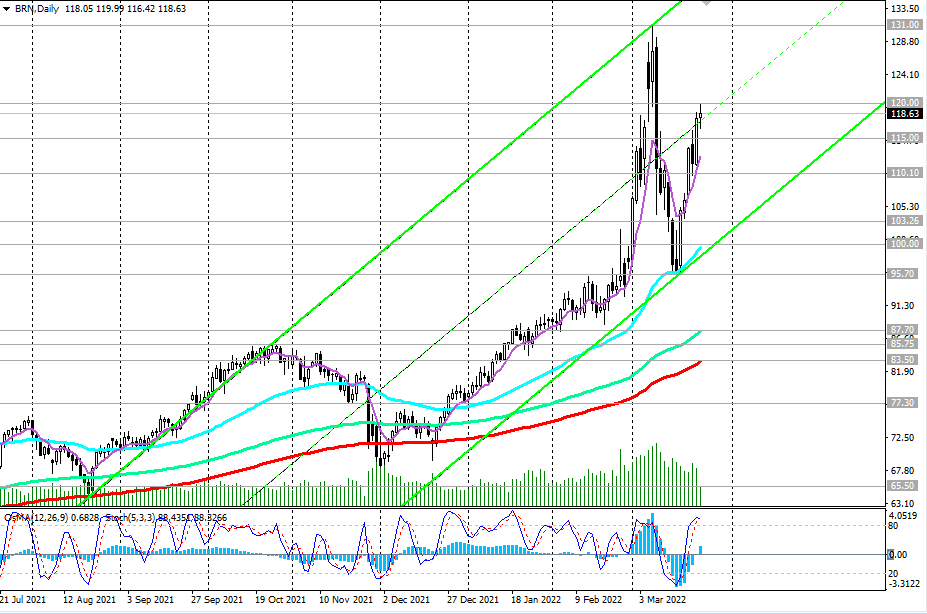

Because the opening of at the moment’s buying and selling day, Brent oil quotes have been rising once more, touching the mark of $120.00 per barrel at the start. Primarily based on the onerous elementary background, we count on additional value progress. From a technical standpoint, a breakdown of the native resistance degree of 120.00 (at the moment’s most) might grow to be a sign to enter lengthy positions (or improve them). Pullback to short-term assist ranges 115.00, 110.10 will also be used to extend lengthy positions, though aggressive patrons will most likely discover it potential to enter the market at present costs. Fears in regards to the impression of latest sanctions on Russian oil provides and the absence of a nuclear cope with Iran proceed to drive demand. Different (apart from Iran and Russia) main oil producers, Saudi Arabia and the United Arab Emirates, should not capable of improve manufacturing rapidly.

The subsequent OPEC assembly might be held subsequent week. At a gathering in March, it was determined to extend oil manufacturing by OPEC+ nations in April 2022 by 400 thousand barrels per day, to 41.694 million barrels per day. The oil coalition believes that the oil market is presently effectively balanced, and the present volatility is attributable to geopolitical occasions.

It’s doubtless that the OPEC+ nations will stay dedicated to this plan, which is unlikely to have a unfavourable impression on oil costs. The OPEC+ ought to utterly take away restrictions on manufacturing whereas sustaining the identical charge of improve in manufacturing in September 2022.

Of the financial information for at the moment, which is able to trigger volatility within the monetary market, traders will take note of the publication (at 12:30 GMT) of information on orders for sturdy items and capital items (excluding protection and aviation) in america (capital items – sturdy items used to supply sturdy items and providers) involving giant investments.

February forecast: -0.5% (sturdy items orders), +0.5% (capital items orders excluding protection and aviation), worse than earlier values (+1.6% and +0.9%, respectively). That is unfavourable info for the greenback. In all probability, solely the information higher than the earlier values may have a constructive impression on the greenback.

Assist ranges: 115.00, 110.10, 103.26, 100.00, 95.70, 87.70, 85.75, 83.50, 77.30, 65.50

Resistance ranges: 120.00, 130.00, 131.00

See additionally – > Buying and selling suggestions

*) essentially the most up-to-date “scorching” analytics and buying and selling suggestions (together with entries into trades “by-the-market”) – -> Telegram

**) Get no deposit StartUp bonus as much as 1500.00 USD