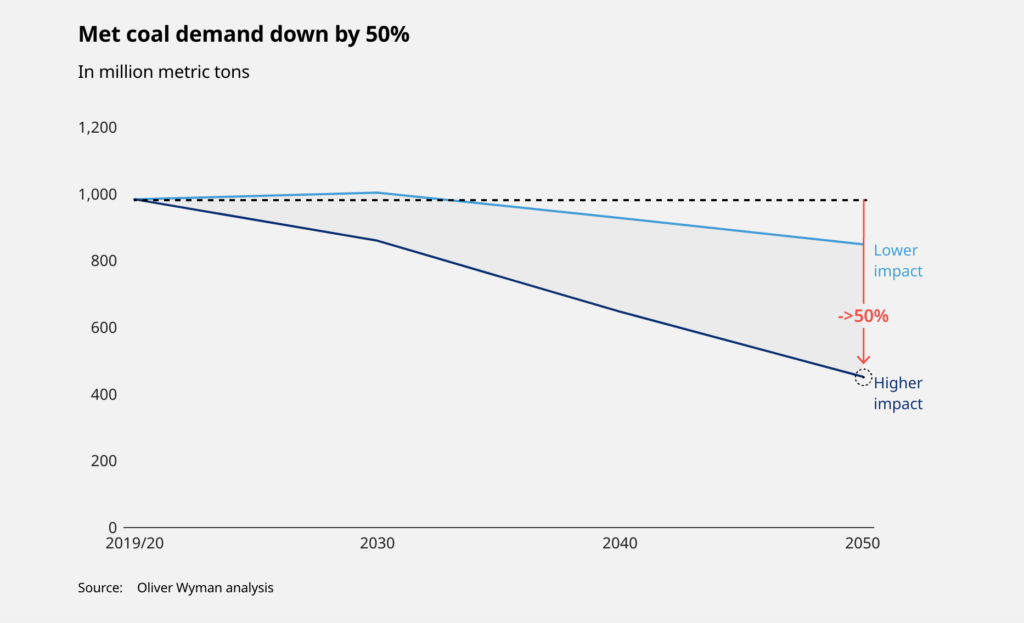

Finally, this overhaul of metal manufacturing will result in considerably diminished metallurgical coal consumption over time. Demand will drop by as much as 50 % by 2050 from common ranges in 2019 and 2020. Whereas the decline will depend upon how briskly the most important customers deploy their effectivity measures, we expect it’s doable to see vital decreases already on this decade.

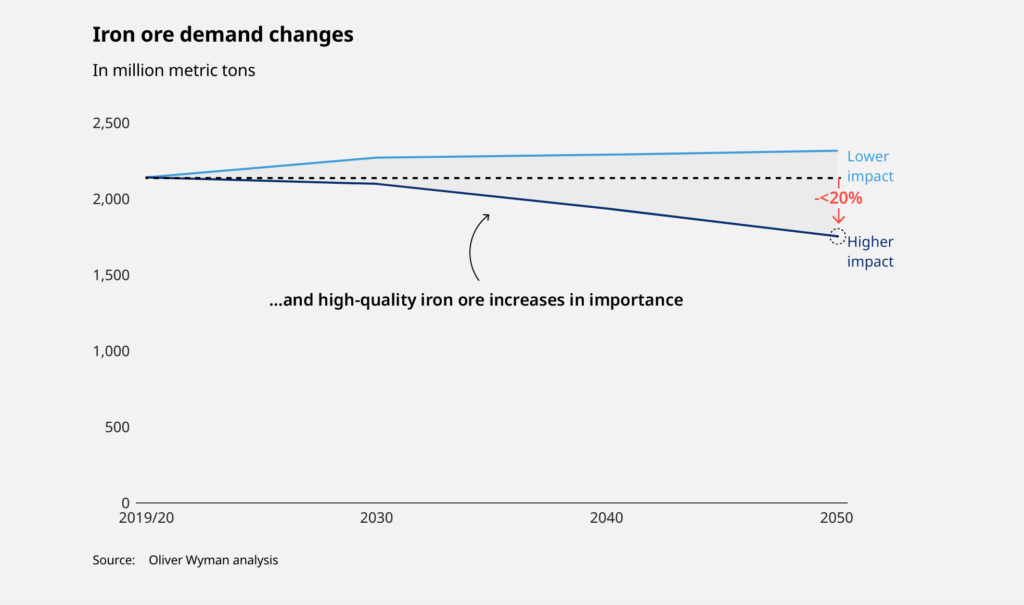

For iron ore, the outlook is extra secure, however the composition of what’s provided will proceed to alter, as demand for higher-quality ores will increase. These larger grades play a key function within the realization of the primary 10 % to 30 % emission discount in BF-BOF routes, in addition to for DRI/HBI manufacturing. Already at this time, they’re fetching vital value premiums.

