Can a company rightfully be referred to as a “nonprofit” if it virtually all the time makes cash? And what if most of that group’s earnings comes from “enterprise earnings,” ought to it legitimately be thought-about a “charity”?

These are the questions lawmakers ought to ask of the greater than 218,000 organizations and entities which were designated as 501(c)(3) taxA tax is a compulsory fee or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of common authorities providers, items, and actions.

-exempt nonprofit organizations.

(And that’s coming from a nonprofit group—Tax Basis itself is organized as a 501(c)(3).)

Based mostly on IRS information, 501(c)(3) tax-exempt nonprofit organizations have by no means been financially more healthy than they’re immediately. In 2019, the most recent information accessible, revenues from charitable donations reached a document excessive in each nominal and inflationInflation is when the final value of products and providers will increase throughout the financial system, lowering the buying energy of a forex and the worth of sure belongings. The identical paycheck covers much less items, providers, and payments. It’s generally known as a “hidden tax,” because it leaves taxpayers much less well-off on account of larger prices and “bracket creep,” whereas rising the federal government’s spending energy.

-adjusted phrases.

Furthermore, whole revenues—together with authorities grants and program service earnings—additionally reached document ranges. Whole nonprofit revenues now equal 12 % of GDP.

IRS information additionally signifies that within the 31 years between 1988 and 2019, the nonprofit sector has suffered only one 12 months of deficits, in 2008. Adjusted for inflation, sector surpluses have averaged $110 billion per 12 months over the previous three a long time.

And the variety of nonprofits has grown steadily over the previous 30 years, from 124,233 in 1988 to 218,516 in 2019, a rise of practically 100,000 new tax-exempt nonprofit organizations. Clearly, the business appears fairly resilient.

TCJA Did Not Trigger a Stoop in Charitable Giving

Regardless of the document earnings and document “earnings” nonprofits have loved currently, some members of Congress have joined with main charitable organizations in calling for an above-the-line charitable deduction in response to the notion that the 2017 Tax Cuts and Jobs Act (TCJA)The Tax Cuts and Jobs Act in 2017 overhauled the federal tax code by reforming particular person and enterprise taxes. It was pro-growth reform, considerably reducing marginal tax charges and price of capital. We estimated it lowered federal income by .47 trillion over 10 years earlier than accounting for financial development.

damped the tax advantages of charitable giving.

Advocates declare TCJA’s close to doubling of the customary deductionThe usual deduction reduces a taxpayer’s taxable earnings by a set quantity decided by the federal government. It was practically doubled for all courses of filers by the 2017 Tax Cuts and Jobs Act as an incentive for taxpayers to not itemize deductions when submitting their federal earnings taxes.

has impacted charitable giving. The elevated worth of the usual deduction dramatically lowered the variety of taxpayers who wanted to itemize their deductions, from 38 million in 2017 to 15 million in 2018, a 60 % decline. Advocates fear that as a result of fewer taxpayers itemize, fewer are incentivized by the tax good thing about giving charitably.

IRS information refutes this. The close by desk exhibits that charitable contributions and whole nonprofit revenues had been each larger in 2018 and 2019 than in 2016 in inflation adjusted {dollars}. Some could level to the truth that charitable giving in 2018 was lower than in 2017. However 2017 was an anomaly as many taxpayers elevated their charitable contributions to make the most of the upper earnings tax charges earlier than TCJA lower charges the next 12 months. At greatest, 2017 represents a shift in giving from the longer term to the current, not a benchmark to match post-TCJA donations.

The extra correct comparability is to 2016, the 12 months earlier than TCJA was enacted. Certainly, charitable contributions in 2019 are 11 % larger than 2016 ranges, clearly not a hunch in donations due to the elevated customary deduction.

