Studying to handle enterprise taxes successfully is important to succeed as an entrepreneur.

In any other case, you would possibly get hit with an unexpectedly massive tax invoice. That may be sufficient to sink your organization.

Even worse, failing to adjust to tax legal guidelines can result in authorized hassle. Establishments accountable for tax assortment don’t mess around.

That’s why right now we need to focus on the right way to handle taxes as a enterprise proprietor!

Which Nation Ought to You Register Your Enterprise in?

If you wish to begin a location-independent enterprise, think about the place to base it.

Essentially the most easy possibility is to register your organization in your house nation, assuming that it’s economically and politically secure.

Nonetheless, it would make sense to buy round for the perfect tax charges and different perks:

- Europe: Malta, Spain, Portugal, Estonia, Norway, and different international locations provide digital nomad visas designed to draw distant staff, freelancers, and entrepreneurs. This will present a chance to dwell and journey in Europe.

- Asia: Hong Kong and Singapore have lengthy been in style amongst entrepreneurs resulting from their interesting tax policies-something to think about for those who love Asia and spend quite a lot of time there.

- Center East: The United Arab Emirates presents a 0% tax charge for private earnings and a 0–9% tax charge for company earnings. Lately, many entrepreneurs have determined to register their firms there and make Dubai their house base resulting from low crime, a sunny local weather, and an thrilling social scene.

Lastly, suppose you propose to pitch your small business concept to buyers and lift capital. In that case, you would possibly need to register your organization in the USA, even for those who aren’t American.

In any case, in response to the “International Startup Ecosystem Report 2024”, the #1 startup ecosystem on the planet is Silicon Valley. In the meantime, New York and London are tied for the second and third place and Los Angeles and Tel Aviv are tied for the fourth and fifth. Of the highest 20 startup ecosystems on the planet, 9 are situated in the USA!

Learn how to Successfully Handle Enterprise Taxes in the USA

Step #1: Resolve The place to Register Your Enterprise

All companies in the USA are topic to federal tax legal guidelines.

Nonetheless, there are additionally state, county, and even metropolis taxes that you must think about when contemplating the place to register your organization.

Along with that, you additionally need to analysis state and native legal guidelines associated to your trade, together with the mandatory rules, permits, and so forth.

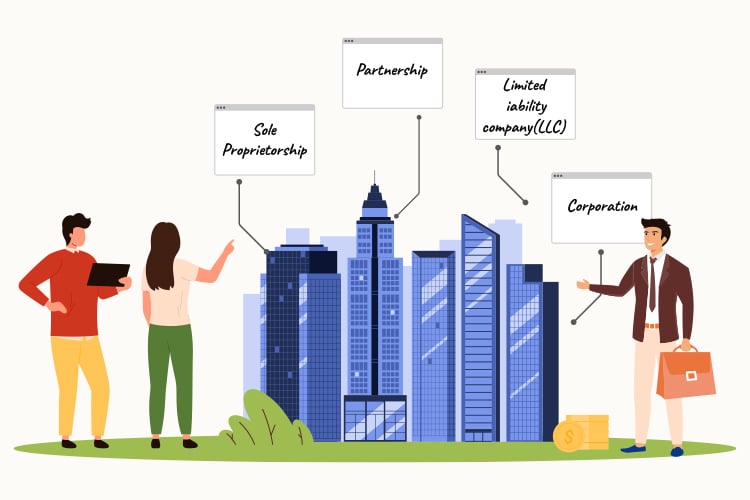

Step #2: Select a Enterprise Construction

The only proprietorship is probably the most easy enterprise construction, making it interesting to first-time entrepreneurs simply beginning out.

Nonetheless, this construction doesn’t separate your belongings from your small business belongings, which means you may be held personally accountable for money owed, damages, and different enterprise obligations.

That’s why we advocate registering a restricted legal responsibility firm (LLC) as an alternative, even in case you are a solopreneur. It’ll allow you to guard your belongings within the case of lawsuits or chapter!

Step #3: Get an EIN if You Want One

EIN stands for Employer Identification Quantity.

IRS has a questionnaire that may provide help to decide for those who want an EIN and detailed directions on making use of for it.

