We are actually on the finish of an period of financial and ethical decadence in a debt infested world constructed on false values, faux cash and abysmal management. All hell will break unfastened.

The results will probably be deadly for the world.

There are eras in historical past which have produced nice leaders and thinkers. However sadly, the present period has produced nothing of that sort. The top of an financial cycle produces no nice management or statesmanship however solely incompetent leaders.

Trying on the Western world, the one notable statesman in the previous couple of many years in my opinion is Margaret Thatcher, prime minister of the UK from 1979 to 1990.

However political leaders are in fact devices of their time. Sadly occasions as the present don’t produce Superior Males.

As Confucius mentioned:

“The Superior Man thinks at all times of advantage, the widespread man thinks of consolation.”

It’s the buildup of an enormous debt mountain which has given the Western world a false consolation primarily based on false values.

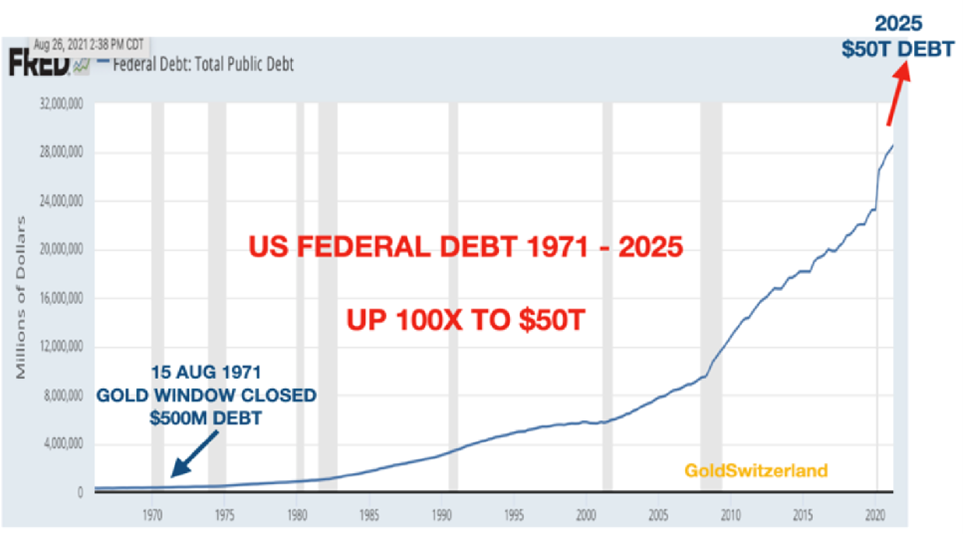

As I’ve identified many occasions, the US has elevated its debt yearly since 1930, with a few minor exceptions within the Nineteen Fifties and Sixties. The Clinton surpluses within the late Nineties had been faux and actually deficits.

In historical past, when there may be undue financial stress, beginning wars is standard and infrequently felt vital. It’s handy accountable the conflict for the growing money owed.

The Gold Normal was a wonderful methodology for stopping governments to spend cash they didn’t have. Since cash couldn’t be printed at will, deficits then needed to be financed by settling money owed in bodily gold.

THE GOLD WINDOW HAS BEEN “TEMPORARILY” CLOSED FOR 50 YEARS

As Nixon within the late Sixties needed to meet the US money owed to France in gold, he determined in 1971 to shut the gold window briefly. He clearly didn’t wish to hand all of the US gold to de Gaulle. Over 50 years later that gold window continues to be briefly closed with deadly penalties for the US and the world.

The chart under exhibits the exponential development of US debt since 1971. As we attain the ultimate phases, the debt curve is explosive since 2019.

Creating money owed of this magnitude is barely doable with out the self-discipline of gold backed currencies.

THE FAT LADY HASN’T SUNG YET

However as I’ve defined earlier than, the debt explosion is just not completed till the fats woman sings. And sadly rather a lot will occur earlier than she lastly sings.

As a result of like most financial eras, this one will end with a variety of spectacular occasions, a lot of which can happen concurrently.

Just a few months in the past, Powell and Lagarde had been singing from the identical hymn sheet about transitory inflation.

However as these Central Financial institution chiefs show constantly, they’re at all times improper. For years they’re attempting to get inflation to 2 p.c after which, swiftly, it’s approaching 10% they usually don’t perceive what has hit them.

They haven’t even understood that Keynesianism was useless earlier than it began.

Even a monkey would perceive that in case you print $10s of trillions and maintain rates of interest at zero or unfavourable for years, the tip end result will probably be spectacular inflation.

Initially we noticed unprecedented asset inflation in shares, bonds and property nevertheless it was at all times clear that the exponential enhance in cash provide would finally attain client costs.

THE PERFECT STORM

What’s coming subsequent is the inevitable excellent storm.

An ideal storm signifies that every part that may go improper will go improper. And that’s not simply apparent failures in lots of components of society but additionally completely unexpected penalties.