Thirty Years of Nonprofit Progress

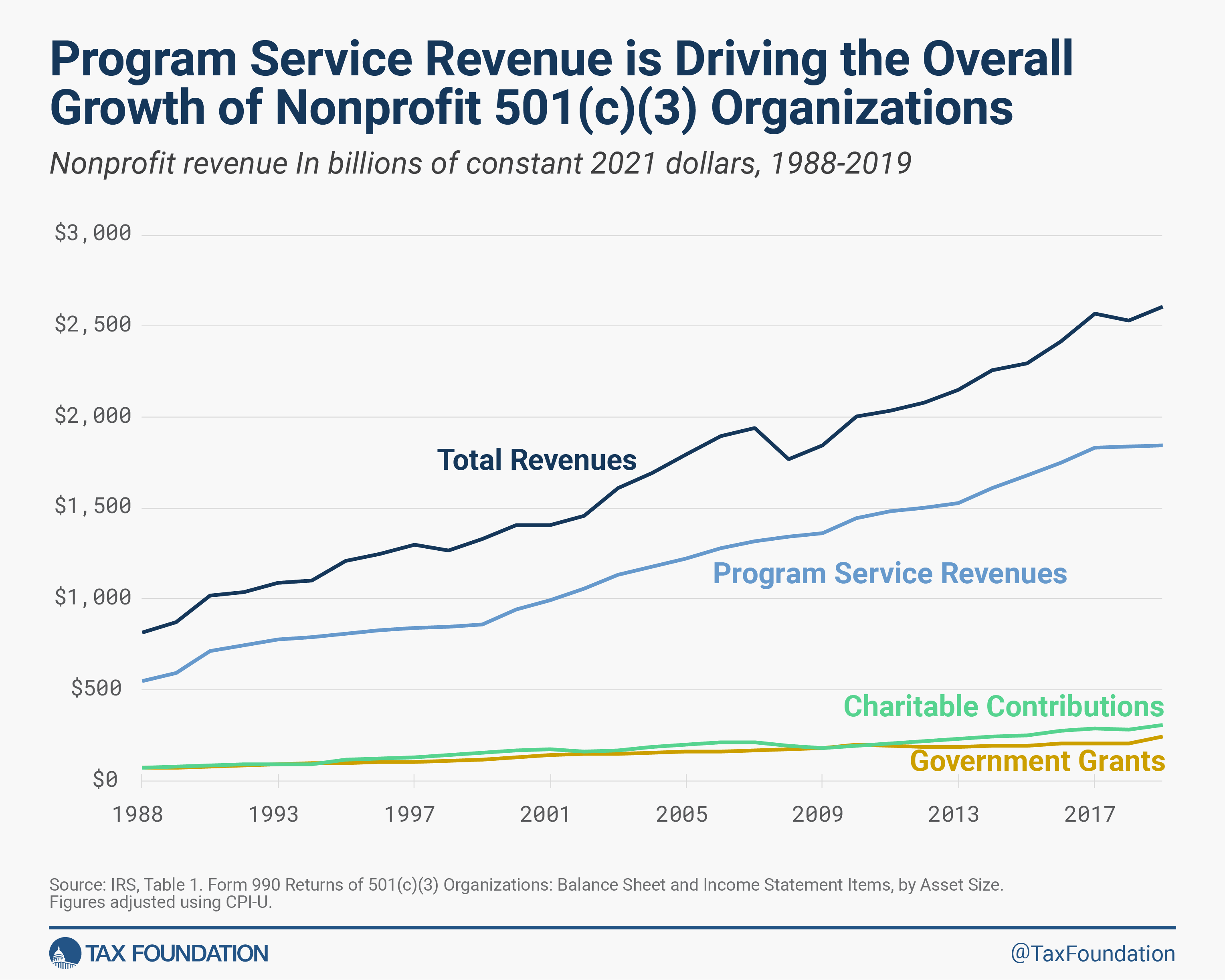

IRS information exhibits that tax-exempt nonprofits have completed very effectively over the previous thirty years. The close by chart illustrates that between 1988 and 2019, charitable contributions grew in actual phrases by greater than 300 %, from $74 billion to $305 billion, outpacing the expansion in authorities grants. Whereas charitable contributions have ebbed and flowed through the years with the financial system, the trail has been upward regardless of the various tax code adjustments in the course of the interval.

The chart clearly exhibits that whole nonprofit revenues have additionally loved three a long time of development, rising in actual phrases from $812 billion in 1988 to greater than $2.6 trillion in 2019, a rise of 221 %. In each nominal and inflation-adjusted figures, 2019 is by far the best degree of nonprofit revenues up to now thirty years.

The Actual Story is Progress in Program Service Revenues

The difficulty advocates overlook within the debate over the charitable deduction is how little nonprofits obtain in charitable contributions in comparison with how dependent they’re on program service revenues.

Program service revenues embody a spectrum of earnings sources, together with tuition, funds for medical bills, funds from Medicare and Medicaid, ticket gross sales, broadcast rights, convention charges, and authorities contracts. Practically all such income is exempt from federal earnings taxes for nonprofits.

The close by chart exhibits how the expansion in program service revenues has pushed the general development in nonprofit revenues over the previous 30 years, rising from $548 billion in immediately’s {dollars}, to greater than $1.8 trillion—a rise of 310 %.

