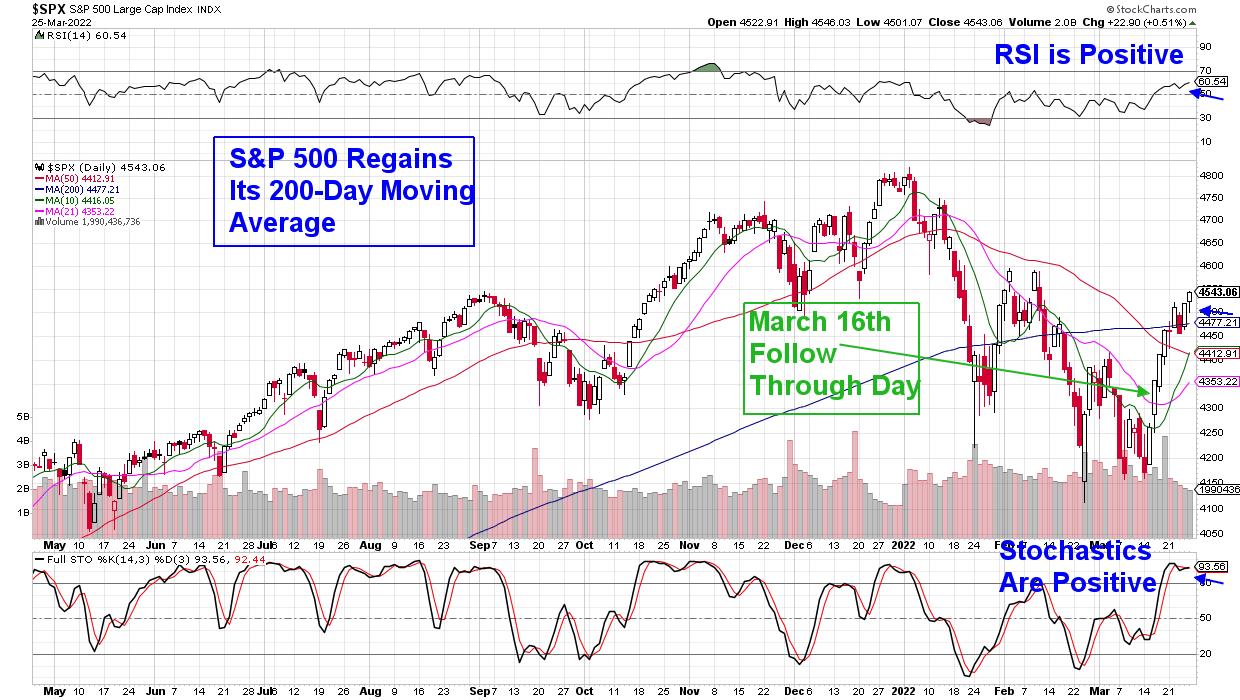

Over the previous 2 weeks, the S&P 500 has managed to reverse a very good a part of this 12 months’s losses with a rally that is put the markets again into an uptrend that started on March sixteenth. Subscribers to my MEM Edge Report had been instantly alerted to this new uptrend when the S&P 500 posted a bullish follow-through day, via using a system that is recognized each market backside going again over 40 years.

DAILY CHART OF S&P 500 INDEX

When the markets enter a brand new uptrend, that always marks a really perfect time to establish new management shares that may go on to commerce increased than the broader markets. Traditionally, these management shares possess a number of traits, amongst these being that they would be the first out of the gate amongst their friends, as their business group begins to show constructive. Moreover, the corporate will exhibit robust development prospects.

For instance, because the markets entered a brand new uptrend on the sixteenth, we highlighted the Semiconductor group as being near reversing its downtrend, whereas additionally figuring out Nvidia (NVDA) as a management identify on this group. NVDA’s robust development prospects is one cause, whereas the truth that it turned constructive forward of its friends was one other, following its break again above its 50- and 200-day shifting averages final Friday.

Whereas I consider NVDA will proceed to outpace the markets, in addition to 2 different Semiconductor shares I will be including in my Sunday MEM Edge Report, there are different areas of the market which are poised to commerce increased as nicely. Particularly, shares that act as a hedge in opposition to inflation are additionally perfect at this juncture. With inflation presently at a 40-year excessive and elevated Oil costs pointing to a protracted interval of upper costs, shopping for high-yield shares is a good hedge. The reason being that these high-dividend corporations usually have cyclical enterprise fashions that maintain up nicely when costs rise, as they’ve robust pricing energy that permits them to take care of excessive income.

DAILY CHART OF S&P 500 HIGH DIVIDEND ETF (SPDY)

A diversified ETF that accommodates excessive dividend shares could be an effective way to achieve publicity. Above is a chart of the S&P 500 Excessive Dividend ETF (SPYD), which broke out of a 2-month base as we speak on its method to larger heights. SPYD consists of 80 high-dividend-yielding corporations inside the S&P 500, together with prime Power and REIT shares. As well as, this ETF supplies a 3.5% yield.

Whereas the markets are in a confirmed uptrend, it is unclear what path will likely be taken or how lengthy the present uptrend will likely be sustained. With the numerous crosscurrents happening amid Russia’s invasion of Ukraine, a shift within the Federal Reserve’s financial coverage and excessive inflation and rising rates of interest, you may see how vital it’s to remain on prime of the markets. If you would like knowledgeable steerage throughout these making an attempt instances, trial my twice weekly MEM Edge Report for 4 weeks for a nominal charge. Along with highlighting sectors and business teams poised to learn from the present atmosphere, you may even be supplied with prime inventory candidates that may profit. Final 12 months, I posted 140 totally different inventory picks and my success price was 75%.

I hope you may make the most of this particular provide.

On this week’s version of StockCharts TV’s The MEM Edge, I evaluate the place the energy within the markets is and methods that you may capitalize on it. I additionally share shares and ETFs which are breaking out of bases, in addition to turnarounds which are happening.

Warmly,

Mary Ellen McGonagle, MEM Funding Analysis

Mary Ellen McGonagle is an expert investing marketing consultant and the president of MEM Funding Analysis. After eight years of engaged on Wall Road, Ms. McGonagle left to change into a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with purchasers that span the globe, together with massive names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Be taught Extra