The greenback continues to dominate the market. Buyers give choice to it towards the backdrop of ongoing hostilities in Ukraine. Final Monday, the DXY greenback index topped 99.41, hitting a 21-month excessive.

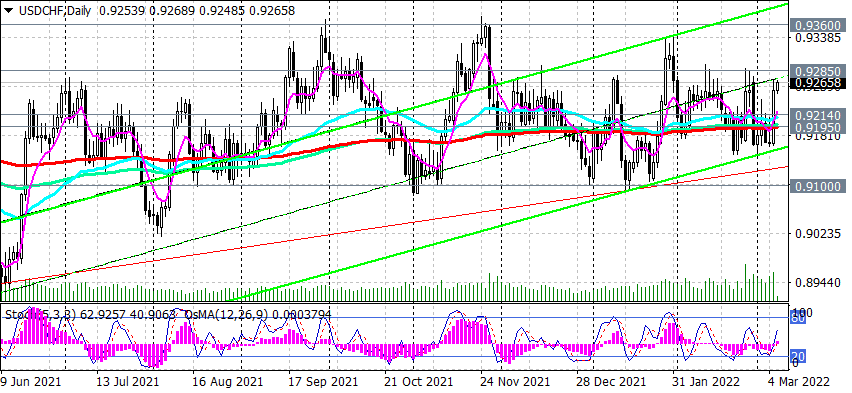

USD/CHF pair has been buying and selling in ranges since final June, with a wider vary between 0.9410 and 0.9000 and a smaller vary between 0.9360 and 0.9100. A form of steadiness line right here is the 200-period shifting common on the every day chart, which is at the moment passing by the 0.9195 mark.

Franc obtained some assist from the optimistic macro statistics from Switzerland, printed on Monday. Thus, the unemployment fee in Switzerland decreased in February to 2.2% from 2.3% in January and the identical forecast. Nevertheless, the primary assist for the franc comes from its standing as a defensive asset.

USD/CHF is traded close to 0.9260 mark, staying above the necessary assist ranges 0.9214, 0.9195. Above these assist ranges lengthy positions stay preferable, and within the occasion of a breakdown of the resistance stage 0.9285 (the higher restrict of the vary positioned between the degrees 0.9100 and 0.9285), the expansion of USD/CHF will proceed with targets on the resistance ranges 0.9360 (the higher restrict of the vary positioned between the degrees 0.9360 and 0.9100), 0.9410.

see additionally -> Technical evaluation and buying and selling suggestions

*) essentially the most up-to-date “sizzling” analytics and buying and selling suggestions (together with entries into trades “by-the-market”) – https://t.me/fxrealtrading