Investing in March is bringing some new challenges to the world. You probably have had huge success in Expertise investing within the final ten years, then this text is for you. I’m making an attempt to divert your consideration to the explosive setup exhibiting up proper now!

Three charts which might be on my should watch checklist are the charts of Copper, Oil and Gold. Discover the similarities of the Copper sample to date to the historic sample in 2005. The prior weekly closing excessive in 2011 was $4.58. In 2021, we tried to interrupt and maintain above that stage however retreated. This week, one other sudden surge appears able to smelt some copper at an all-time excessive. The earlier sample noticed copper triple because it broke out and surged for a 12 months. If that occurs once more, Copper could be $14. My suggestion is that even $7 could be a exceptional surge. Keep tuned, as we are actually proper there proper now.

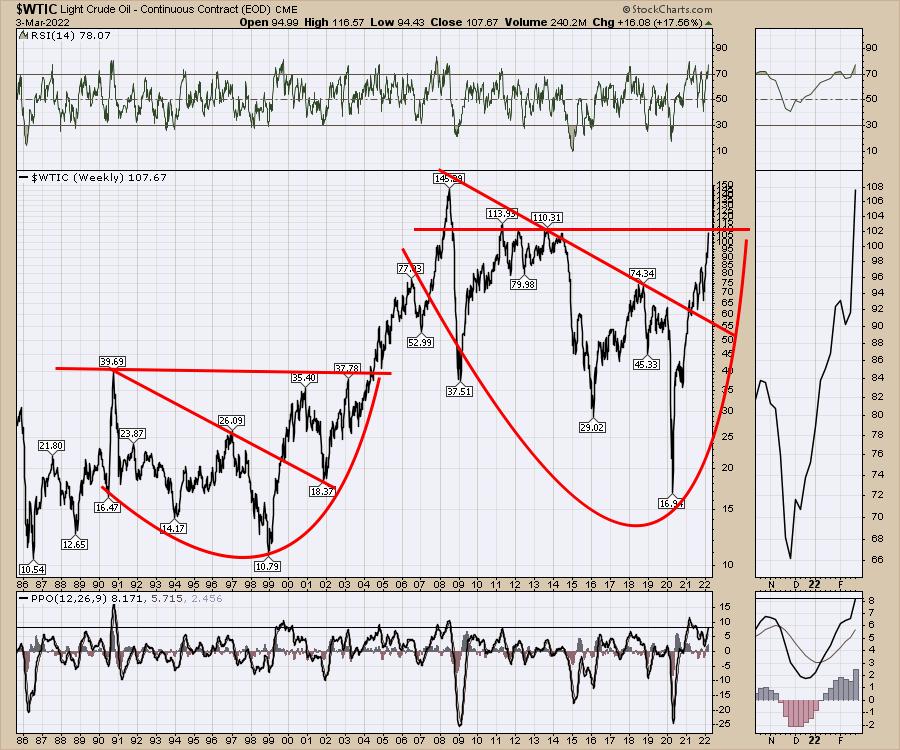

The second chart that’s giving us roughly the identical sample as copper is crude oil. The breakout there was $37 to $145, which was a 4x transfer. That may counsel oil hovering to $440. Okay, even I am unable to get my head round $440, however a double to $220 could be attainable! The earlier breakout was 2005.

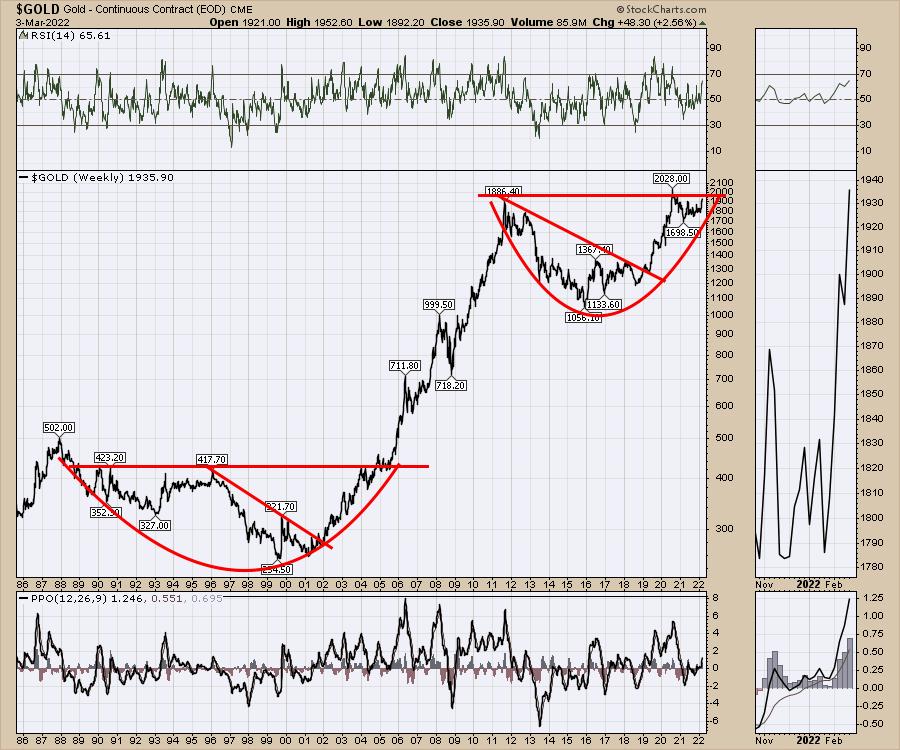

For buyers, the identical sample setup is in Gold. Guess when that breakout occurred. Sure, it was additionally in 2005.

I believe the message may simply be that, in the event you beloved investing in know-how for giant positive aspects, it may be time to look throughout to commodities. I do not suppose it’s a fluke that these large patterns are organising on all of the charts on the similar time, like they did again in 2005.

If you want some assist following commodity-related investing, this is able to be the window to do it. Take a look at the one month starter bundle at OspreyStrategic.org for simply $7. I am fairly certain you may benefit from the journey!

Greg Schnell, CMT, is a Senior Technical Analyst at StockCharts.com specializing in intermarket and commodities evaluation. He’s additionally the co-author of Inventory Charts For Dummies (Wiley, 2018). Based mostly in Calgary, Greg is a board member of the Canadian Society of Technical Analysts (CSTA) and the chairman of the CSTA Calgary chapter. He’s an energetic member of each the CMT Affiliation and the Worldwide Federation of Technical Analysts (IFTA).