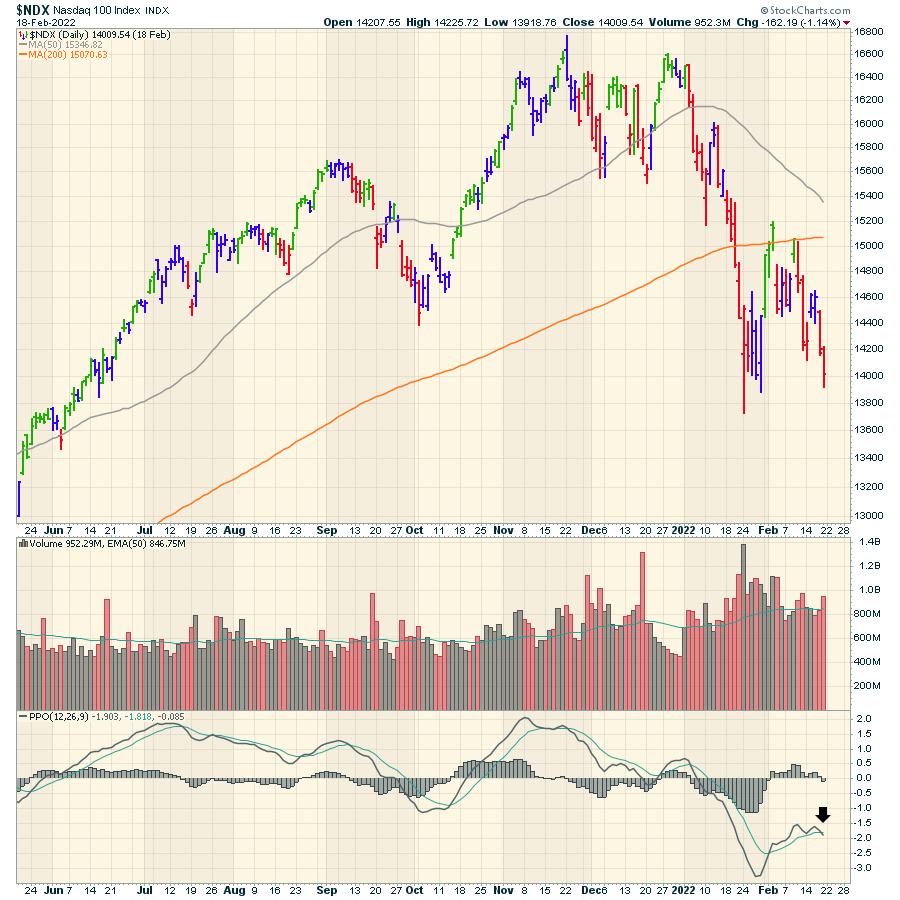

The chart beneath from Friday for the Nasdaq Composite is terribly weak. A couple of bearish factors of curiosity are on the chart.

- The 50-day transferring common (DMA) is transferring beneath the 200 DMA proven within the circle. That is not good.

- After the index broke beneath assist on the black line, it has been a uneven mess. Discover how easy the worth transfer was in October and most of November. The month of February has been a really uneven mess.

- Now the PPO momentum indicator is rolling over beneath zero. That’s actually weak. It’s going to want some consumers to step in because the Nasdaq 100 is on the January lows.

The Nasdaq 100 closed Friday probing the low of January. Friday’s shut had all the standard situations for the market to push decrease with a PPO crossing the sign line beneath zero. The 50 DMA nonetheless has just a little room to maneuver right down to cross beneath the 200 DMA.

Friday’s $SPX additionally acquired a PPO momentum crossing the sign line beneath zero. This was a really weak restoration to the January selloff by way of momentum.

Clearly there are many weak charts on the market, however I discovered this one significantly beautiful. That is the Nasdaq advance/decline line ($NAAD) proven three other ways.

The highest panel reveals the Nasdaq 100 chart.

- The second panel reveals an 11-day transferring common of the Advance/decline line. Discover how this panel continues to make decrease lows by 2021 and 2022.

- The third panel reveals a cumulative view. It’s close to 5-year lows in simply 8 months, though the index is simply down 15%! The second wonderful factor is have a look at the size on the appropriate hand aspect. This was at 60000 and now it’s merely 12000. The calculation for that is subtracting/including the distinction between the full variety of up shares and the full variety of down shares. This single quantity – the web difference- is added or subtracted to this cumulative whole every day. Since July, we’ve had a complete of 46000 extra ‘transfer downs’ than ‘strikes up’. That’s surprising to me. Additionally, have a look at the plummeting line during the last six months.

- The underside panel is the every day $NAAD distinction.

We’ll want to begin seeing some type of divergence or not less than a stalling of this excessive promoting momentum to get some structural energy out there.

Commerce cautiously. Wars involving superpowers and NATO are usually not normally over shortly. That ought to most likely be added to our buying and selling plan for the 12 months.

Greg Schnell, CMT, is a Senior Technical Analyst at StockCharts.com specializing in intermarket and commodities evaluation. He’s additionally the co-author of Inventory Charts For Dummies (Wiley, 2018). Based mostly in Calgary, Greg is a board member of the Canadian Society of Technical Analysts (CSTA) and the chairman of the CSTA Calgary chapter. He’s an lively member of each the CMT Affiliation and the Worldwide Federation of Technical Analysts (IFTA).