Program service revenues comprised 71 % of nonprofit revenues in 2019, up from 67 % in 1988. The high-water mark for program service revenues was in 2008 when it reached 76 % of nonprofit revenues.

Opposite to the picture of charitable organizations, program service revenues—as soon as referred to as “enterprise receipts”—have been the dominant supply of revenues for nonprofit organizations for many years. A 1987 Authorities Accountability Workplace (GAO) evaluation of competitors between taxable companies and tax-exempt organizations reported that in 1946, “enterprise receipts” comprised 46 % of whole revenues for 501(c)(3) organizations whereas donations comprised 36 %.

Comparable information for “enterprise receipts” will not be accessible for intervening years, however revenues apart from contributions—principally comprised of program service earnings—continued to develop into the Nineteen Eighties whereas donations fell as a share of total nonprofit revenues. By 1975, contributions had fallen to 27 % of revenues, and additional to 18 % by 1982. By 2019, charitable contributions comprised 12 % of nonprofit revenues.

Nonprofit Hospitals and Personal Universities are Large Companies

Digging beneath the topline numbers, information exhibits nearly all of program service revenues are generated by nonprofit hospitals, well being care programs, and personal universities.

Certainly, because of 2019 IRS nonprofit information made accessible by the City Institute’s Middle for Charitable Statistics Knowledge Archive, nonprofit organizations might be separated into 26 classes starting from arts and tradition to social science and expertise.

By far, the most important sector of nonprofits are hospitals, with practically $1 trillion of whole revenues in 2019. As well as, well being care programs generated whole revenues of practically $375 billion, whereas psychological well being amenities added one other $40 billion in revenues. Whole revenues for the nonprofit well being care sector had been greater than $1.4 trillion—greater than half of all nonprofit revenues. The sector reported internet earnings (i.e., untaxed earnings) of greater than $62 billion in 2019.

Program service revenues for the well being care sector totaled practically $1.3 trillion, or 90 % of the sector’s income. Had been these organizations for-profit firms, each internet greenback could be taxable at 21 %.

Personal universities generated greater than $294 billion in revenues in 2019, practically 70 % of which was program service revenues from tuition, ticket gross sales, and different businesslike earnings. This doesn’t embody greater than $3 billion in revenues generated by faculty athletic associations, such because the Nationwide Collegiate Athletic Affiliation (NCAA) and the Large 10 Convention. Practically all the earnings of those organizations is from promoting broadcast rights to tv and radio networks, revenues that might be taxed if these organizations had been for-profit companies.

The Problem: $2.6 trillion in Principally Untaxed Revenue

To make certain, sure nonprofit organizations report no businesslike revenues and survive solely on charitable donations. Nevertheless, even this earnings escapes taxation due to the way in which the tax code offers a deduction for the donor and exempts from tax the earnings acquired by the nonprofit. In tax parlance, it’s referred to as double non-tax earnings as a result of the earnings just isn’t taxed at both the person degree or on the group degree.

The City Institute’s dataset additionally identifies various giant organizations (some with incomes over $1 billion) that present consulting, analysis, and evaluation for the federal government and for-profit firms. This earnings additionally escapes tax as a result of the funds for service by the businesses are deductible as a enterprise expense and never taxed on the group degree. After all, the federal government pays no tax on its earnings.

A small quantity of nonprofit revenues are taxed if they’re tangential to the principle mission of the nonprofit. That is referred to as unrelated enterprise earnings. Nevertheless, the definition of unrelated enterprise earnings is so slim that few nonprofits really pay it. In 2017, the most recent information accessible, roughly 40,000 501(c)(3) organizations reported $10.5 billion in gross unrelated enterprise earnings, however simply $1.7 billion in internet earnings. So, after deducting bills, simply 24,000 organizations paid roughly $469 million in taxes on that earnings.

The 501(c)(3) nonprofit sector wants an entire rethink. First, the information exhibits that the sector is wholesome financially, weakening the argument that the sector wants a bigger tax deductionA tax deduction is a provision that reduces taxable earnings. An ordinary deduction is a single deduction at a hard and fast quantity. Itemized deductions are widespread amongst higher-income taxpayers who typically have vital deductible bills, reminiscent of state/native taxes paid, mortgage curiosity, and charitable contributions.

for charitable giving. Second, permitting organizations to generate billions of {dollars} in earnings freed from taxes whereas competing in opposition to tax-paying companies is unfair and distorts the which means of nonprofit. It was actually not what Congress meant when it created the nonprofit designation within the first place.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted specialists delivered straight to your inbox.

Share