Californians is likely to be going through new taxes, once more.

Waves have been stirred final week when Assemblymember Chris Ward (D-San Diego) launched the California Hypothesis Act (AB 1771).

The invoice is the Meeting’s newest try to curb rising housing prices and bludgeon investor income. If handed, the Act would add an extra 25% tax on the capital acquire from the sale or change of residential properties inside three years of its preliminary buy.

In different phrases, California lawmakers try to disincentivize investor exercise within the state’s housing market. But, the invoice’s language may even have an effect on the normal home-owner, together with essentially the most susceptible.

An Overview of the California Hypothesis Act

The California Hypothesis Act carries the next provisions:

- Owners could be taxed as much as 25% on capital acquire in the event that they promote their dwelling inside three years of buy.

- The tax applies to all “Certified Taxpayers”.

- Applies to most residential properties with few exemptions.

- First-time homebuyers and reasonably priced housing items are exempted.

- Properties offered inside three years are topic to a 25% tax. After three years, the speed declines by 5% annually till seven years have handed.

- Collected taxes could be put in the direction of group funding, with 30% designated for reasonably priced housing.

- If handed with a 2/3 vote within the Meeting, the invoice would develop into regulation on January 1, 2023.

What’s The Story Behind It?

California’s housing market is notoriously costly. San Francisco normally charts at primary for the costliest actual property market within the U.S. State tax charges are additionally among the many highest within the nation.

AB 1771’s intention is to decrease dwelling costs by stopping traders from benefiting from the market with money gives. In accordance with the invoice’s sponsor, Chris Ward, the Act will dissuade institutional traders who purchase up properties with money and flip them at inflated costs quickly after.

“We’ve heard of individuals entering into their first dwelling getting beat by money gives,” Ward stated at a information convention. “When traders fall out of the shopping for pool, that may give common dwelling patrons an opportunity to purchase a house,”

For Ward, costs are a significant drawback. As a consultant of San Diego, traditionally one of many extra reasonably priced spots in California, he’s overseen skyrocketing actual property appreciation that’s put San Diego on par with San Francisco, a voting problem that doesn’t bode properly for him.

Sadly for Ward, his invoice is being confronted with vital opposition.

In accordance with detractors, the principle problem going through California’s actual property disaster is the extreme lack of housing provide. Demand has been via the tough over the previous few years and provide has been exceptionally gradual in catching up.

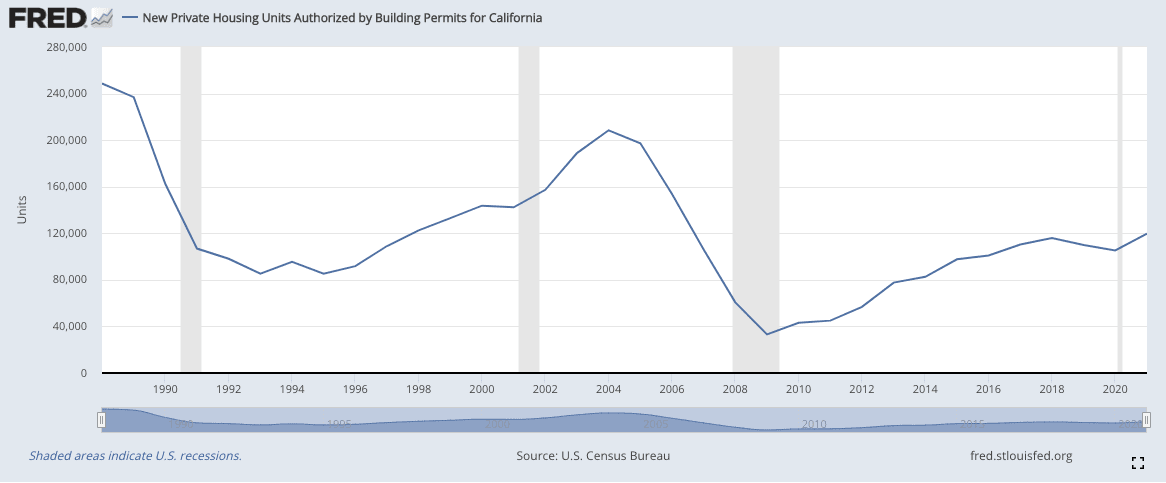

California housing begins in 2021 totaled about 120,000. That’s a slight uptick from 2020, however proper on par with the final 4 or so years. It’s method down from 2004 or 1988 ranges although, the place complete items rose properly above 200,000. The state can be beneath its building targets, which is focused to fall round 180,000 items per yr.

In essence, California is brief a number of million housing items and remains to be not on monitor to fulfill demand. This, paired with excessive tax charges, has created a catastrophically overpriced market, locking out hundreds of thousands and placing an infinite quantity of strain on low-income and first-time patrons.

In actual fact, many actual property consultants are declaring that the Act would seemingly exacerbate the stock disaster.

“California has a significant affordability disaster. Sadly, this invoice would tax most householders and traders alike, resulting in an excellent worse lack of stock, one of many main causes for housing value escalation. We imagine that is well-meaning laws with vital unintended penalties,” stated Nema Daghbandan, Companion at Geraci LLP, the Common Counsel for the American Affiliation of Personal Lenders.

A number one problem with the invoice is that it applies to all certified taxpayers. Until you’re on active-duty army service or deceased, you’re thought-about a professional taxpayer. Should you have been to promote your private home inside a seven-year interval, then you may be subjected to the tax, investor or not.

The argument, in fact, is that almost all Californians don’t promote their properties that shortly, which is true. For example, residents of Los Angeles are likely to maintain their properties for a median size of about 16 years.

Nevertheless, it begs the query of whether or not it’s an infringement of the property rights of sellers? Let’s say you got a house in Los Angeles in 2020 however have been simply supplied a improbable job in San Francisco. The catch is that it is advisable to relocate.

Do you have to be taxed as much as 25% for needing to maneuver? A joint assertion by a number of California actual property commerce associations, together with the California Affiliation of REALTORS®, says completely not.

“In accordance with the Neighbor 2020-2021 American Migration Report, over 20% of these surveyed acknowledged they deliberate to maneuver based mostly on job adjustments, monetary challenges, or extra area necessities. Beneath AB 1771, property homeowners with a rising household searching for to maneuver into a bigger dwelling, downsizing as a result of job lack of one of many occupants, and even those that should relocate to behave as a caregiver for a liked one who turned unwell could be harshly penalized for merely needing to maneuver” the letter acknowledged.

The assertion continued to scorn the invoice, citing essential knowledge that implies traders who paid with money solely made up 3.8% of all transactions in 2021. It additionally ensured to handle the invoice’s main reasoning, which is to decrease costs.

“Additional, [the bill] does nothing to make sure that first-time or different homebuyers are assured entry to properties, nor does it create extra housing alternatives. Fairly, the invoice will trigger unintended penalties for the market by decreasing the variety of properties obtainable on the market. In January 2022, new dwelling listings continued to drop by the double digits – with listings declining from 13,301 in January 2021 to only shy of 10,000 in December 2021. The discount in listings could be exacerbated by this invoice because it incentivizes traders to really maintain on to their properties longer and would pressure householders who have to promote to attend – additional miserable California’s possession housing provide.”

Closing Ideas

General, the California Hypothesis Act is a mindless try to curb housing costs and can seemingly trigger extra hurt than good to the true property market.

By concentrating on all certified taxpayers as an alternative of traders particularly, it’s laborious to see this invoice as something greater than a authorities cash seize off the backs of extremely valued properties.

We’ll maintain you up to date on additional developments.