Let’s simply take a look at a few of the apparent occasions that may happen within the subsequent few years:

Monetary Markets

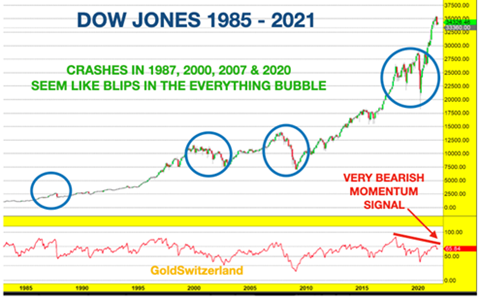

Shares have topped worldwide. The correction at present happening is more likely to finish very quickly in a devastating decline.

Everybody will get slaughtered when hell breaks unfastened. Whether or not traders purchase the dip or simply maintain on to their shares, they received’t perceive what has hit them.

Simply take a look at the chart under and the main falls beginning in 1973, 1987, 1999, 2007 and 2020. They had been all nail biters on the time, however as we speak you possibly can hardly discern a lot of them on the chart.

For many years each correction has recovered and reached new highs.

However this time WILL BE DIFFERENT, though nobody expects it!

Shares are more likely to decline by 75-95% in actual phrases and never get better for years or possibly many years.

Do not forget that in 1929, the Dow declined by 90% and that it took 25 years earlier than it recovered in nominal phrases. And this time the financial circumstances are exponentially worse.

Bonds have gone up for over 40 years and charges reached zero or unfavourable. Charges have now turned up and we’re more likely to see rates of interest attain at the very least the 1980 ranges of 15-20% and doubtless increased in a hyperinflationary debt collapse. Many bonds will turn out to be nugatory and extra appropriate for framing and hanging on the bathroom wall as a reminder for future generations.

Credit score markets will come beneath that very same stress as bond markets with defaulting debtors, neither able to service the debt nor repay it.

Property markets have additionally reached extremes, fueled by low-cost or free cash and limitless credit score at very excessive leverage. In Europe mortgage charges are round 1%. These negligible and irresponsible financing prices have pushed property costs to ridiculous and unsustainable ranges.

My first mortgage was within the UK. In 1973 the speed went as much as 21% in a excessive inflation surroundings!

At present, few debtors may afford a rise to three%, by no means thoughts 10% or 20% like within the Nineteen Seventies.

As charges rise, it’s completely sure that the residential and business property markets bubble will implode, resulting in main defaults, very excessive emptiness charges and homelessness.

Governments will initially subsidise these markets by limitless cash printing, however ultimately that may fail too as cash dies.

Derivatives are a significant monetary nuclear bomb that’s more likely to be a loss of life knell for monetary markets. As I wrote in a latest article “Chaos and the triumph of survival”, LINK world derivatives, primarily OTC (over-the-counter), are most probably within the $2+ quadrillion vary.

Each single monetary instrument accommodates a by-product factor with large leverage.

As a result of present volatility in commodity markets, most giant commodity buying and selling companies in addition to hedge funds are actually uncovered to margin calls.

For instance, many JP Morgan shoppers are at present beneath monumental stress in a massively over leveraged market.

So if JP Morgan shoppers are beneath stress, because of this JPM and different banks may also be beneath stress.

Do not forget that that is just the start of the disaster with extra dangerous information unravelling each day.

Because the derivatives market blows up with counterparties failing, central banks must print quadrillions of nugatory {dollars}, paving the way in which for large hyperinflation.

Banks & Monetary System will clearly be beneath great stress initially and finally completely or partly fail because the above issues unravel.

Governments and central banks will clearly be powerless on this situation. The rescue of the system in 2008 was only a momentary keep of execution. World debt has trebled since early this century from $100 trillion to $300 trillion. However bear in mind that is largely faux cash which has created false asset values standing on a basis of quicksand.

All that is now about to break down.

NOT JUST AN ECONOMIC & FINANCIAL STORM, BUT ALSO HUMAN HELL

The approaching financial and monetary disaster could have devastating results on the world. Listed here are just a few affected areas:

Commodity inflation is assured. For years it has been clear that the long-term commodity cycle was bottoming and an enormous surge in commodity costs would begin. The cycle had already began to go up nicely earlier than the Ukraine disaster, however it’s fascinating how occasions fall into place in an effort to create the proper storm. I lined a few of this in my earlier article “A World Financial & Financial Inferno of Nuclear Proportions”.

Greenback collapse, along with most different currencies, is assured. As cash printing and inflation rises in an uncontrolled style, the greenback will shortly attain its intrinsic worth of ZERO. Most currencies will observe however they’ll take turns.

Digital cash is more likely to be launched in coming years. However I don’t suppose that crypto currencies will play a significant function besides as a really speculative funding. Extra vital will probably be CBDC (Central Financial institution Digital Foreign money) which will probably be one other type of fiat cash, however now digital. As all fiat cash, CBDCs will probably be shortly debased by limitless digital printing.