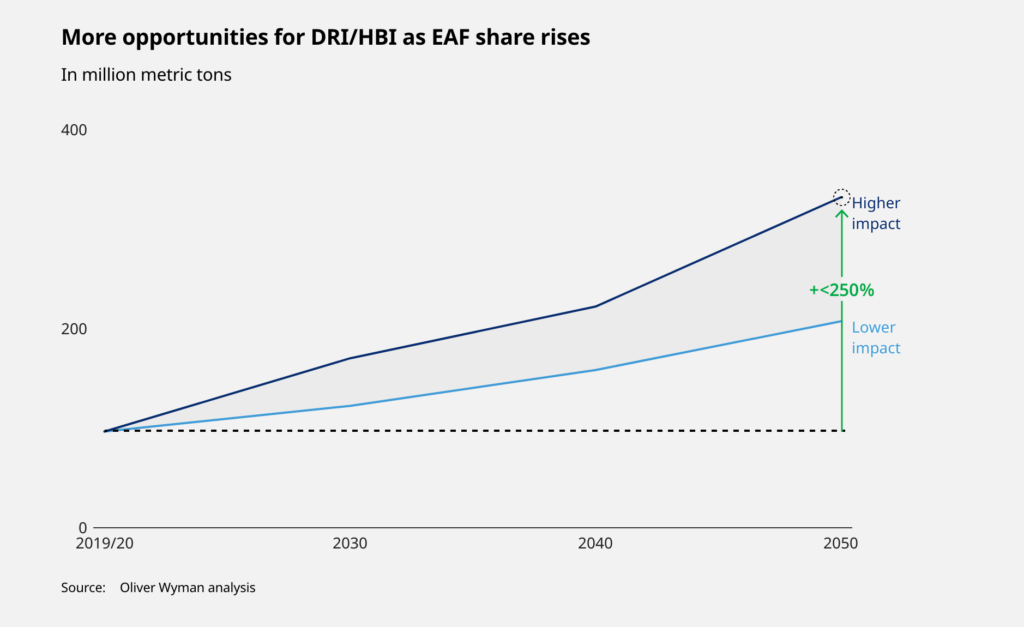

DRI/HBI based mostly metal will play an vital function within the new metal trade. Even with provide limits on higher-grade iron ores, we forecast a big demand improve for DRI/HBI, by way of 2050 — perhaps as a lot as 200 % larger. This could additionally point out a marked improve within the buying and selling quantity of HBI, suggesting the formation of a brand new commodity market.

