SPX Monitoring Functions: Lined 1/24/22 open 4356.32=7.57%; Quick SPX 1/11/22 at 4713.07.

Monitoring Functions GOLD: Lengthy GDX on 10/9/20 at 40.78.

Lengthy Time period SPX Monitor Functions: Impartial

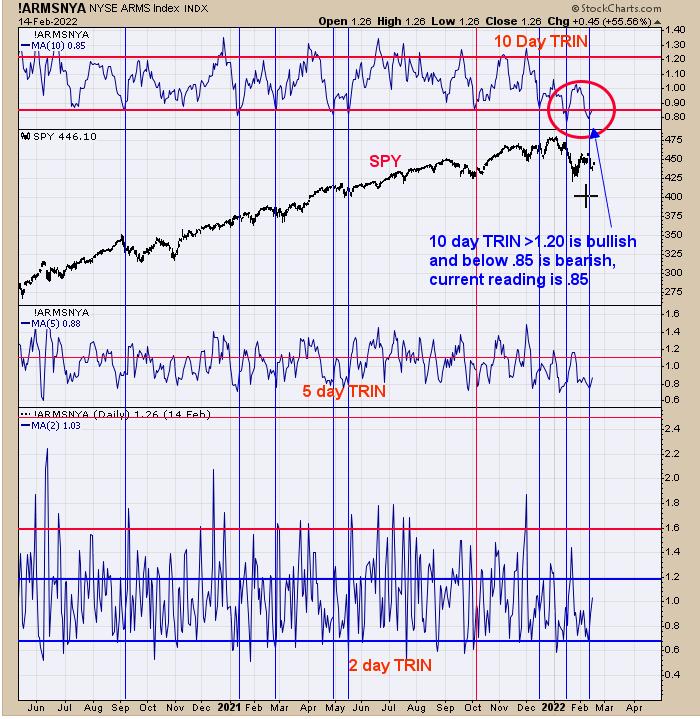

We up to date this chart from yesterday, after we stated “we’re of the opinion that the 1/24/22 low will likely be examined. For that to occur, the 10-day TRIN ought to attain above 1.20. The ten-day TRIN at present stands at .83. TRIN closes above 1.20 are the place panic kinds and panic are what market bottoms are made from. With out panic, there aren’t any bottoms. The two-day “Charge of Change” (web page 2) suggests a brief time period bounce is close to. We are going to watch how the potential bounce performs and will find yourself with a short-term promote sign for a goal to the 1/24/22 low.” Not a lot so as to add right here, however 10-day TRIN moved to .85 and continues to be bearish. Staying impartial for now.

