The broad market setting is the only most vital issue to think about when investing in shares or stock-related ETFs. Are we in a bull market or a bear market? The current enlargement of recent lows and the 5/200 cross within the S&P 500 counsel that we’re in a bear market setting.

The broad market setting is the only most vital issue to think about when investing in shares or stock-related ETFs. Are we in a bull market or a bear market? The current enlargement of recent lows and the 5/200 cross within the S&P 500 counsel that we’re in a bear market setting.

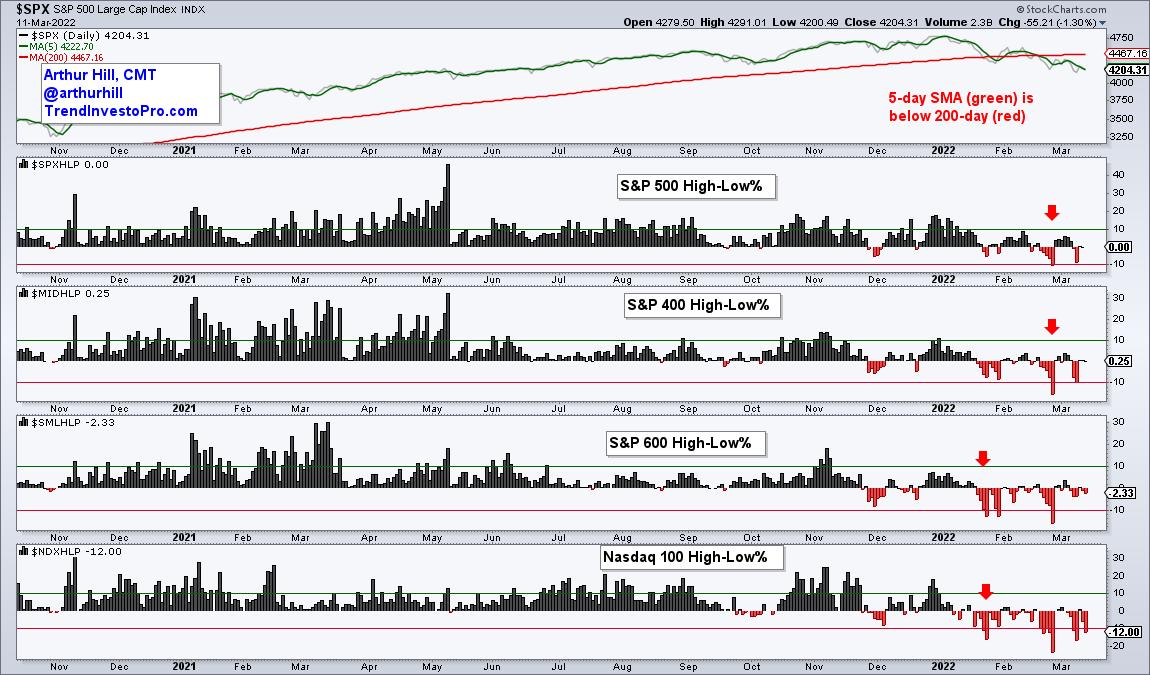

The chart beneath reveals the S&P 500 within the high window and the Excessive-Low P.c indicators for 4 main indexes within the decrease home windows (S&P 500, S&P MidCap 400, S&P SmallCap 600 and Nasdaq 100). In the beginning, the S&P 500 is in a downtrend as a result of the 5-day SMA (inexperienced) is round 5.5% beneath the 200-day SMA (pink). The S&P 500 is a very powerful benchmark for US shares and a downtrend bodes in poor health for many shares.

The Excessive-Low P.c indicators have been sturdy till November 2021, took successful in December and turned bearish right here in 2022. The pink arrows present S&P 500 Excessive-Low% and S&P MidCap 400 Excessive-Low% dipping beneath -10% in late February. Previous to that, S&P SmallCap 600 Excessive-Low% and Nasdaq 100 Excessive-Low% dipped beneath -10% in late January. These strikes beneath -10% broke my bearish threshold and present an enlargement of recent lows all through the market. That is bearish for the broader market.

Excessive-Low P.c equals the share of shares hitting new 52-week highs in an index much less the share hitting new 52-week lows. A inventory is in a powerful downtrend and main decrease when hitting a 52-week low. The extra shares in sturdy downtrends, the extra bearish for the market. The inexperienced traces are at +10% and the pink traces are at -10%.

Curious about breadth indicators? StockCharts members who subscribe to TrendInvestorPro are entitled to the important breadth indicator chartlist. This checklist has over 100 custom-made charts with dozens of indicators. It is usually organized in a logical top-down method. Click on right here to subscribe and get quick entry.

This week’s Subsequent Degree Charting video (right here) coated the bullish setup within the 10-yr Treasury Yield (bearish for bonds), the breakouts within the Silver and Protection ETFs, and the long-term bullish setups in some clear power ETFs.

The TIP Indicator Edge Plugin for StockCharts ACP has 11 indicators designed to assist along with your evaluation and buying and selling course of. These embody the Development Composite, the Momentum Composite and ATR Trailing. Click on right here to study extra.

—————————————————

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic method of figuring out development, discovering alerts throughout the development, and setting key worth ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise Faculty at Metropolis College in London.