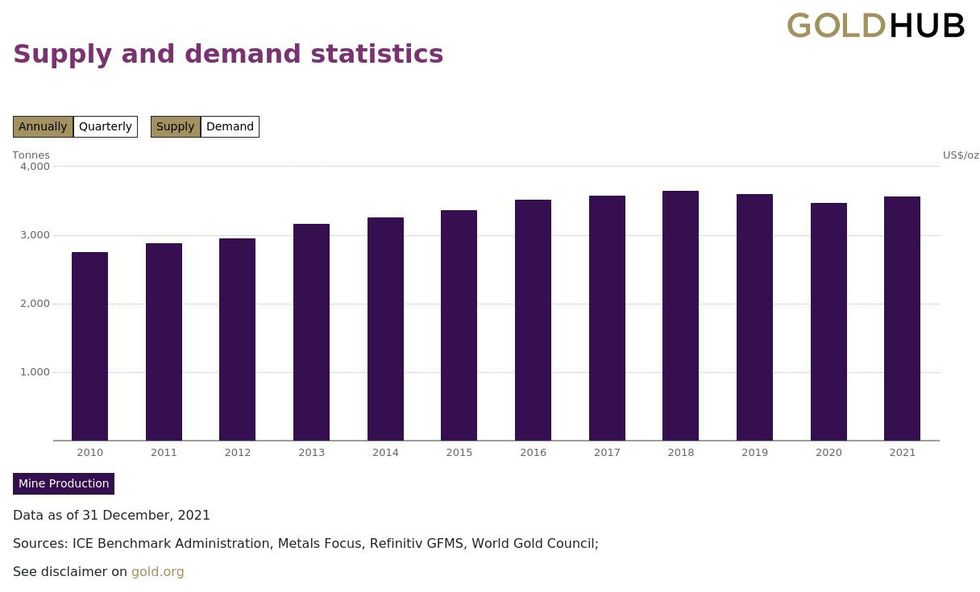

Annual mined gold manufacturing has hit a wall in recent times. Coming in at 3,667 tonnes in 2018, output has largely plateaued since then, impacting general provide of the yellow metallic.

Though 2021 introduced some restoration in mine manufacturing following the pandemic-related shutdowns seen in 2020, whole gold provide fell to 4,666 tonnes, the bottom stage since 2017.

Mined output noticed a 2 p.c year-over-year (y-o-y) improve in 2021, however this small rise was outweighed by an 11 p.c decline from the recycling section. The overall downtrend in mine output, mixed with decrease recycling, has prompted some to take a position in regards to the shortage of future provide.

What do specialists see coming for gold provide? The Investing Information Community requested specialists for his or her ideas.

Breaking down 2021’s gold mine manufacturing numbers

As talked about, 2021 introduced a 2 p.c y-o-y improve in mined gold manufacturing. Nonetheless, not all areas noticed development, and in some instances COVID-19-related challenges have been changed by operational points.

For instance, persistent safety-related stoppages out of China’s Shandong province decreased the nation’s annual output by 10 p.c y-o-y. China was nonetheless the world’s chief in gold output, producing 370 metric tonnes final 12 months.

There was additionally an 8 p.c y-o-y drop out of Burkina Faso, and a 7 p.c y-o-y decline for Australia. Elsewhere, a fireplace at Kinross Gold’s (TSX:Okay,NYSE:KGC) milling operations at its Tasiast mine in Mauritania triggered a brief suspension in operations, which led to a 58 p.c y-o-y manufacturing discount for the nation.

In distinction, Canada’s annual output climbed by 19 tonnes on the again of expansions and a restoration from 2020. Mexico and South Africa additionally noticed upticks in 2021, including 14 tonnes and 13 tonnes y-o-y, respectively.

This development is on development, in keeping with Adam Webb, director of mine provide at Metals Focus. “We anticipate mined gold provide to proceed rising over the following few years, pushed by elevated output from current operations alongside new initiatives coming on-line, significantly within the Americas,” he mentioned.

It is value noting that though gold has registered two new document highs within the final two years (2020, 2022), gold producers have not benefited as a lot as they may have, with some upside being offset by rising operational prices. This downside was additional compounded by 2021’s decrease gold worth, world inflation and better enter prices.

In 2021, all-in sustaining prices rose 8 p.c y-o-y to a mean of US$1,058 per ounce. This rise is anticipated to proceed this 12 months, primarily pushed by surging costs for power.

As mine output plateaus, is general gold provide in jeopardy?

Regardless of constructive expectations for future gold mine provide, latest flatter ranges have left some questioning if general gold provide will be capable of maintain as much as demand — are these considerations legitimate?

Consultants at each Metals Focus and the World Gold Council consider that world reserves and the insulated nature of the gold market will stop any important provide challenges.

“There’s loads of gold recognized in present reserves and assets to maintain manufacturing at present ranges for a few years to come back,” mentioned Webb.

“On the finish of 2020, recognized reserves have been able to supporting present manufacturing ranges for 14 years, and recognized assets have been doubtlessly in a position to help an extra 31 years of worldwide manufacturing.”

These numbers additionally don’t account for added useful resource potential recognized by exploration.

Gold mine manufacturing, 2010 to 2021.

Chart by way of the World Gold Council.

For Krishan Gopaul, senior analyst, EMEA on the World Gold Council, like all assets there may be some shortage to gold as a commodity, though it’s not as impacted by manufacturing declines as different metals and minerals.

“Gold mine manufacturing sometimes contributes 3,500 tonnes (75 p.c of annual provide), however the the rest comes from recycling,” mentioned Gopaul. “As well as, gold mine manufacturing is geographically various and, as such, much less topic to the sort of provide shocks that different commodities are likely to expertise.”

Due to this, gold provide is much much less unstable in comparison with nearly all different commodities, he famous. “Thus, whereas a considerable discount in mine manufacturing might end in increased costs, gold would not going expertise the identical stage of supply-driven worth dislocation that different markets, akin to oil or base metals, might see.”

Tech developments might assist enhance gold manufacturing

Regardless of the comparatively regular nature of gold provide, one issue that would impression future manufacturing charges is the development of autonomy and know-how associated to mining and mineral restoration.

“It might additionally decrease working prices, thus making lower-grade materials financial to extract, which might improve reserves and mine lives,” defined Webb.

There have additionally been advances within the potential to reprocess tailings and waste to seize gold that was not extracted initially. Reprocessing underscores the significance of the environmental stewardship and sustainability themes which can be turning into extra prevalent within the sector annually.

“As with all different trade, technological developments have the potential to carry down a number of the prices of mining, which can result in elevated ranges of output,” Gopaul defined.

“Nonetheless,” he continued, “large-scale gold mining is capital intensive, already using excessive ranges of mechanization and experience to mine huge areas each on and under the floor.”

The analyst on the World Gold Council went on to level out, “As well as, there may be an elevated concentrate on sustainability. As such, gold mine manufacturing has solely elevated at a price of round 2 p.c per 12 months over the previous decade, highlighting a number of the pure limitations of gold extraction.”

Don’t overlook to observe us@INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the knowledge reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

From Your Website Articles

Associated Articles Across the Net