Russia’s invasion of Ukraine is anticipated to create a sudden scarcity of key merchandise within the U.S. that, in flip, will worsen already excessive inflation charges. A tough-pressed Federal Reserve will now have to stop shopper costs from rising uncontrolled whereas reducing their charge hikes within the face of geopolitical turmoil. The danger of disruption to a U.S. financial restoration that is already been hampered by new variants of COVID-19 is actual.

There could also be a silver lining for traders in a number of areas, nevertheless, as rising costs imply a rise in choose underlying securities. Whereas Russia accounts for under 0.1% of gross sales to corporations within the S&P 500, the nation controls massive segments of the commodity markets that are already experiencing low inventories worldwide.

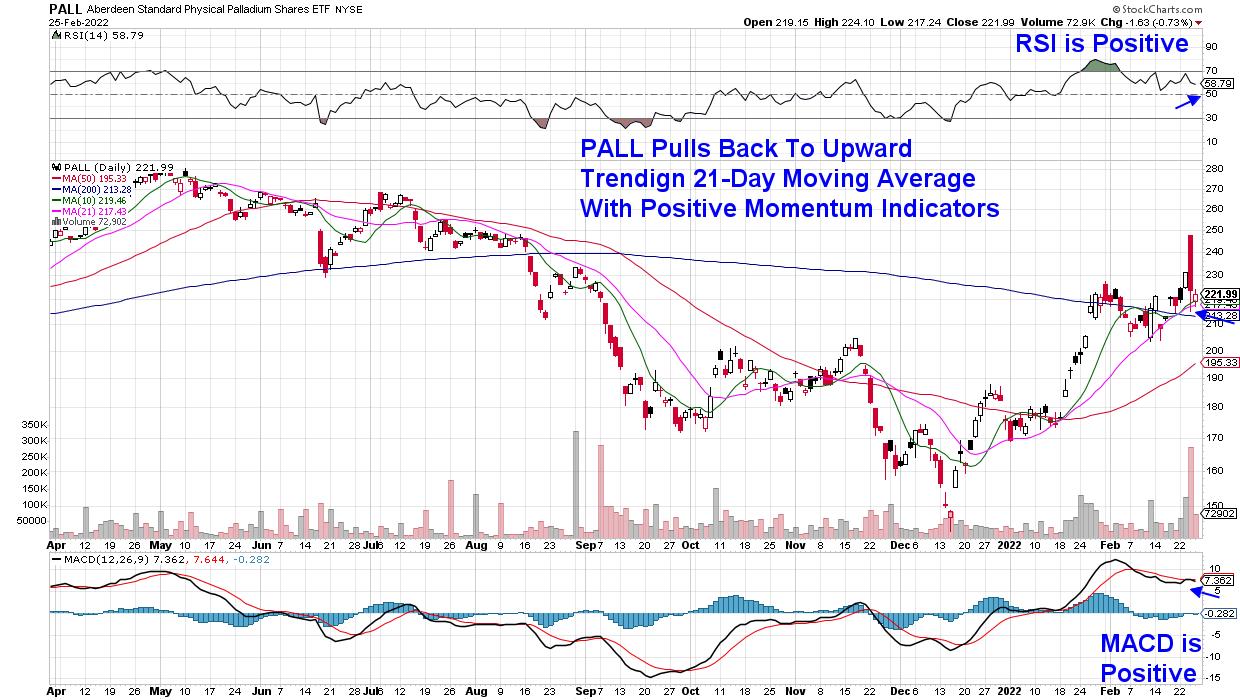

DAILY CHART OF PALLADIUM SHARES ETF (PALL)

To start, the nation dominates the market within the mining of platinum and palladium; each metals are used extensively in vehicles, in addition to different industrial markets. One of many largest ETFs, PALL, is proven above; it has pulled again to its upward trending 21-day transferring common with each its RSI and MACD in optimistic territory.

Platinum and palladium costs have rallied for the reason that begin of this 12 months, and their steep rise in worth could be anticipated to proceed ought to the Ukraine state of affairs worsen.

DAILY CHART OF ALCOA CORP. (AA)

Russia accounted for six% of world aluminum and 5% of nickel provide in 2021 and, final week, aluminum costs hit an all-time excessive whereas nickel reached a decade-plus excessive. In response to JPMorgan, inventories of those base metals are already extraordinarily low, which leaves “little or no extra cushion for additional provide disruptions.”

Alcoa (AA) produces and sells aluminum merchandise globally, with their main prospects within the transportation, development and packaging markets. The corporate reported This fall outcomes that have been 23% above estimates, with administration anticipating continued progress into the rest of this 12 months. AA is transferring again into an overbought place and might be purchased on a pullback.