Step #4: Get a State Tax ID if You Want One

You would possibly want a state tax ID to pay state and native taxes. Examine with the state authorities to be taught extra.

Step #5: Get the Required Licenses and Permits

You would possibly want numerous federal, state, and native licenses and permits to function your small business. Ensure that to analysis this so that you simply received’t miss something!

Step #6: Spend money on Good Bookkeeping Software program

Relating to bookkeeping software program, Freshbooks and QuickBooks are the 2 hottest choices.

Freshbooks is arguably higher for many freelancers, solopreneurs, and small enterprise house owners. If your organization’s funds are easy, this app has the whole lot you want.

QuickBooks is a more sensible choice for companies with advanced funds resulting from its pricing construction, product and repair vary, and organizational scale. It presents numerous superior options, lots of of integrations, and 24/7 group help.

We advocate beginning with Freshbooks and solely transferring to QuickBooks if there’s a real want for that as a result of its sophistication may be overkill.

Step #7: Study the Fundamentals of Bookkeeping

It’s a good suggestion to be taught the fundamentals of bookkeeping.

In any other case, you would possibly file enterprise transactions incorrectly, resulting in messy books that you’ll both have to scrub up your self or pay somebody to scrub up.

Additionally, keep in mind that not understanding bookkeeping makes you weak to theft. When you rent knowledgeable to maintain your organization’s books, you need to have the ability to double-check their work.

Positive, realizing the fundamentals received’t be sufficient to uncover advanced fraud. Nonetheless, it might probably provide help to spot inconsistencies, particularly in case your bookkeeper is stealing cash with out bothering to cowl their tracks. This occurs extra usually than you would possibly assume!

Step #8: Familiarize Your self With Enterprise Taxes

IRS lists 5 basic varieties of enterprise taxes:

- Earnings tax

- Estimated taxes

- Self-employment taxes

- Employment taxes

- Excise taxes

Which of those taxes you’ll have to pay will depend upon numerous components, together with the construction of your small business, the variety of staff, the services you promote, and so forth.

Step #9: Rent a Good Tax Accountant!

In idea, you possibly can get monetary savings by submitting your small business taxes, however in follow, it may cost a little you extra. How so?

It’s really easy to neglect one thing, fill out some kind incorrectly, or make a mistake. That may result in every kind of issues down the highway, doubtlessly even authorized hassle.

That’s why we extremely advocate hiring a tax accountant to arrange and file your small business taxes, particularly if you aren’t detail-oriented.

Relying on the enterprise kind, complexity, and dimension, it’s going to value you someplace between a number of hundred and some thousand {dollars}. Consider it as an funding in your peace of thoughts!

Is Avoiding Taxes Price it?

Entrepreneurs usually really feel they need to optimize their tax technique by exploiting tax loopholes. However is that the perfect use of your assets?

Our good friend Alex Hormozi argues that it isn’t. In any case, many of the so-called “tax avoidance” techniques are tax evasion techniques. In different phrases, they’re unlawful.

It’ll take you so lengthy to sift by means of all of the shady stuff to search out one thing authorized that works that you simply would possibly as effectively use that point to earn more money as an alternative of merely.

Within the video beneath, Alex shares a narrative of how one among his buddies flew to Puerto Rico and again each weekend to get a greater tax charge. That’s 102 flights per yr. Fairly loopy!

Wish to Study Learn how to Construct Gross sales Funnels That CONVERT?

Our co-founder Russell Brunson used gross sales funnels to take ClickFunnels from zero to $100M+ in annual income in lower than a decade.

He’s now extensively thought-about to be one of many high gross sales funnel consultants on the planet. Wish to be taught from him?

His best-selling guide “DotCom Secrets and techniques” is the perfect place to begin as a result of it covers the whole lot it is advisable to know to be able to construct gross sales funnels that convert.

This guide is out there on Amazon the place it has over 2,500 international rankings and a 4.7-star general score.

However you may as well get it immediately from us at no cost…

All we ask is that you simply pay for transport!

So what are you ready for? 🧐

Get “DotCom Secrets and techniques” for FREE!