The S&P 500 is now “formally in correction territory” I’ve been instructed by the TV. Good to know, though for a lot of shares the bear market began a yr in the past – particularly the type of shares your nephew in school started buying and selling in the course of the pandemic. However now it’s the true factor – index-level correction. Apple, Microsoft, Residence Depot’s down 120 factors from its excessive, BlackRock’s down 200 factors. The declines in these vital shares weren’t attributable to a change within the fundamentals. They’ve been attributable to the investor class’s notion of the near-term outlook for shares usually. And a few mechanical market stuff, like program buying and selling and choices market making, and many others.

Final night time’s opening salvo of rocket and missile strikes despatched S&P 500 futures plunging and the costs of commodities skyrocketing. Shares are falling around the globe as crude takes out $100 a barrel, pure gasoline costs explode greater in spot markets from the US to Europe and the Fed’s job turns into considerably tougher. Right here’s Goldman Sachs’s Jan Hatzius explaining why the speed hikes are nonetheless coming whatever the onset of conflict – however the 50 foundation level hike in March is perhaps off the desk:

“The present scenario is totally different from previous episodes when geopolitical occasions led the Fed to delay tightening or ease as a result of inflation danger has created a stronger and extra pressing cause for the Fed to tighten as we speak than existed in previous episodes…With some indicators of problematic wage-price dynamics rising and near-term inflation expectations already excessive, additional will increase in commodity costs is perhaps extra worrisome than normal. In consequence, we don’t anticipate geopolitical danger to cease the FOMC from mountaineering steadily by 25bp at its upcoming conferences, although we do suppose that geopolitical uncertainty additional lowers the chances of a 50bp hike in March.”

Sounds about proper.

Now, every part I’ve simply talked about is totally out of your management. There’s nothing you are able to do about it. You may’t cease it. You may’t handle it. And I promise you that no matter what occurs along with your portfolio this week, month, quarter, you wouldn’t commerce locations with a household residing in Kyiv who could should ship a son or a father off to struggle. Who could should scramble to arrange a family for meals and power shortages within the coming days. So slightly perspective could also be so as.

In moments like these, and there have been dozens of them all through the course of my profession, I spend my time reminding people who the one reply is to deal with the issues they will management. These items embody their very own response. Retaining their financial savings charge the place it’s. Sustaining the disciplined funding technique they’ve already received in place. Staying calm. Pondering by way of alternative tomorrow versus volatility as we speak. It really works, however it’s a must to make it work. It takes effort to do that. Expertise helps. Temperament helps. Having the principles established prematurely helps. Such a market is exactly why we make the most of tactical asset administration alongside strategic asset allocation. Each are needed.

I wrote this publish two weeks earlier than the market bottomed in March 2020 in the course of the onset of coronavirus. All of it nonetheless applies. Return and browse it once more: I’m right here to remind you

If it helped you then, it can make it easier to now.

Lastly, I wish to finish on a hopeful notice, with slightly little bit of assist from one in all my favourite strategists on Wall Road, BMO’s Brian Belski. Right here’s what he put out to purchasers this morning:

A Market Correction Has Been Lengthy Overdue

The S&P 500 has exhibited a value correction each 362 calendar days, on common, or roughly one yr.

It has been almost 22 months because the index final skilled a correction, making a ten% drawdown lengthy overdue primarily based on historical past.

Most Corrections Do Not Morph Into Bear Markets

We recognized 29 S&P 500 value corrections going again to 1970. The height-to-trough decline exceeded 20% simply seven occasions, whereas the index prevented a bear market in the course of the different 22 intervals.

Period of Corrections Could Differ, however on Common Lasts Much less Than 4 Months

The common S&P 500 correction lasts 110 calendar days or simply underneath 4 months with the longest being 531 days and shortest solely 13 days.

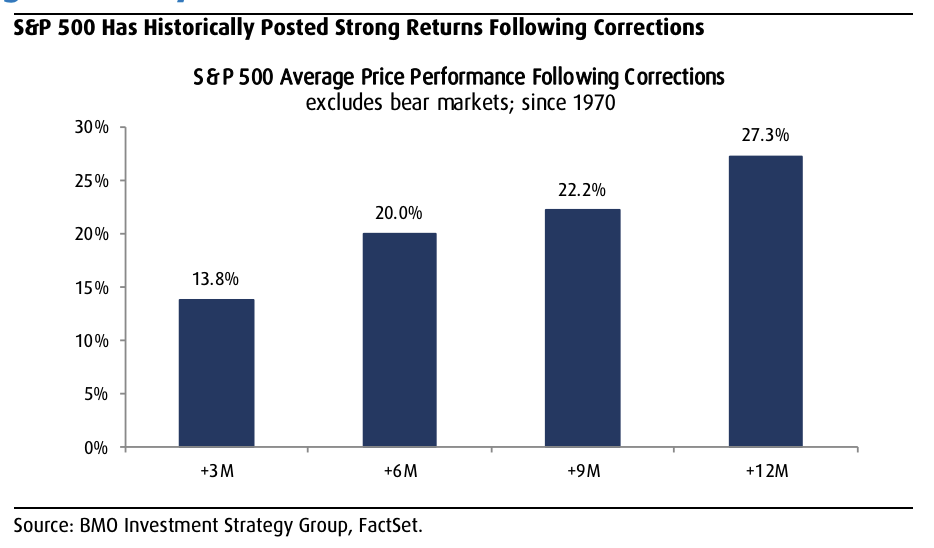

S&P 500 Efficiency Can Rebound Following Drawdown Intervals

Following the top of non-bear market value corrections, the S&P 500 index has rebounded 13.8%, on common, within the subsequent three-month interval and logged a mean achieve of twenty-two.2% within the subsequent 9 months.

Supply:

US Technique Snapshot: Correction and Battle Combo Lastly Testing the Bull

BMO Capital Markets – February twenty third, 2022

Josh right here – it’s tempting to suppose this time is perhaps totally different. And certain, some elements of it is going to be. However persons are nonetheless individuals. And the way in which they’ve gotten over previous crises would be the manner they recover from present crises and future crises. These items slowly low cost themselves into the consensus after which, finally, develop into a part of the backdrop slightly than the driving power of every day’s market exercise. We’ve a brief consideration span. We adapt. We get by way of it.

Brian’s chart is the fact of what comes subsequent. Till then, deal with what you may management.