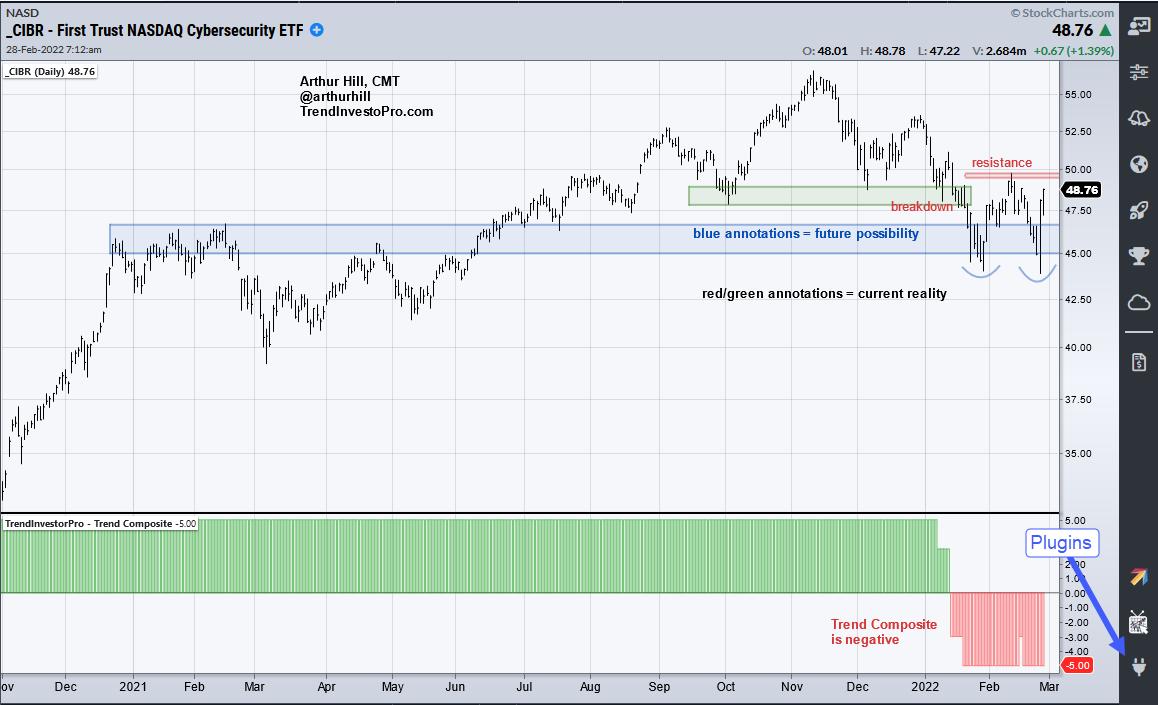

The chart beneath reveals the Cybersecurity ETF (CIBR) with two units of annotations: a future risk and the present actuality. The longer term risk reveals {that a} bullish reversal could possibly be within the making because the ETF held the January low and surged late final week. The present actuality, nevertheless, is a downtrend that has but to be reversed.

The chart beneath reveals the Cybersecurity ETF (CIBR) with two units of annotations: a future risk and the present actuality. The longer term risk reveals {that a} bullish reversal could possibly be within the making because the ETF held the January low and surged late final week. The present actuality, nevertheless, is a downtrend that has but to be reversed.

The blue annotations present a attainable assist zone that stems from damaged resistance (45-46 space). It’s also clear that the decline from the November excessive to the Jan-Feb lows retraced round 2/3 of the prior advance (March low to November excessive). Thus, now we have a traditional retracement and a return to damaged resistance break, which suggests this could possibly be a correction.

Although CIBR discovered assist and surged late late week, it has but to reverse the rapid downtrend by breaking above a previous excessive. Additionally be aware that the Development Composite turned bearish in mid January and value broke assist on 21-January (inexperienced zone). The Development Composite sign and breakdown are the dominant chart options. The purple shading reveals resistance and a break above this stage is required to reverse the rapid downtrend. Thus, the downtrend is in drive till confirmed in any other case.

Just lately at TrendInvestorPro we recognized new bullish Development Composite indicators in two commodity-related ETFs. The weekend video additionally confirmed a bullish setup in an Aerospace & Protection ETF and a short-term breakout in a Clear Power ETF. Click on right here to study extra and achieve rapid entry.

The Development Composite is considered one of 11 indicators within the TrendInvestorPro Indicator Edge Plugin for StockCharts ACP. Different indicators embrace the Momentum Composite and ATR Trailing Cease. Click on right here to study extra

—————————————————

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic method of figuring out development, discovering indicators throughout the development, and setting key value ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise College at Metropolis College in London.