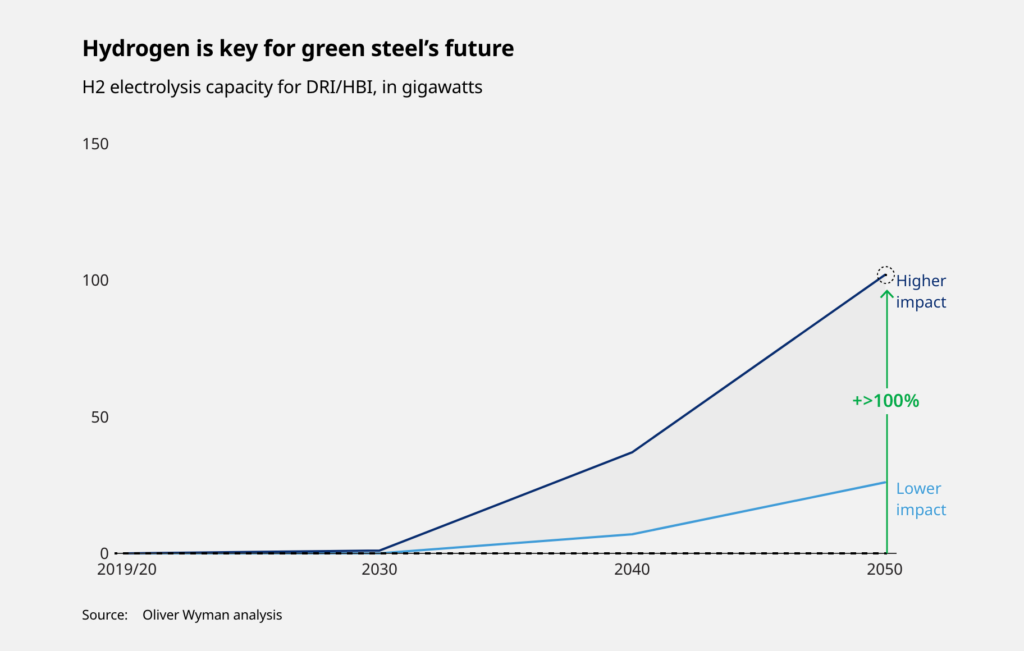

Elevated use of DRI/HBI in flip will drive demand for hydrogen, not all of which shall be inexperienced, particularly to start with. We count on to see a big improve in electrolysis capability starting within the subsequent decade. By 2050, a further 100 GW could also be required the place at this time there may be little or no devoted capability.

Each, the growing share of EAF and H2 electrolysis will considerably drive electrical energy demand, and particularly for renewable vitality.

Lastly, scrap provide should improve considerably. That is very true for China, the place provide must double to as a lot as 400 million metric tons to accommodate a big improve in EAF-based manufacturing. That will envision a soar from 10 % of Chinese language manufacturing being EAF to at the very least 40 % or extra.

In consequence, the availability chains that at this time transfer giant quantities of metallurgical coal (the kind of coal used for making metal) and iron ore to metal producers might want to change to offering equally voluminous quantities of electrical energy and hydrogen, scrap and DRI/HBI. Whereas ultimately the goal shall be for these new inputs to be “inexperienced,” initially there may be unlikely to be sufficient manufacturing to realize that.

What does this imply for varied regional economies? Listed here are some examples:

Australia has a number of sources it may leverage, together with renewable vitality and pure gasoline, to change into a pacesetter in hydrogen manufacturing. It moreover has huge iron ore deposits that could possibly be used to supply HBI for export or inexperienced metal merchandise or semi-finished merchandise.

Sweden already has bold plans to construct inexperienced metal manufacturing leveraging its sources, together with carbon-free electrical energy and iron ore to assist home automotive manufacturing and different actions.

Russia is aiming to make use of its gasoline for hydrogen and DRI manufacturing.

Chinese language metal producers wish to begin producing high-grade iron ores in locations resembling Africa, in an effort to change into extra impartial from Australian ore producers and make its personal metal manufacturing extra environment friendly.

Tendencies to anticipate

The significance of renewable energy, hydrogen and scrap in these new worth chains make it important and inevitable for vitality, expertise, engineering and recycling gamers to change into lively within the transformation of the metal provide chain. That new competitors will put strain on incumbents from mining and metal. Anticipate some jostling as gamers attempt to seize an early benefit in what shall be a $1 trillion-plus transition over the following 30 years.

The bevy of newcomers and the dramatically elevated must cooperate throughout industries to cut back carbon footprints will result in a re-evaluation of manufacturing places and new contractual preparations. It should encourage the formation of recent partnerships and symbiotic ecosystems that can share the price of the transition and develop new markets. One instance is a memorandum of understanding signed between Rio Tinto and Nippon Metal to collectively discover and develop low-carbon metal worth chains. However many others exist.

The eventual greening of metal is inevitable, and it’s apparent that the metallurgical coal enterprise seems to be to be one of many greatest losers, with different applied sciences and commodities, resembling renewable electrical energy and hydrogen, clear winners. Which can come out on high amongst areas and company gamers stays far much less obvious. However given the quantity of funding required and the size of time wanted to carry product to market, the benefit will go to these prepared to maneuver rapidly and take calculated and shared dangers by way of partnerships to assist create new industrial ecosystems and place themselves alongside metal’s worth chains.