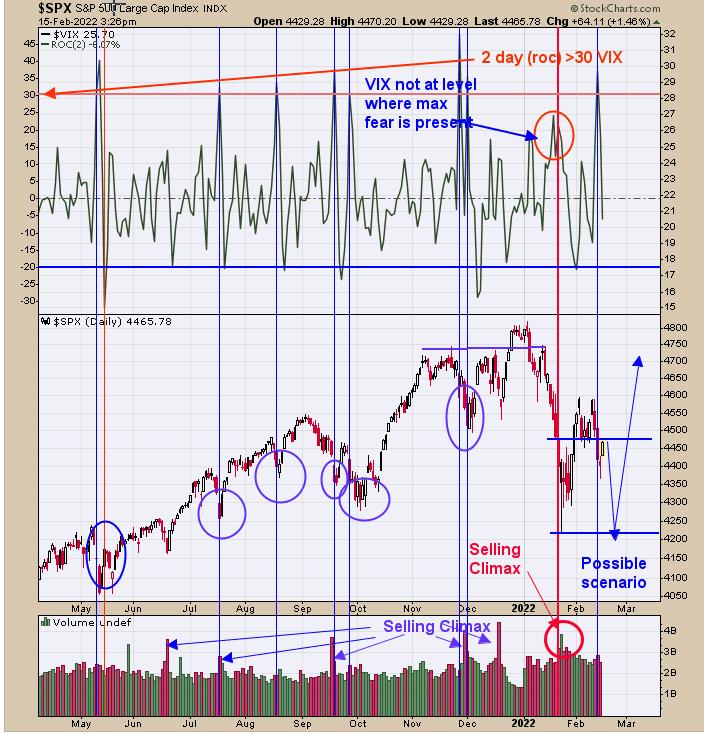

Yesterdayl we stated “at this time’s decline pushed the two-day ‘Charge of Change’ for the VIX above 30, displaying VIX going up too quick, which is an indication of panic. The underside window is the two-period Charge of Change for the VIX. When this indicator reaches above 30, the market is not less than close to a bounce space.” The two-period Charge of Change is within the high window and the bounce available in the market has began. We do not assume this potential bounce will go far, as there may be resistance on the earlier lows close to the 4500 SPX vary. Right now’s quantity can be comparatively mild, suggesting upside power is weak. That is the week of Choices Expiration, which has a bullish bias, and the market may maintain up this week. We nonetheless anticipate the “Promoting Climax” low of 1/24/22 to be examined, however most likely not this week; subsequent week is extra doubtless.

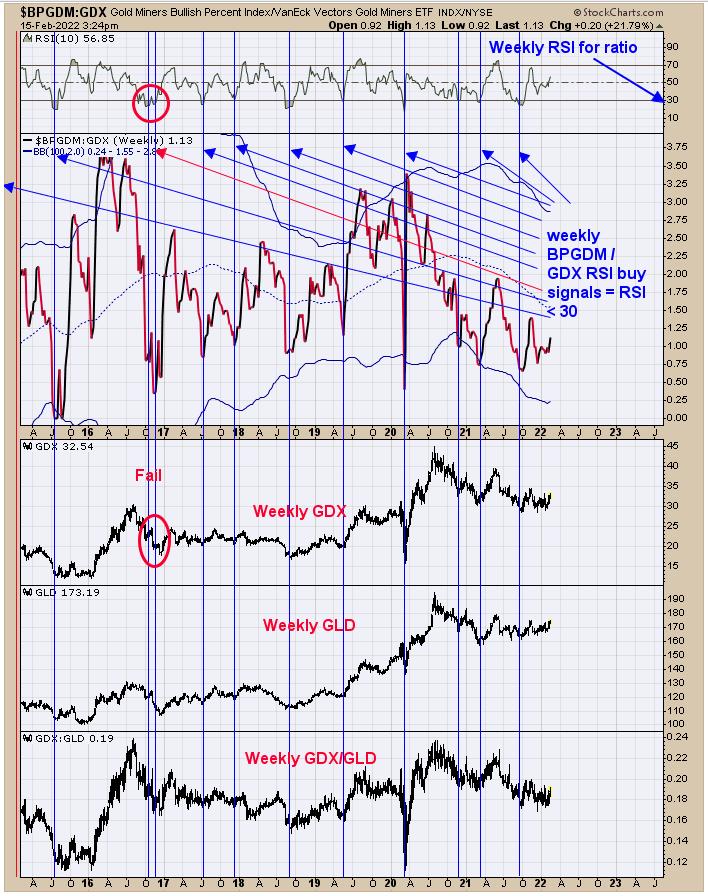

We offered this chart again final September. The chart above is the weekly Bullish P.c index for the Gold Miners index/GDX ratio. The highest window is the RSI for this ratio. The Bullish P.c Index measures the p.c of shares within the Gold Miners index which might be on Level & Determine purchase alerts. Bullish alerts are generated when this RSI for this ratio drops under 30. The RSI dropped under 30 late September and we pointed that out on our report. Since September, GDX moved sideways however by no means touched the September low, although it got here shut in December. Since mid-2015 there have been 10 alerts with one failure in late 2016, making a 90% success price. Most alerts lasted a number of months and a few final 6 months or longer. The sideways-to-down consolidation from August 2020 could also be ending and a multi-month rally has begun.

Tim Ord,

Editor

www.ord-oracle.com. New Guide launch “The Secret Science of Worth and Quantity” by Timothy Ord, purchase at www.Amazon.com.