It occurred to us, after we mentioned the “Dying Crosses” (50-day EMA dropping under the 200-day EMA) on the NDX and Nasdaq 100 in yesterday’s subscriber-only DecisionPoint Alert, that we must always examine the precise injury executed. The tech-heavy NDX and Nasdaq 100 are in bear markets, together with Know-how (XLK).

We have been questioned about our dialogue of the SPY being in a bear market as a result of we do not have a 20+% decline but. Properly, in case you go by that “official” 20% quantity, XLK, NDX and Nasdaq are all in “official” bear markets. Let us take a look at all three.

XLK seems significantly bearish proper now. Value has failed on the 200-day EMA and the PMO has topped beneath its sign line. It simply had a brief bear market rally, however it’s again to declining. From its excessive to its latest low, it’s a slightly-more-than-20% decline. Participation is missing, with solely 17% of shares having a 20-day EMA > 50-day EMA (a “Silver Cross”) and fewer than 1 / 4 with value > 20-EMA. Solely about half of the sector have “golden crosses” (50-EMA > 200-EMA), which means they’re in a bull market. The remaining, we assume, are in bear markets.

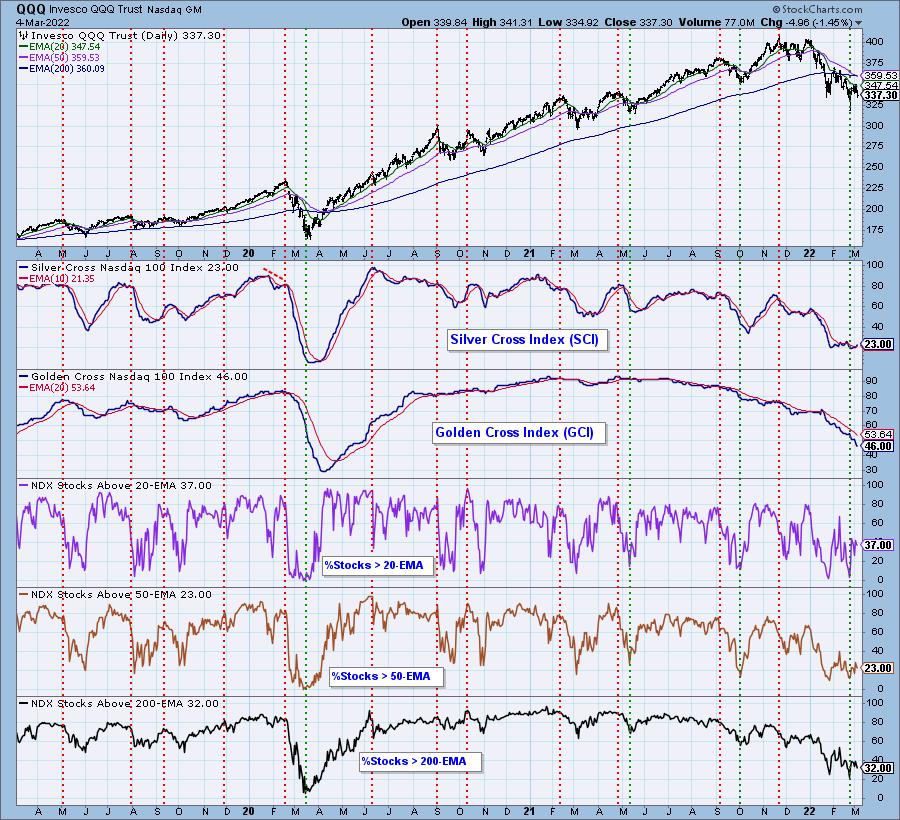

PARTICIPATION and BIAS Evaluation: The next chart objectively reveals the depth and pattern of participation in two time frames.

- Intermediate-Time period – the Silver Cross Index (SCI) reveals the proportion of SPX shares on IT Development Mannequin BUY alerts (20-EMA > 50-EMA). The other of the Silver Cross is a “Darkish Cross” — these shares are, on the very least, in a correction.

- Lengthy-Time period – the Golden Cross Index (GCI) reveals the proportion of SPX shares on LT Development Mannequin BUY alerts (50-EMA > 200-EMA). The other of a Golden Cross is the “Dying Cross” — these shares are in a bear market.