WEF & Claus Schwab have gotten extra prominence than they deserve. For my part they’ll lose no matter energy they now have as monetary asset values and their wealth implode. Thus, I don’t imagine that their reset will occur or succeed. Governments may attempt resets however they’ll fail. The one actual reset will probably be disorderly and as outlined above.

Unemployment will enhance dramatically as world commerce declines and the monetary system comes beneath stress. Many firms will perish.

Pension methods will fail, because the values of pension funds collapse.

Social safety methods is not going to operate because the governments run out of actual cash.

Human Hell breaking unfastened will sadly be felt by most individuals on earth as a consequence of the issues outlined above. And that’s with no larger nuclear conflict, which clearly can be deadly for the world.

Huge worth will increase, particularly in meals and power mixed with shortages, will hit everybody, each growing international locations and the industrialised world.

The penalties of meals shortages and financial distress, mixed with the failure of governments to operate correctly, will clearly result in social unrest in lots of locations, even civil conflict!

THE WAR IS NOT THE CAUSE BUT A VERY GRAVE CATALYST

The present monetary and financial disaster was neither attributable to Covid, nor by what is going on in Ukraine at present.

The present disaster began with the issues within the banking system and the Repo market in Aug-Sep 2019 after which exacerbated by Covid in early 2020.

The origin of the 2019 banking disaster is clearly the debt bonanza since 1971 and particularly since 2006.

Additionally, the issues in commodity, particularly meals and power markets, had already began earlier than the conflict in Ukraine.

However in an ideal storm, a variety of very ugly catalysts will at all times happen on the worst doable time in an effort to set off one worse disaster after the following.

Nobody is aware of how this conflict will finish. The Western world could be very badly knowledgeable in regards to the state of the conflict for the reason that media is biased professional West and anti Putin. However Putin is just not doubtless to surrender simply. Due to this fact, sadly the conflict will at finest be native and protracted, and at worst result in penalties which I received’t speculate on at this level.

WEALTH PRESERVATION AND GOLD

For over 20 years I’ve written in regards to the monetary and financial issues which are about to hit the world. Many of the issues are occurring though I’ll willingly admit that issues have taken longer than I anticipated. The monetary system was miraculously saved in 2008 which thus was a rehearsal. What is going to occur subsequent will certainly be for actual.

What I’ve learnt is that we should be affected person for the reason that finish of an period and financial cycle doesn’t simply occur as a result of you possibly can see all of the indicators. The method is lengthy and arduous.

Governments and central banks are combating with all of the restricted instruments they’ve. However as fiat cash has misplaced 97-99% of its worth since 1971, this subsequent time the present financial system will die prefer it at all times has all through historical past.

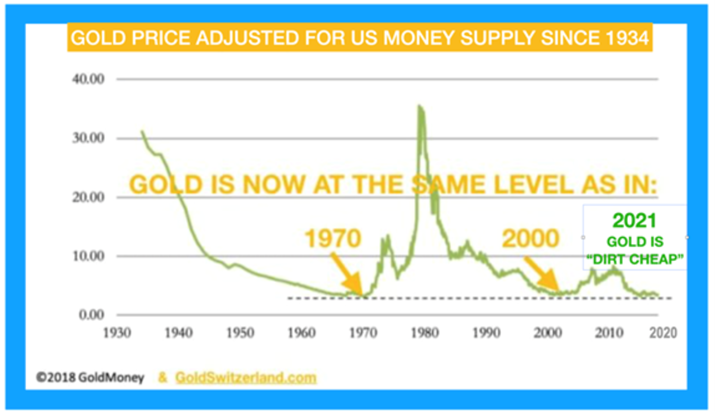

We now have invested in and beneficial bodily gold since early 2002. On the time it was $300. So at $1,920, gold is up 6.4X since then which is best than most asset lessons.

However we by no means purchased gold purely for funding functions, however primarily to protect wealth. Nonetheless, it has been an excellent funding for the final 20 years.

Because the graph under exhibits, gold is as we speak is as unloved and undervalued because it was in 1971 at $35 or in 2000 at $290.

Inflation and hyperinflation are more likely to destroy most asset values in coming years and currencies will make that remaining transfer to ZERO.

The gold worth will clearly replicate these strikes and can, measured in fiat cash, attain ranges that nobody can think about. As a result of severity of the present financial and geopolitical scenario, gold is more likely to do higher than simply keep buying energy.

So preserving wealth in bodily gold is as we speak vital. The share of monetary belongings to place into gold is as much as everybody to resolve for himself. In 2002 I beneficial as much as 50% and as we speak the dangers on the earth are exponentially increased.

Lastly, what is going to hit the world in coming years will result in great struggling as all hell breaks unfastened, so serving to household, pals and others is of utmost significance.