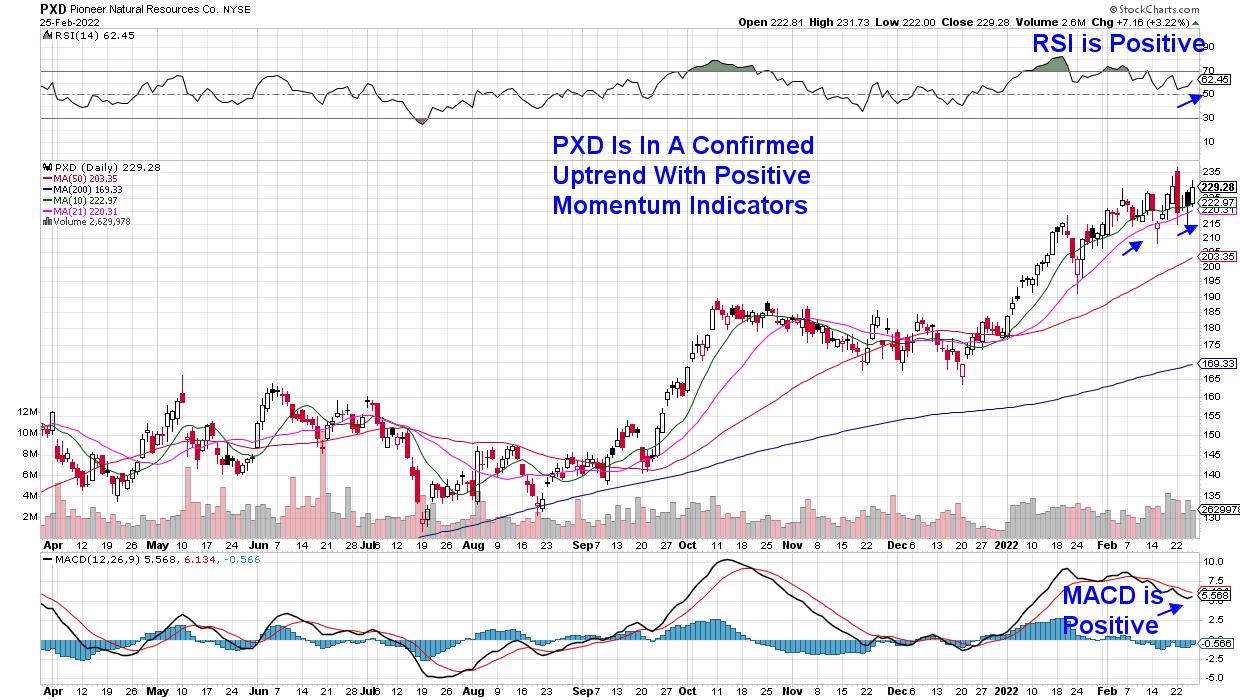

DAILY CHART OF PIONEER NATURAL RESOURCES CO. (PXD)

Russia is the third-largest producer of oil on this planet, and any disruption to their manufacturing volumes will proceed to impression already-high oil costs. Power shares, which had already been on the rise as a result of elevated oil demand, stay in an uptrend.

Pioneer Pure Sources (PXD) produces oil and fuel within the Midland Basin in West Texas and is among the many fastest-growing corporations based mostly on their most up-to-date quarterly earnings and gross sales outcomes. PXD additionally presents a 2.5% yield and lately elevated their share repurchase program as a result of excessive free money circulate and low debt.

The inventory is amongst a number of Oil corporations that have been added to the Recommended Holdings Listing of my MEM Edge Report in January. I intend so as to add an extra Power inventory to this twice-weekly report on Sunday that you simply will not need to miss, in addition to detailed evaluation of the broader markets that will even be included.

It has been a turbulent interval for the markets and you will need knowledgeable steerage throughout these making an attempt instances. Use this hyperlink right here to trial my MEM Edge Report for 4 weeks at a nominal price.

On this week’s version of StockCharts TV’s The MEM Edge, I evaluation the broader markets following the sharp rally into the week’s shut. I additionally share sizzling spot areas and shares being pushed into uptrends because of the battle between Russia and Ukraine.

Warmly,

Mary Ellen McGonagle, MEM Funding Analysis

Mary Ellen McGonagle is an expert investing marketing consultant and the president of MEM Funding Analysis. After eight years of engaged on Wall Avenue, Ms. McGonagle left to grow to be a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with shoppers that span the globe, together with massive names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Be taught Extra