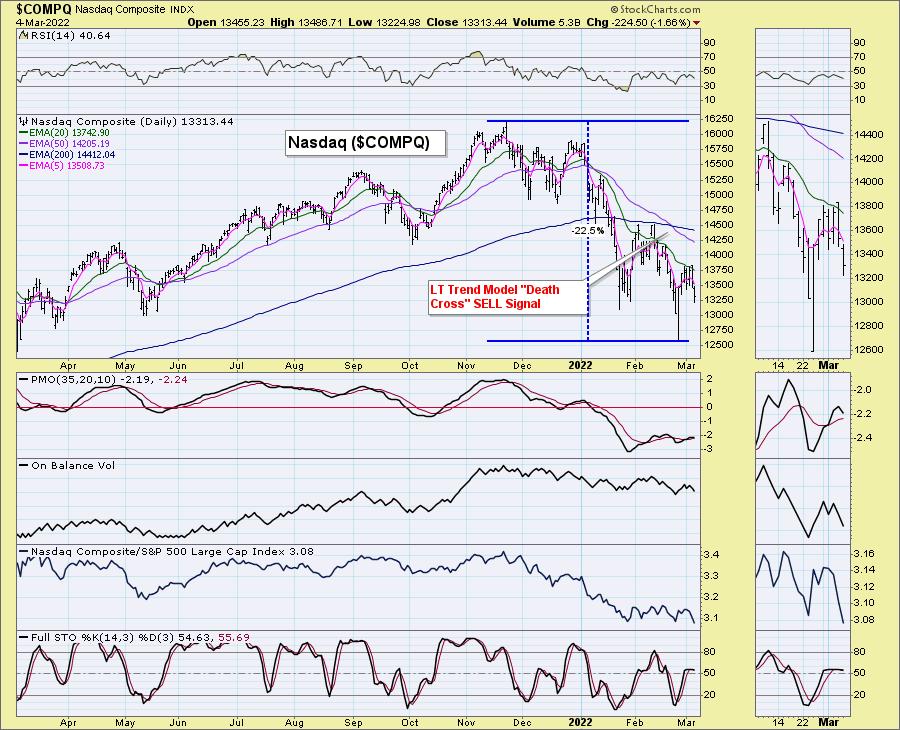

The Nasdaq ($COMPQ) had its “Dying Cross” just a few weeks in the past. It’s down over 22% from prime to backside.

Under is the Participation chart for the Nasdaq. Each the SCI and GCI are at very bearish ranges, under 30%.

The NDX had a Dying Cross yesterday. It was down just a little over 22% from all-time excessive to the final low.

Under is the participation chart for the NDX. The SCI is at a paltry 23% and the 46% studying on the GCI tells us that greater than half of the index are in bear markets themselves.

Conclusion: Aggressive sectors like Know-how proceed to be very weak. There are wartime beneficiaries on the market like Crude Oil, Gold, Specialty Chemical substances, Metals and Mining, to call just a few. Erin has been following these intently within the subscriber-only DecisionPoint Diamonds stories. She had some very profitable inventory picks from these areas that had “Diamonds within the Tough” ending this week within the inexperienced.

Do not miss this FREE upcoming instructional alternative to see Erin current on the “4th Annual Ladies Educate Investing” convention! If you cannot go, the recording can be despatched to registrants. She can be presenting her market timing instruments that may enable you enhance your buying and selling entries and exits. You will additionally get a follow-up eBook the place Erin covers bear market guidelines. Help Erin and click on HERE to register without spending a dime.

Good Luck & Good Buying and selling!

Carl & Erin Swenlin

Click on right here to register for the recurring free DecisionPoint Buying and selling Room! Try her newest recording:

- Matter: DecisionPoint Buying and selling Room RECORDING

- Begin Time: Feb 28, 2022 09:00 AM

- Assembly Recording Hyperlink.

- Entry Passcode: Feb#twenty eighth

Technical Evaluation is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Useful DecisionPoint Hyperlinks:

DecisionPoint Alert Chart Checklist

DecisionPoint Golden Cross/Silver Cross Index Chart Checklist

DecisionPoint Sector Chart Checklist

Value Momentum Oscillator (PMO)

Swenlin Buying and selling Oscillators (STO-B and STO-V)

DecisionPoint will not be a registered funding advisor. Funding and buying and selling selections are solely your duty. DecisionPoint newsletters, blogs or web site supplies ought to NOT be interpreted as a suggestion or solicitation to purchase or promote any safety or to take any particular motion.

Carl Swenlin is a veteran technical analyst who has been actively engaged in market evaluation since 1981. A pioneer within the creation of on-line technical assets, he was president and founding father of DecisionPoint.com, one of many premier market timing and technical evaluation web sites on the internet. DecisionPoint focuses on inventory market indicators and charting. Since DecisionPoint merged with StockCharts.com in 2013, Carl has served a consulting technical analyst and weblog contributor.

Be taught Extra

Erin Swenlin is a co-founder of the DecisionPoint.com web site alongside along with her father, Carl Swenlin. She launched the DecisionPoint every day weblog in 2009 alongside Carl and now serves as a consulting technical analyst and weblog contributor at StockCharts.com. Erin is an lively Member of the CMT Affiliation. She holds a Grasp’s diploma in Info Useful resource Administration from the Air Pressure Institute of Know-how in addition to a Bachelor’s diploma in Arithmetic from the College of Southern California.