You might need heard of the Golden Rule in life: Deal with others as you wish to be handled. However, do you know that there’s additionally a golden rule for accounting? In truth, there are three golden guidelines of accounting. And no … one among them will not be treating your accounts the best way you wish to be handled.

If you wish to preserve your books up-to-date and correct, observe the three fundamental guidelines of accounting.

3 Golden guidelines of accounting

It’s no secret that the world of accounting is run by credit and debits. Debits and credit make a guide’s world go ‘spherical.

Earlier than we dive into the golden rules of accounting, you should brush up on all issues debit and credit score.

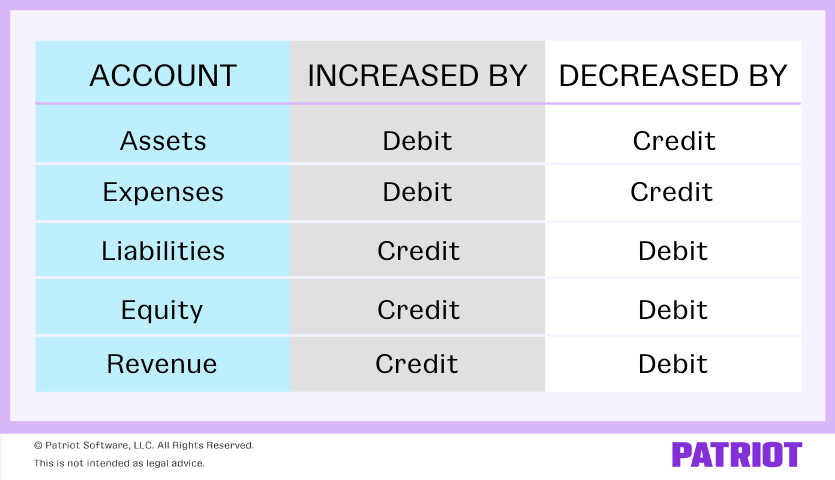

Debits and credit are equal however reverse entries in your accounting books. Credit and debits have an effect on the 5 core kinds of accounts:

- Belongings: Assets owned by a enterprise which have financial worth you may convert into money (e.g., land, tools, money, autos)

- Bills: Prices that happen throughout enterprise operations (e.g., wages, provides)

- Liabilities: Quantities owed to a different particular person or enterprise (e.g., accounts payable)

- Fairness: Your belongings minus your liabilities

- Earnings and income: Money earned from gross sales

A debit is an entry made on the left facet of an account. Debits enhance an asset or expense account and reduce fairness, legal responsibility, or income accounts.

A credit score is an entry made on the precise facet of an account. Credit enhance fairness, legal responsibility, and income accounts and reduce asset and expense accounts.

You need to file credit and debits for every transaction.

