Russia’s invasion of Ukraine has laid naked all of the misguided, naïve insurance policies our “leaders” have foisted upon us within the final 18 months.

Among the many extra silly insurance policies enacted by U.S. policymakers is the concept that the U.S. ought to NOT be vitality impartial however ought to depend on outdoors sources for oil.

Inside days of taking workplace, President Biden ended the event of the Keystone XL Pipeline whereas placing an indefinite pause on new oil and pure fuel leases on public lands.

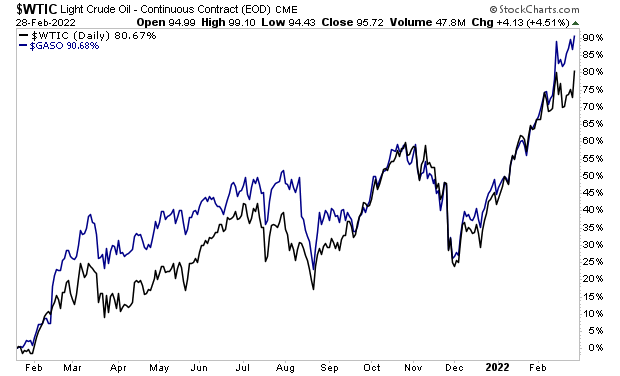

Months later he was asking OPEC to extend manufacturing of oil as a result of oil and gasoline costs skyrocketed. So far, fuel is up over 90% through the Biden Presidency, whereas oil is shut behind at 80%.

Perhaps we shouldn’t depend on international locations that profit from increased oil costs for our vitality wants? Perhaps these Govt Orders weren’t such a good suggestion? Perhaps we must always have individuals working our vitality coverage who truly know what number of barrels of oil the U.S. customers per day?

The icing on this cake of incompetence is the truth that the U.S. is instantly financing Russia’s invasion of Ukraine. Russia provides 7% of the U.S.’s vitality wants. We are actually sending cash to Putin each single day of the week… whereas calling him a monster. Perhaps we must always… cease shopping for oil from him!?!

As misguided because the Biden White Home has been about vitality coverage, Europe’s leaders make it seems to be a bunch of geniuses. To that impact, Europe has been shutting down nuclear energy crops and different sources of home vitality manufacturing for years… all whereas signing offers with Vladimir Putin to provide its vitality wants.

At present Russia provides ~40% of Europe’s fuel and greater than 25% of its oil.

How insane, or corrupt, or just ignorant do it’s important to be to close down home vitality manufacturing and hand your vitality wants over to Vladimir Putin? A kindergartener might let you know this was a dumb concept. However Europe’s elites signed off on it.

The tip consequence?

Oil is above $100 a barrel for the primary time since 2014. And there’s little if any indicators it’s not going a lot increased.

That is going to set off a world recession… which in flip will set off a market crash.

The world financial system which was already fragile resulting from roaring inflation and provide chain points will now be contending with an vitality disaster. How do you assume the financial system will deal with $100 oil when inflation was already at main downside when oil was at $80 a barrel?

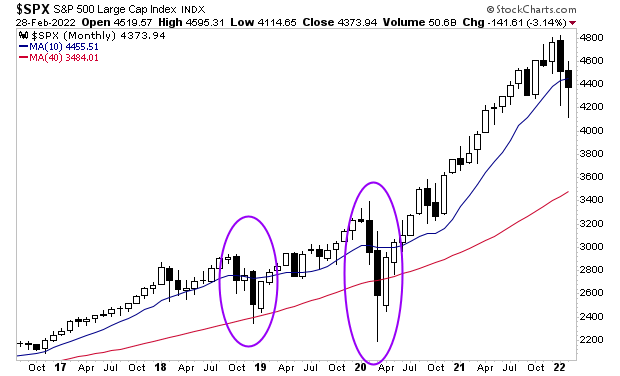

Shares know what’s coming, as they’ve already damaged beneath their 10-month transferring common (MMA). The final two instances this occurred, the market ended up testing its 40-month transferring common quickly after (see the purple circles beneath).

Meaning the S&P 500 falling to three,450 or so.