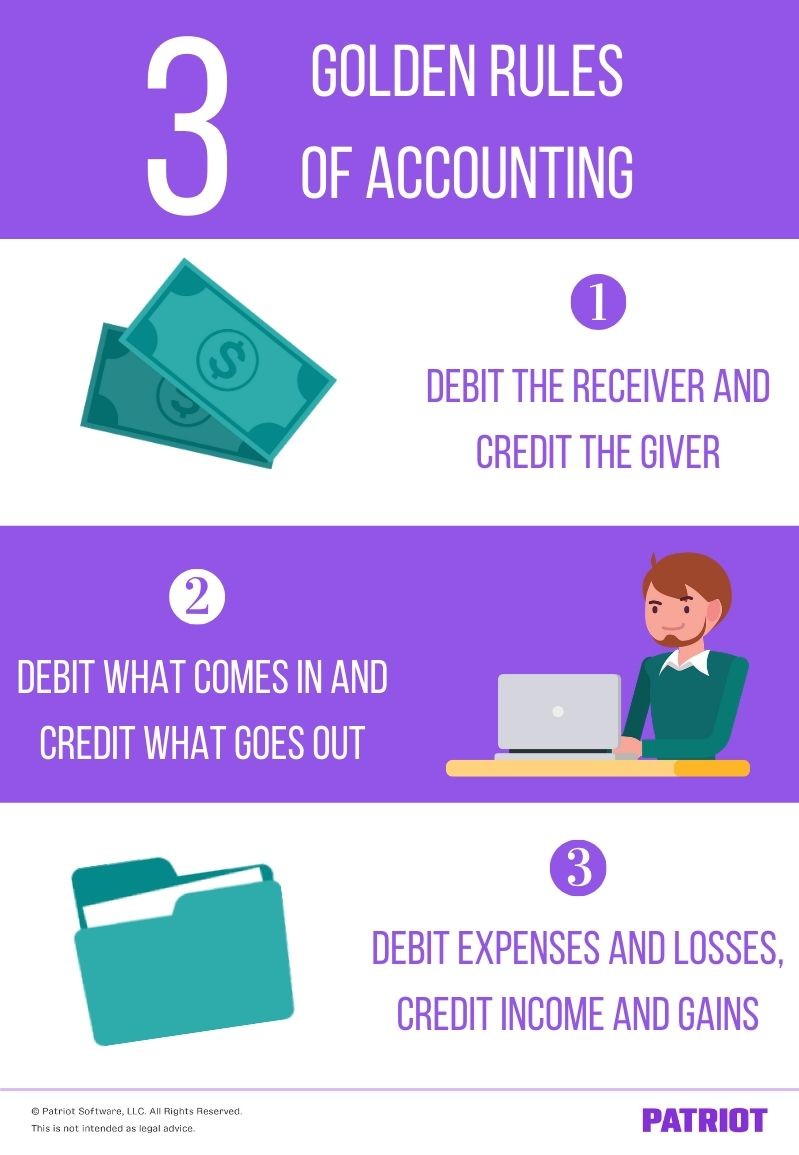

The golden guidelines of accounting additionally revolve round debits and credit. Check out the three predominant guidelines of accounting:

- Debit the receiver and credit score the giver

- Debit what is available in and credit score what goes out

- Debit bills and losses, credit score revenue and good points

Let’s get into every of the golden guidelines of accounts, we could?

1. Debit the receiver and credit score the giver

The rule of debiting the receiver and crediting the giver comes into play with private accounts. A private account is a normal ledger account pertaining to people or organizations.

When you obtain one thing, debit the account. When you give one thing, credit score the account.

Try a few examples of this primary golden rule under.

Instance 1

Say you buy $1,000 price of products from Firm ABC. In your books, you should debit your Buy Account and credit score Firm ABC. As a result of the giver, Firm ABC, is offering items, you should credit score Firm ABC. Then, you should debit the receiver, your Buy Account.

| Date | Account | Debit | Credit score |

|---|---|---|---|

| XX/XX/XXXX | Buy Account | 1000 | |

| Accounts Payable | 1000 |

Instance 2

Say you paid $500 money to Firm ABC for workplace provides. It is advisable to debit the receiver and credit score your (the giver’s) Money Account.

| Date | Account | Debit | Credit score |

|---|---|---|---|

| XX/XX/XXXX | Provides Account | 500 | |

| Money Account | 500 |

2. Debit what is available in and credit score what goes out

For actual accounts, use the second golden rule. Actual accounts are additionally known as everlasting accounts. Actual accounts don’t shut at year-end. As an alternative, their balances are carried over to the subsequent accounting interval.

An actual account may be an asset account, a legal responsibility account, or an fairness account. Actual accounts additionally embody contra belongings, legal responsibility, and fairness accounts.

With an actual account, when one thing comes into your online business (e.g., an asset), debit the account. When one thing goes out of your online business, credit score the account.

Instance

Let’s say you bought furnishings for $2,500 in money. Debit your Furnishings Account (what is available in) and credit score your Money Account (what goes out).

| Date | Account | Debit | Credit score |

|---|---|---|---|

| XX/XX/XXXX | Furnishings Account | 2500 | |

| Money Account | 2500 |

3. Debit bills and losses, credit score revenue and good points

The ultimate golden rule of accounting offers with nominal accounts. A nominal account is an account that you simply shut on the finish of every accounting interval. Nominal accounts are additionally referred to as short-term accounts. Momentary or nominal accounts embody income, expense, and achieve and loss accounts.

With nominal accounts, debit the account if your online business has an expense or loss. Credit score the account if your online business must file revenue or achieve.

Instance: Expense or loss

Say you buy $3,000 of products from Firm XYZ. To file the transaction, you could debit the expense ($3,000 buy) and credit score the revenue.

| Date | Account | Debit | Credit score |

|---|---|---|---|

| XX/XX/XXXX | Buy Account | 3000 | |

| Money Account | 3000 |

Instance: Earnings or achieve

Say you promote $1,700 price of products to Firm XYZ. You need to credit score the revenue in your Gross sales Account and debit the expense.

| Date | Account | Debit | Credit score |

| XX/XX/XXXX | Money Account | 1700 | |

| Gross sales Account | 1700 |

On the hunt for a easy approach to observe your account balances? Patriot’s accounting software program has you lined. Simply file revenue and bills and get again to your online business. Strive it at no cost right this moment!

This text has been up to date from its authentic publication date of March 10, 2020.

This isn’t supposed as authorized recommendation; for extra info, please click on right here.